Investment Strategy Mailbag: Where Do You Invest During a Pandemic?, Investing at Age 70

Is it better to invest in stocks during a pandemic or hold onto cash?

Answered by Mike Antonelli, Private Wealth Management Market Strategist

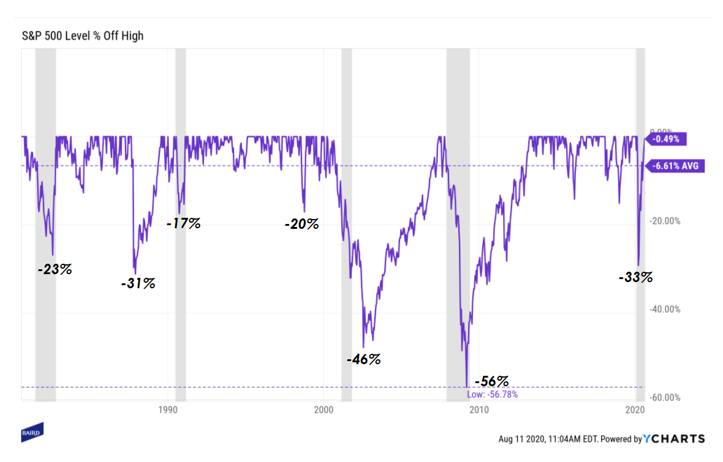

This is my favorite kind of client question to answer because it boils down to one thing – investor behavior. Before we answer, let us set the stage by showing you all the major stock market drawdowns over the past 30 years (recessions in gray):

What do you notice here? That’s right – selloffs happen all the time. The thing to remember is that they are a feature of the market, not a bug. If stocks weren’t risky, then they wouldn’t return what they do. You have to get used to living with fear in order to be an investor. Holding stocks in a bull market is practice – holding them in scary times is the Super Bowl.

So let’s answer the question: Is it better to invest in stocks during a crisis or hold onto cash? Howard Marks tell us that an investor’s goal should be to make a large number of good buys, not just a few perfect ones. He’s right: Stop worrying about whether stocks have bottomed or whether you nailed the absolute low. Your goal should be to buy where you find value and let those buys compound over time.

Now, I’m not saying you have to buy stocks every single time the market crashes. It’s OK to hold some cash in order to sleep better at night. But when markets panic, that’s when the expected future value of stocks begins to rise and opportunities can be found. I know it seems crazy – the stock market is the only place I know where things go on sale and everyone runs out of the store.

You have to hold two things in your mind to be a great investor:

- The world breaks all the time, and the stock market crashes often.

- That doesn’t preclude long-term growth.

That is important: You must learn this wisdom. Another stock market crisis is going to happen in the future. Don’t let it knock you off your plan to benefit from long-term growth.

Of course, we never want to be 100% in stocks or 100% in cash. We want to stay broadly diversified and use selloffs (and rallies) as opportunities to rebalance between our chosen allocation. Lean on your advisor to help get you through difficult times – that is what they are there for!

I just turned 70, and I’m worried about the COVID-19 recession. Why shouldn’t I get out of the market and preserve what I have?

Answered by Ross Mayfield, Investment Strategy Analyst

The answer to this may seem obvious with the full hindsight of the recent rally, but that is one of the risks of selling into a crash – locking in a big loss only to see the market recover sooner than expected. Stocks usually begin rallying well before company fundamentals and economic data hit bottom.

The larger question to ask is, What is my equity allocation for? Stocks are usually owned for their long-term growth potential, but that can come with lengthy periods of underperformance and occasionally painful volatility. The market has historically rewarded stock owners with robust long-term gains, but for some the downside risk is too much to bear.

If you feel that your portfolio is too stock-heavy, you might consider a more risk-averse asset allocation. This can include higher-quality bonds, cash or simply more diversification within your portfolio.

That said, an underdiscussed risk associated with retirement is “longevity risk,” or the chance that you will outlive your money. At 70 years old and with interest rates at historic lows, a larger-than-you-might-expect allocation to stocks could make sense. According to the Social Security Administration, the average 70-year-old is expected to live more than 15 additional years. Of every 15-year stretch the S&P 500 has been through, it has only been negative 1% of the time. While the volatility of stocks can feel overwhelming, particularly in later years, their growth opportunity can be a key facet of retirement success.

A bear market is a painful experience, particularly for a retiree watching the value of their nest egg plummet. Work with a Baird Financial Advisor to help determine an appropriate asset allocation for your risk tolerance and better understand the role of each puzzle piece in your portfolio.

If you have additional questions on making sure your investments are in tune with the current economic environment, your Baird Financial Advisor is here to help. Find a Baird Financial Advisor near you.