Make the Most of Your Stock Compensation With an 83(b) Election

Whenever you receive stock as part of your compensation, you owe taxes on it the same as any other income. When it comes to how much you pay, the IRS calculates your tax liability based upon the fair market value of the equity at the time it’s transferred to you. But you don’t pay those taxes until the year in which the equity is actually transferred to you.

Very frequently, and especially with founders, any grant of equity is subject to a vesting agreement, and you pay taxes based upon the value of the stock at the time of vesting. If the company does really well and goes up in value over the course of the vesting agreement, you’re going to end up paying more and more taxes over the years.

That’s where an 83(b) election comes in. It allows you to pay income tax up front, before your options have vested. Particularly when the initial price of the stock is low, such as with a startup, this can result in significant tax benefits.

Here’s how it works: Whenever your employer issues new equity benefits to you, you will also receive a notice about making an 83(b) election on the benefits. This gives you the option, at the start of your vesting agreement, of paying tax on the entire amount that will eventually vest, but at the present value. Rather than paying tax each year, you pay all the tax upfront based on the value of the stock when it was granted to you.

When does it make sense to take this election? It’s especially valuable if you’re the founder of a brand-new company with no real value and you’ve agreed to a multiyear vesting agreement. In such a situation, you pay tax upfront on all the shares – when they’re valued basically at nothing. You only pay tax again when there’s a liquidity event, such as when you sell your shares.

An 83(b) election also lets you qualify for the lower long-term capital gains tax rate sooner. As soon as your stock is taxed, at the grant date, the timer for calculating long-term capital gain begins. If you don’t elect 83(b), your stock doesn’t become a long-term capital gain until it’s held at least one year from the vesting date. Even though selling the stock creates a taxable event for you, the 83(b) still helps you come out ahead.

Note that you’re really under the gun here: In order to make this election, you have to send a letter to the IRS within 30 days of the grant being made. You will not be able to make the election after those 30 days are up. It makes sense to discuss this with your Baird Financial Advisor as soon as the options are granted in order to make sure your decisions are executed in a timely manner.

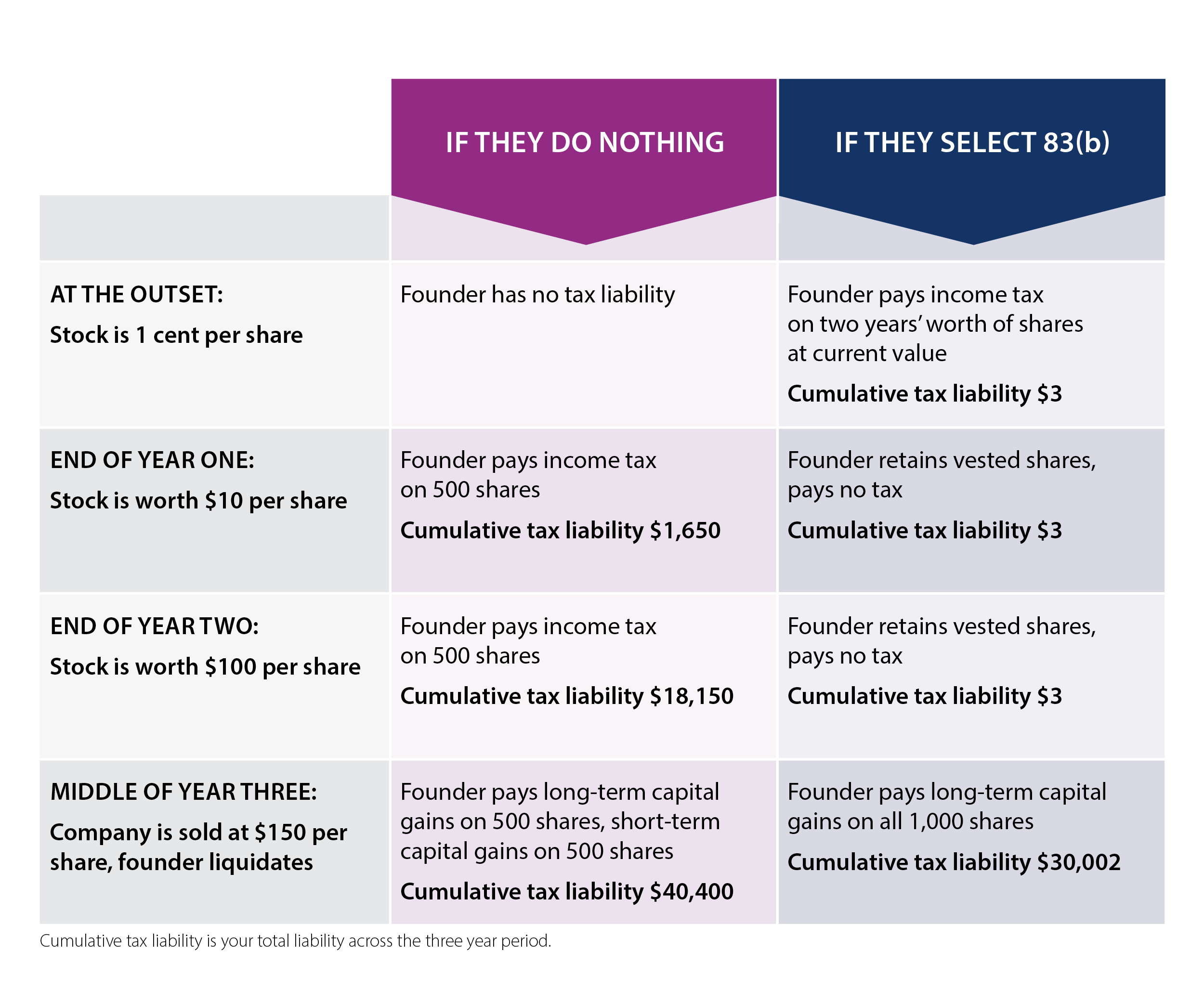

Here’s an example of how much of a difference this can make. Assume a brand-new company with two founders who are granted 1,000 shares, with a price at founding of 1 cent, on a two-year vesting plan. Their income tax rate is 33%, and the long-term capital gains rate is 20%. Here’s how this would play out with and without an 83(b):

So not only does the 83(b) election in this example save the founder $10,000, but nearly the entire burden is shifted into the final year, when he or she is likely to be more capable of handling a big tax bite.

Exercising stock options is always a tricky business with long-term tax implications. Talk to your Baird Financial Advisor for more advice on making this strategy work for you.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.