Four Investment Themes for 2024

Strategas, a Baird Company, weighs in on what could move the market in 2024.

At Strategas, we often urge investors to avoid the siren song of over-trading and focus instead on long-term returns. (Warren Buffett – arguably the single best investor of all time – often reminds people that his favorite holding period is forever.) One way investors can play the long game is to choose major investment themes that are likely to stand the test of time. We believe the following four themes have the potential to offer superior returns in 2024.

Deglobalization

The golden age of globalization that started with the fall of the Berlin Wall in 1989 seems to be coming to an end. Legislators on both sides of the aisle in Washington can agree on the risk China’s emergence poses to American prosperity and security, and we believe many American companies will look to shorten the supply chains that help them produce and distribute the products they sell. Global defense spending tends to rise when geopolitical tensions rise, which could benefit Energy and Aerospace & Defense companies.

A Focus on Flow

As interest rates rise and become more variable, we believe investors should focus on companies that can organically generate profits and cash flows. Years of perpetually low interest rates made it possible for unprofitable companies to survive – incredibly, greater than 40% of the companies in the small-cap Russell 2000 Index have not generated a profit in the last 12 months. That is far less sustainable today, as access to outside capital has become more difficult and the cost of capital continues to rise. Large-cap stocks with a proven record of enhancing shareholder returns through dividends or share repurchases would be one way to take advantage of this theme.

Given the current macroeconomic backdrop, we believe there is a 50% chance of a recession in 2024.

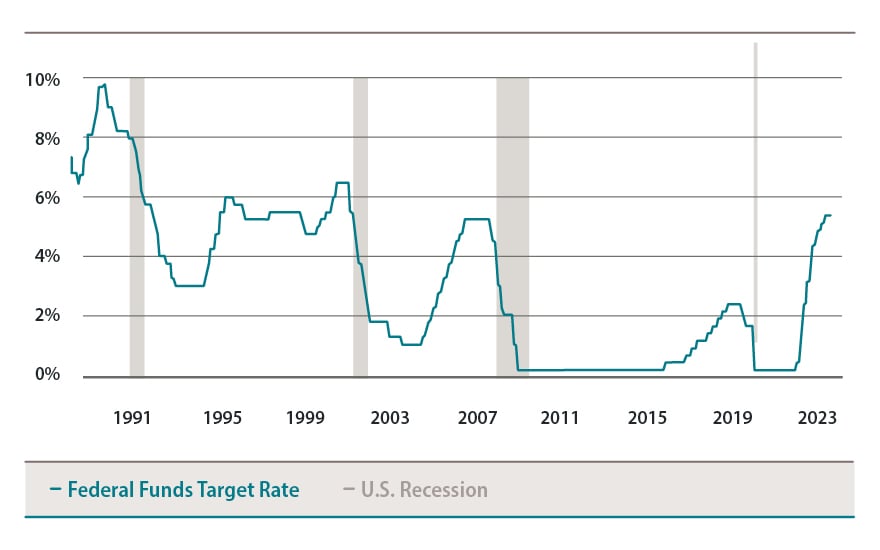

Recession Protection

No one really likes to think about the word “recession,” and so far, it appears the Fed has threaded the needle of fighting inflation while avoiding a significant economic slowdown. That said, the tools at the Fed’s disposal are blunt, and the chances of recession increase greatly after a tightening of monetary policy. Given the current macroeconomic backdrop, we believe there is a 50% chance of a recession in 2024. History would suggest that recession losses can be offset with investments in pockets of the economy where consumer demand is more durable, such as Healthcare and Consumer Staples.

Periods of Federal Reserve rate hikes have often been followed by recessions.

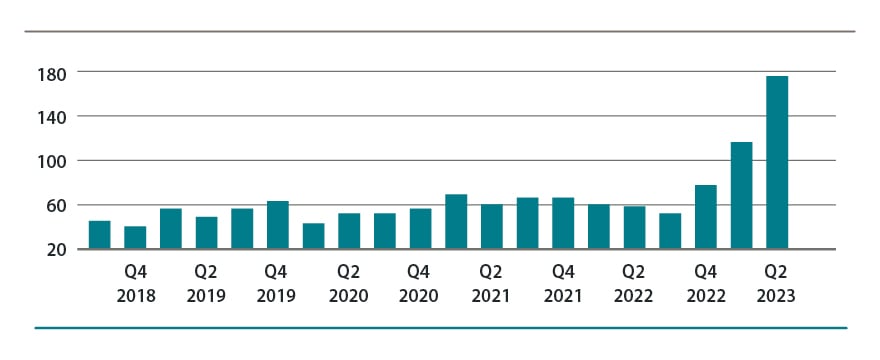

Artificial Intelligence

We believe the companies that best leverage the power of generative artificial intelligence will be most able to maintain profit margins and grow earnings. While the widespread use of artificial intelligence in day-to-day business operations is still a long way off, virtually every company of scale has started experimenting with this powerful new technology – for both growth and survival. Many hardware and software companies in the Technology sector are well-positioned for almost-certain growth in the use of artificial intelligence and related cybersecurity solutions.

The number of S&P 500 companies that referenced “artificial intelligence” on earning calls more than doubled since the end of 2022.

We believe long-term investors will be served well by these four themes for 2024. In our opinion, a broadly diversified portfolio of companies that are poised to take advantage of these trends can provide the right balance between preserving capital and taking advantage of growth opportunities.

We believe long-term investors will be served well by these four themes for 2024. In our opinion, a broadly diversified portfolio of companies that are poised to take advantage of these trends can provide the right balance between preserving capital and taking advantage of growth opportunities.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.