Take Advantage of Your Most Valuable Asset

A home can be many things – a roof over your head, a place to raise your kids, an entryway into a larger community. But your home is also an investment – perhaps your most valuable investment outside your portfolio. Here are five housing decisions you might make over the course of your lifetime, plus planning recommendations to help you make the most of them.

Purchasing Your First Home

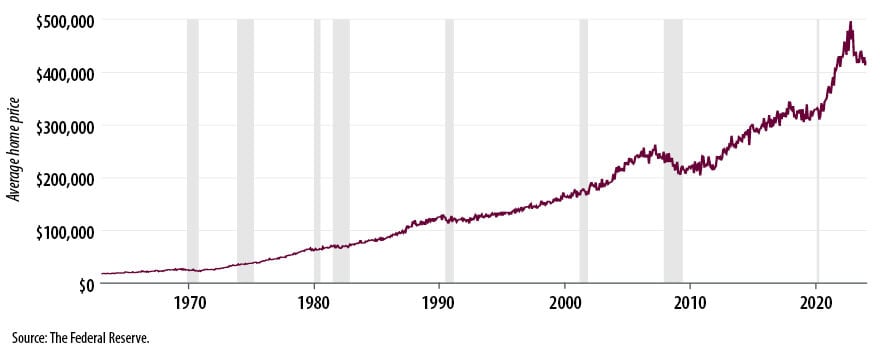

There are many long-term benefits to buying a house – but with average home sale prices soaring above $400,000 (see the chart below), be sure to think through every financial aspect of your purchase, from your down payment (can you save enough to keep from paying private mortgage insurance?) to your budget (can you afford the expenses that accompany home ownership?). Sometimes the best advice is to be patient: If buying a home will cause you to lie awake at night stressing about mortgage payments, you might be better served saving for a bigger down payment or reducing your other debt first.

Tim Says: A larger down payment can also mean qualifying for a better rate on your home loan. A smaller loan with a lower interest rate can make a huge difference in your monthly mortgage payment.

Home prices have increased by roughly one-third in the past five years.

Remodeling

Besides choosing the right financing vehicle, one of the most significant home ownership decisions you could face is what to upgrade. Some improvements, like landscaping and kitchen updates, tend to get a better return on investment when it’s time to sell, as do renovations that incorporate new technology. Be forward-looking too: You don’t want to deplete your financial resources on more ornamental updates just ahead of a major undertaking like replacing a roof.

Tim Says: If you’re looking to maximize your home’s value ahead of a sale, know that the U.S. tax code distinguishes between “home improvements” and “home repair.” Improvements to your home can increase your cost basis, which reduces your capital gain when you sell. Repairs don’t provide any tax benefit.

Downsizing

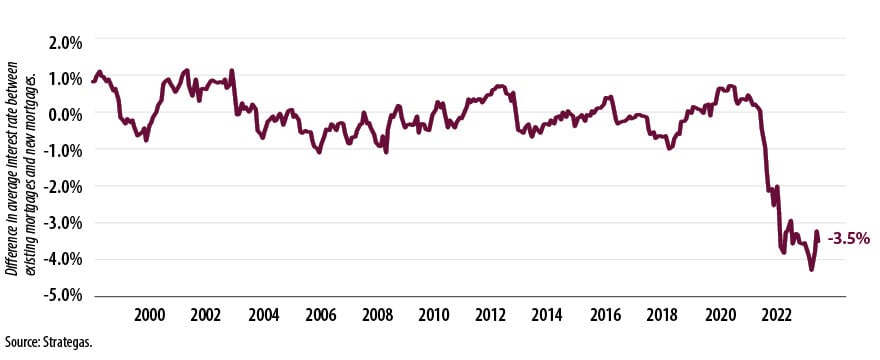

Selling your house and moving to a smaller one can lead to savings in unexpected ways, like the energy costs to heat and cool your home. But you could also be taking on expenses you haven’t had to account for previously. If you decide to take out a new mortgage, expect to pay interest costs that could be much higher than on your current one (see the chart below). Use this opportunity to revisit your basic living expenses and reset your budget.

Tim Says: It’s not just about finances: Downsizing may sound like a great idea, but make sure you’ll be comfortable living in closer quarters.

If you’re taking out a new mortgage, expect to pay 7% or more in interest – roughly double the 3.5% average interest rate on existing mortgages.

Purchasing a Vacation Home

When considering a vacation home, be realistic about who will use it, for what and how often. If you have a large family that doesn’t like to cook, maybe you trade kitchen and dining room space for an extra bedroom and bathroom. If you’re planning on making it a rental property, you might need a more traditional setup – as well as a property manager to maintain it while you’re away, which is an extra cost.

Tim Says: Are you someone who likes to travel to new destinations? Owning a second home may make it hard to justify traveling and seeing new things.

Retiring

Any conversation about retiring will need to include a decision on your house. If you decide to stay put, you’ll likely want to have the mortgage paid off – and perhaps even explore taking out a home equity line of credit for additional liquidity in retirement. If you want to pass it down to your kids, there are vehicles that let you do that (such as a trust or transfer-on-death deed) – but make sure you talk with them first and make sure they have the interest, and means, to insure and maintain it.

Tim Says: If you plan to retire in your home, make sure it will accommodate your needs as you get older. A larger, multistory home may not be realistic as you slow down later in life.

As you think about the ways your home can be an investment, remember that its greatest value might not be financial at all. For many people, a home is where they raised their kids, laughed with loved ones around a kitchen table and joined a community of neighbors. Your Baird Financial Advisor can help you sort through these sentiments and make the most of your most significant asset.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.