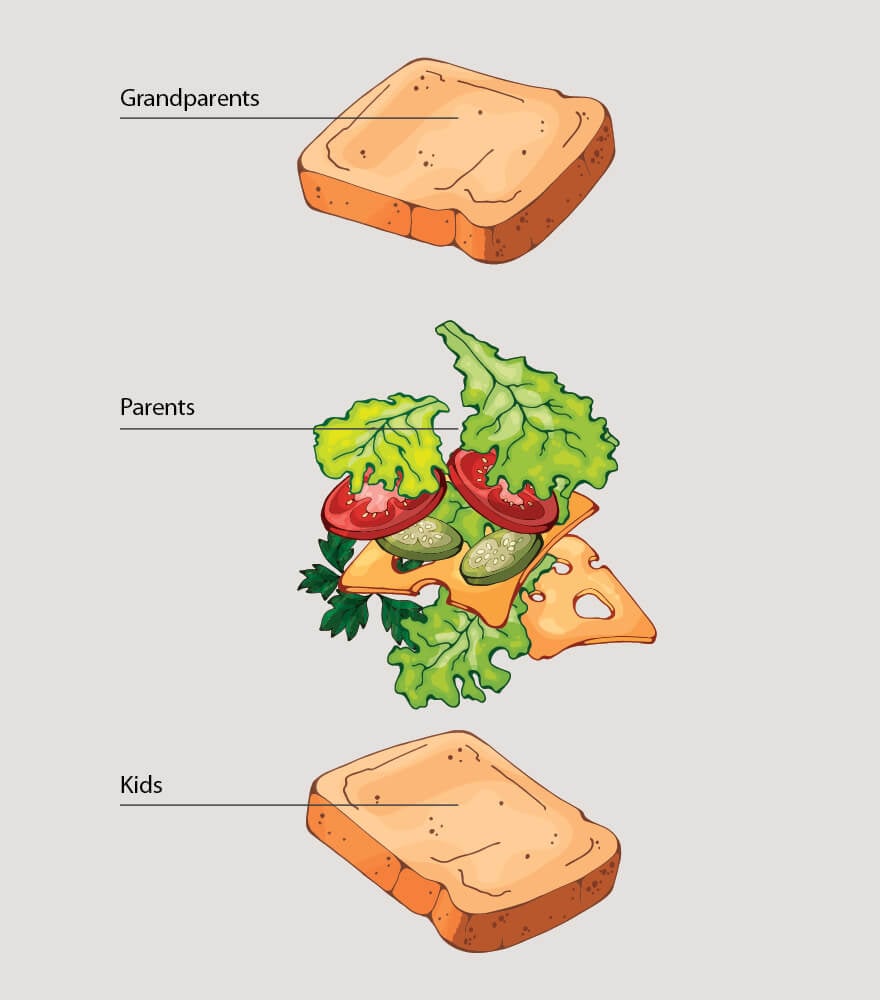

Stuck in the Middle: Making Sense of the Sandwich

Amid balancing your kids’ education, soccer practices and family social gatherings, you may be faced with an entirely new challenge – taking on the care of your aging parent. As you enter this sandwich generation era, this guide can be used as a starting point to make the transition as smooth as possible.

Housing Needs

The best housing option for your parent is greatly dependent on their needs and level of independence. For example, a generally healthy parent may just need a few modifications to their current home like handrails and step-in showers. But, someone who needs assistance with daily living activities may need an in-home caregiver or assisted living center. When deciding on housing, be sure to consider factors like cost, proximity to family and even weather conditions.

How You Can Help: If your parent isn’t comfortable moving to a facility, you might welcome them to move in with you. If you decide to do so, consider any modifications you’d need to make to your home and how your kids and family may need to adjust.

Social Needs

Be sure your parent has access to transportation so they can keep their social spark alive. And if your parent struggles with mobility, introduce them to the possibility of a continuing care retirement community where they can connect with their peers.

How You Can Help: Get every generation involved! Maybe your own children can help train your parent on keeping in touch through technology or encourage them to come along on family outings.

Healthcare Needs

Be sure you understand all your parent’s health concerns, including the care required for them and any medications they’ve been prescribed. Also, check that they’ve appointed a Healthcare Power of Attorney and that you both have a comprehensive understanding of what is and isn’t covered on their health insurance.

How You Can Help: Perhaps one of your older kids can drive your parent to appointments – or you can arrange to visit your parent’s doctors with them. This way, you can meet their healthcare providers and ensure you’re getting full and accurate information about their health concerns.

Financial Needs

Take a more active role in monitoring your parent’s finances. Ask about their preparation for future healthcare costs, their advisors’ contact information and their bank account information. Lastly, talk about their estate planning needs, ensuring they’ve appointed a Power of Attorney and that you have access to the paperwork for their wills, trusts and end-of-life preferences.

How You Can Help: Set up a meeting with your parent and their Financial Advisor, maybe even including your older children for awareness. While legacy planning can be a difficult topic to discuss, having these conversations can help avoid any future potential confusion.

Looking Ahead: Setting Your Kids Up for Success

If you’ve felt the stress of needing to care for your parent and want to prepare your children for the possibility of them caring for you someday, we have some tips.

First, get all your crucial documents in order and share them with your kids long ahead of time. Make sure they have access to paperwork like your will, insurance card, medications list and usernames and passwords for any online accounts. Consider using Baird’s Personal Information Guide – designed to help you capture all your personal and financial information into one document.

It’s also vital that you have an intentional conversation around one another’s expectations and boundaries. Consider how dependent you’ll need to be, like whether you’ll need your child for transportation or meals. Once you step into the role of the elderly parent, take the chance to double down on anything you felt went well when you were the caretaker, and share what you feel could’ve gone better.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.