The Tech Boom: Sustainable Growth or 1990s-Era Bubble?

The incredible run of the stock market has led to many comparisons to the market performance of the late 1990s. There are many similarities, including a transformative technology central to both market and economic growth (then the internet, today artificial intelligence). We believe AI marks another in a long line of productivity-enhancing technologies reaching as far back, if not farther, than the agricultural revolution – though, like the dot-com boom and bust of the 2000s, the path to widespread usage and efficiency gains may be bumpier than investors would prefer.

While there are many similarities, we see a few key differences between today’s market and that of the 1990s.

Like the late 1990s, today’s market is historically concentrated in the country’s biggest tech companies. The S&P 500’s 10 largest stocks (i.e., just 2% of its companies) account for 35% of its total value, exceeding the prior peak of 26% set in 1999. Unlike the late 1990s, however, today’s “Big Tech” conglomerate is both mature and quite profitable – in stark contrast to the less sound “internet darlings” of the late 1990s.

Said another way, today’s top 10 are the top 10 for a good reason – the fundamentals back them up.

There’s also a valuation comparison to be made. At their core, stocks represent ownership shares of a company – but what an investor should pay for that opportunity is up for debate. Investors often use simple heuristics like “price-to-earnings” to judge whether a stock looks expensive or cheap – the higher the price-to-earnings ratio, the more investors are paying for the promise of greater profitability down the line. Both the late 1990s and today saw the stock market rising to historically high P/E ratios – a sign of optimism that the underlying companies could deliver future earnings growth. But again, there’s a stark difference between then and now: The P/E ratios in the late 1990s dwarf today’s levels, with the most expensive stocks reaching nosebleed-level valuations. This doesn’t mean every valuation today is justified – we might argue the market’s risk/reward profile at current levels skews to the downside. But there is a material difference between today’s “stretched” valuation and the late-1990s “insanity.”

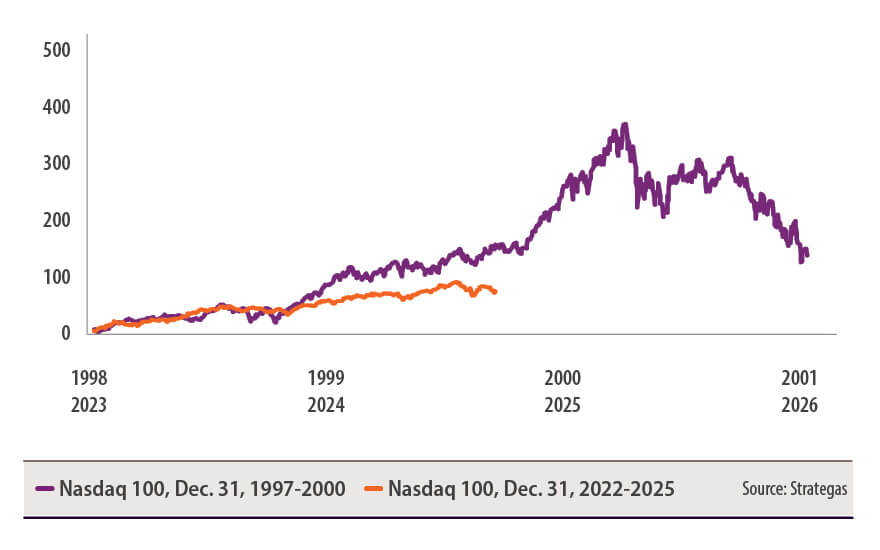

While the Nasdaq’s current streak (orange) resemble its late-‘90s run (purple), the market would need to skyrocket from here to match the blowoff top of the 1999–2000 dot-com bubble.

Speaking of insanity, investor sentiment seems far more muted today than during the dot-com bubble. This squares with the point made above: If investors are willing to pay higher prices for lower earnings, they must be even more excited about a company’s future prospects. In the late 1990s, the country was in the grips of a stock trading mania: New internet companies were going public regularly, and money was flowing into stocks and mutual funds at a far greater pace than today. There simply isn’t the investor interest, mergers and acquisitions activity, or overall froth today to signal a broad-based euphoria.

In terms of investor sentiment, the closest parallel to the late 1990s might not be today’s AI moment, but the meme stock / SPAC / crypto craze of early 2021.

Of course, this doesn’t mean the market will evade the volatility or big selloffs from the late-‘90s. We’ve already seen the NASDAQ fall over 35% in 2022 when the Fed hiked interest rates to combat inflation. Plus the late 1990s had some economic advantages compared to today: Thanks to an enormous peace dividend after the fall of the Berlin Wall, the U.S. actually ran budget surpluses, and the price of oil fell to a mere $11 in 1998. But on the whole, we see little evidence of a bull market top forming – while we acknowledge the close comparisons to the late 1990s, we feel the economic cycle and bull market may yet have room to run before conditions must be reconsidered.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.

*Strategas Securities has been recognized in Institutional Investor’s (“II”) 2023 All-American Research survey and remains, for the 7th consecutive year, the top macro-only research firm. Strategas Securities was also ranked as the #1 Best Independent Research Provider of sell-side firms in Institutional Investor’s (“II”) 2022 All-American Research survey.