Three Questions To Consider Before a Roth Conversion

A large part of what makes Roth IRAs such a popular investment tool is how they create a source of tax-free income for you through your retirement years – but while these accounts can be effective retirement savings vehicles, not everyone is eligible to contribute to them. To do so, you must be making income from a job and have a total income that falls under a certain threshold.

If you don’t meet those criteria, though, don’t fret – because there’s another way to fund a Roth IRA: a Roth conversion.

When you execute a Roth conversion, you withdraw funds from your traditional, pre-tax retirement savings account and move them to a Roth account. When you do that, you are taxed on the amount converted, meaning you make the choice to pay on your savings today in exchange for tax-free growth in the future. Because of this upfront cost, it’s essential to evaluate whether a Roth conversion is in your best interest. At Baird, we analyze a Roth conversion strategy by considering three important questions:

1. How will you pay the upfront tax?

Ideally, if you choose to complete a Roth conversion, you’ll use money from an account outside your IRA or 401(k) to pay the initial tax on the conversion. While you can keep some of the amount you withdraw from your IRA or 401(k) to cover the tax, that leaves less money growing tax-free. Plus, if you’re under age 59 ½, the amount used for taxes will be subject to a 10% early withdrawal penalty. This doesn’t necessarily mean a Roth conversion isn’t a good strategy for you, but it will take longer for the benefits of the conversion to be realized.

2. How does your current tax rate compare to your future tax rate?

A Roth conversion is most effective if the tax rate on the conversion now is less than what the tax rate will be when you eventually withdraw those funds in retirement. And while we can’t predict what tax rates will be down the line, we can predict your income level and analyze its tax implications both now and in the future.

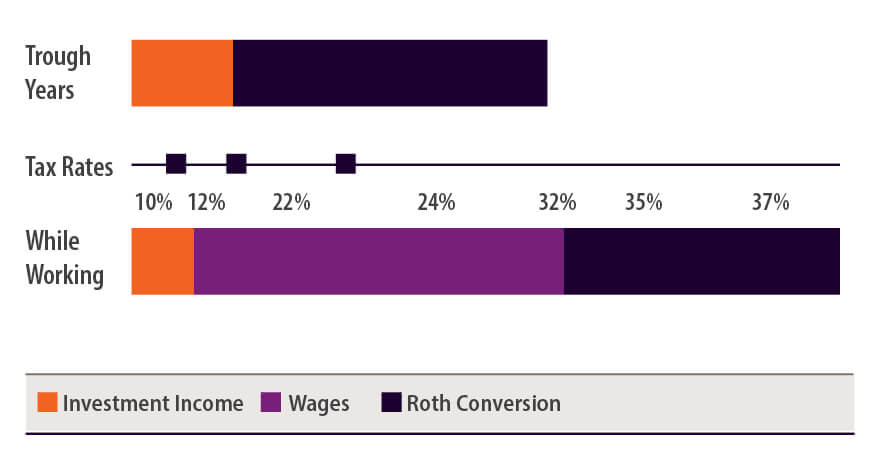

For example, if someone who is at their peak earnings level were to add on conversion income, they may take on a significantly higher tax cost. Instead, they could consider making that conversion after retirement when their wages have gone away and they’re in a lower marginal tax bracket. This period (illustrated in the chart below) is called the “trough years” – the years after retirement but before Social Security benefits are collected and required minimum distribution rules take effect.

As seen in this chart, layering a Roth conversion onto your wages during your working years can create a substantially higher tax rate.

3. When do you plan to withdraw?

Generally, the longer you leave money inside the Roth after completing a conversion, the more effective the conversion will be. It’s important to give the Roth time to grow tax-free and overcome the initial tax drag.

That may be longer than you’re able to wait, and sometimes that even means your heirs are more likely to benefit from the conversion than you are – but that’s okay. In fact, the most effective conversions are done with dollars you’re never going to need in retirement. If you pay the tax on those savings now, you’ll never have to touch them again, giving you years – perhaps decades – of tax-free growth.

To decide whether completing a Roth conversion is for you, consider these questions alongside your Financial Advisor in the context of your greater plan.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.