A Closer Focus: The Market and Policy Environment in 2025

Market and Economic Growth

There are a few key reasons to have a positive outlook for the year ahead: corporate profit estimates are looking strong through midyear, the market is reacting nicely to the new administration’s pro-growth policy initiatives like deregulation, and extraordinary liquidity measures could be a shot in the arm as the U.S. government reaches the debt ceiling. The U.S. economy also grew at a healthy 3% rate for the last three quarters of 2024 – but if history is any indication, this is a challenging rate to maintain. While we do expect the economy to continue expanding, it’s possible that it will do so at a slower clip in 2025.

Inflation

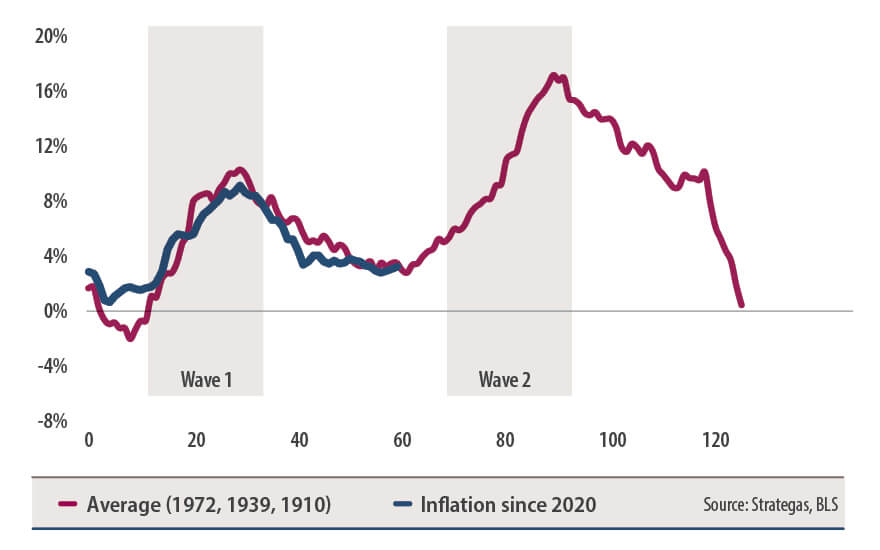

After high rates of inflation in recent years, one could hope that the worst is behind us. Market expectations for future rate cuts continue to drop; as we expect to only see two more rate cuts in the year ahead, and likely not before June. However, history shows that developed economies generally see inflation play out in two waves. The U.S. experienced inflation as high as 9% just a few years ago – and while it has fallen back down to the 3% level, it’s unclear whether that will stay steady. With this in mind, it is possible that inflation will reaccelerate toward the end of 2025 and into 2026. If it does, the Fed could begin to raise rates yet again, which is something to remain mindful of.

Inflation has historically come in waves.

Corporate Profits

At this point, corporate profits (and profit margins by extension) are expected to provide a helpful boost for the market. Currently, consensus expects double digit earnings growth in 2025 – and at Strategas, we predict a relatively healthy 8.5–9%. However, if slower economic growth (and therefore lower investor and consumer sentiment) leads to slower sales, firms could struggle with delivering on profit margin expectations – and this could be taken as a negative sign by the market.

Policy Proposals

With a new administration in Washington, proposed tariff and immigration policies have taken the spotlight. On the trade side, we remain somewhat skeptical of the desire to increase tariffs through a universal trade measure. Instead, we would focus on China specifically in more retaliatory terms, and then expect tariffs to be leveraged as a negotiating tool with other trade partners. Historically, when tariffs are raised and left in place for long periods of time, goods can broadly become more expensive. This impact could also be seen as a result of Trump’s immigration policy, as it’s been shown that deporting large shares of the labor force could foster similar results – and if done rapidly, could be destabilizing to the economy. If this upward pressure on inflation occurs, the Fed could be called back into the game to raise rates toward the end of 2025 and into 2026.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.