Four Economic Trends To Watch For in 2025

At Strategas, we strive to help our clients uncover long-term opportunities by identifying key themes playing out in the markets and the economy. This practice allows us an opportunity to break from the daily grind of government statistics and put forth our take on the major drivers of stock prices in the years ahead. Given the tumult and unpredictability of the last five years, we believe this exercise in long-term thinking is more useful than ever.

Here, we offer four themes we think have the potential to deliver superior returns in the coming years.

Artificial Intelligence

The growth of ChatGPT has proved to be a catalyst for companies to aggressively experiment with artificial intelligence as a means to enhance productivity and, ultimately, bottom-line profitability. Investment options within this theme range from traditional Technology firms to those that show promise in harnessing AI as a productivity booster (such as in the Automotive and Healthcare sectors). We would also look to invest in organizations that create and provide software applications capable of intelligent learning, coding, data analytics, linguistics and neuroscience, as well as those that utilize AI in search of more efficient and effective methods to provide value.

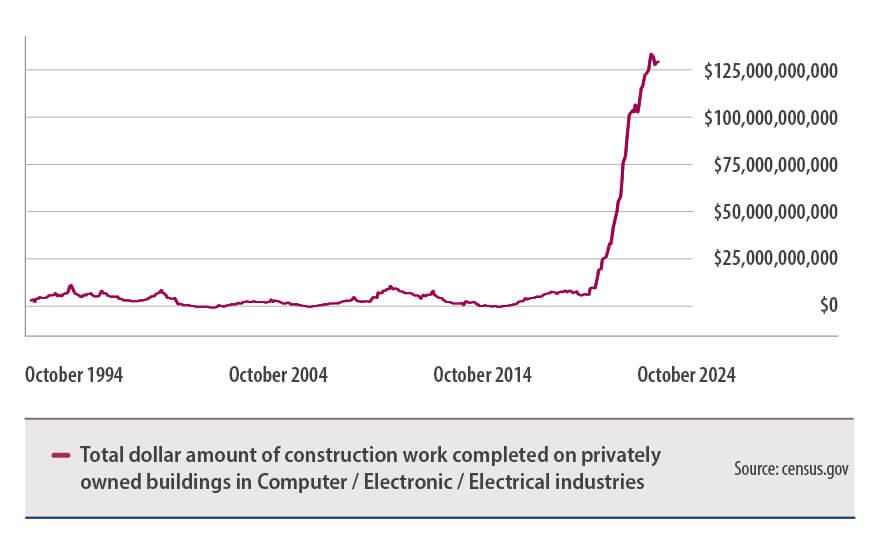

Industrial Power Renaissance

Artificial intelligence requirements, a push for electric vehicles, the proliferation of cryptocurrency mining and the ever-increasing need for new manufacturing and data centers have created a surge in the demand for power, putting additional strain on already aging utility infrastructure. As an example, global electricity consumption from data centers is set to more than double from 2022 to 2026. We believe positioning for this “surge” in power demand requires investing in all-encompassing, power-related securities – particularly those either directly involved in creating sources of power or whose businesses are a secondary beneficiary from the add-on impacts of increased power generation. Nuclear projects, while costly and time-consuming, will likely continue to be seen as an important energy solution as well.

Spending on technology infrastructure is booming – and more power is required.

Deglobalization

Supply chain disruptions from both the COVID-19 pandemic and Russia’s invasion of Ukraine have resulted in companies taking a closer look at near-shoring or onshoring their operations. Executives and policymakers have witnessed the importance of self-reliance when it comes to critical supplies (from energy to food to semiconductors), and spending on security – both military and cybersecurity – is set to increase. We believe investing opportunities lie in Energy and Materials companies that benefit from established operations, cybersecurity firms that are buoyed by government and corporate spending, the traditional Aerospace & Defense sector, and businesses that are reliant on domestic revenues or input goods produced domestically.

Cash is King

We believe the single biggest change to the financial markets in 2022 was the transition from quantitative easing (i.e., the Federal Reserve buying bonds to suppress interest rates) to quantitative tightening (i.e., the Fed shrinking their balance sheet). With the expectation that this change will lead to higher interest rates throughout the economy – and particularly with the distinct possibility of a second wave of inflation – we believe investments in organizations that demonstrate an ability to create revenue and cash flow, manage cash and return income to shareholders are prudent. In a world of higher and more variable interest rates, companies not dependent on the kindness of strangers should outperform.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.

Strategas has been recognized in Extel’s (formerly Institutional Investor) 2024 All-America Research Team survey and remains, for the 8th consecutive year, Extel’s highest ranked provider of exclusively macro research, preceded only by providers of both macro and bottom-up research.