All That Matters: Should You Be Worried About a Recession?

In this month’s episode of All That Matters, Investment Strategy Analyst Ross Mayfield and PWM Market Strategist Mike Antonelli tackle all things recession: Is one imminent? How should you prepare? And, what’s going on with regional banks? Get perspectives from two of our market experts on what really matters to you.

Is a recession imminent?

Mike:

There's an entity called the NBER that determines whether we're in a recession or not. I'm going to give you six characteristics of a recession that they look at:

- Do people have jobs?

- What is the employment situation?

- Are people buying things?

- Is our nation making things?

- What are the after-inflation effects of people's income?

- Are we manufacturing items and are we selling things?

Ross:

I don’t think a recession is imminent. At least, I don't think we're going to wake up tomorrow and find ourselves in a recession. We've been talking about a recession for 16, 18, 20 months, because as the Fed raises interest rates, that typically leads us into a recession. But the economy has been so resilient, and the labor market has been so resilient. Even the most recent jobs report was so incredibly strong that it's hard to see a world where we wake up next month or in a couple of months and see a recession. Could one be on the horizon? Absolutely, these things happen all the time with consistency, but is one imminent? I'm going to say no. What do you think?

Mike:

Two of the NBER characteristics I mentioned were related to jobs, and I want to jump back to the jobs report that just came out. You may not know this, but the prime age population in the United States is 25 to 54. How many of those people have full-time jobs? The latest jobs report listed the highest level since 2001. I sometimes hear people say, “oh, everybody just has part-time jobs or the jobs nobody wants to work.” That is not in the data at all. It’s the highest level in two decades of prime-age people working. So, jobs are doing well, the housing market is doing well, most people's homes are stable in terms of price, and people are still buying things.

Ross:

You can use a pretty easy roadmap for our economy. We're a consumer-based economy, people spending on services and goods. If people have jobs, they also feel good about spending. If their home value hasn't plummeted, they feel good about spending. Neither of those things have happened, and people are out and spending. You can go pretty much anywhere and see a lot of people willing to fork over money for goods or services.

Let me just wrap up with one final thought. The Atlanta Fed, which is one of the regional feds, has a model called GDP Now, where they try to predict what GDP is going to be. In the first quarter of this year, it was a little over 1% – that’s positive. And in the second quarter, they think it's going to be 2.7%. That model changes over time, but even their model doesn't say we're in a recession.

What’s going on with regional banks?

Mike:

We have to center ourselves as to what it is that banks do: how they make money. They take in deposits, and they make loans. That's as simple as we can make it. When the Federal Reserve hikes rates like we just mentioned, it does tend to reduce the value of some of those long-term loans. And a lot of these banks hold Treasury bonds and Treasury bills. We know those performed poorly last year, so some of the bank assets fell. So if their assets are falling and then depositors are taking their money to a money market fund for a better interest rate, the banks have a problem.

Ross:

Yes, and that’s why people lose confidence and then they can spiral really quickly. And it's really important, because regional banks are the ones who do the lending to small businesses and smaller communities – that's where a lot of the jobs in our country come from. So if regional banks tighten their lending and those smaller businesses have a harder time getting credit or they're paying more for the purpose of that, then that can start to spiral a little bit and tip the scales for a recession. It really is all about confidence and things seem like they're shoring up right now. But this, like you said, is a major thing on my radar because it has been percolating now for really two months at this point.

Mike:

I like to remind people that every now and then the market just kind of taps on a sector. And it tends to tap on the banking sector a lot, because you could go back to the 1600s and see banking crises all the way back. It's just trying to say to the sector, what's going on? Rates have gone up a lot. Your depositors are looking for maybe a little bit more yield somewhere. And how will this end? Policy makers would need to come out and say we’re guaranteeing deposits up to some new amount. It's $250,000 right now for the FDIC. Policy makers, not the Fed, would have to change that. And that would give people confidence. I think that's my view as to how this ends. But Ross, this has happened before, right?

Yeah, it happens all the time. There’s a saying that the Fed raises until they break something. And a lot of the times it's a big bank or it's the banking sector. History is littered with examples of this and while they're not good, we've been through them time and again. And I think the important thing, as you mentioned, is policymakers learn a little something each time and apply that to the new crisis. So I agree with you, it has to come from Washington.

What should you do if you’re worried about a recession?

Ross:

I’m going to repeat something you told me: which is just survive it. You have to survive recessions to participate in the upside of the bull markets and the much longer expansions. And one critical way that you can do that, whether it's a mild recession or a deep recession, is to have cash and have liquidity. Right now, you can actually earn something on that cash. You want to have emergency cash sitting in something right now that's giving you a yield, so that you're not forced to sell your stocks or sell your home. If things do get a little more dire or a little dicey, you just have to survive a recession with cash so that we can participate in the usually much longer expansions.

Mike:

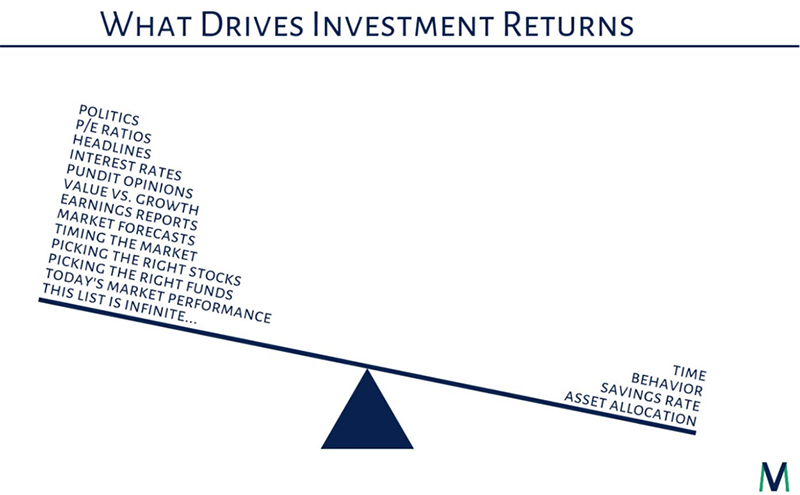

Here’s this great image about what actually drives investment returns.

On the left side is a whole bunch of stuff we've been talking about, you might be talking about and the media might be talking about. And on the right side is what matters: time, behavior, savings rate and asset allocation. And Ross, you’re right, you have to survive. Which is why we do planning, right?

Ross:

Recessions pretty much happen every six to eight years with consistency. When you sit down with your advisor and build a plan, you're not building a plan thinking that there's no recessions or bear markets ever again. These downsides are built into the plan. This is part of the deal. Your plan is built to survive it. And so yeah, we get through it and we get onto the next big bull market.

That's right. The United States of America has experienced 34 recessions since the Civil War. 34! You have to have recessions. If you didn't, the economy and the market would just go straight up and they would get so fragile because you'd have people doing incredibly stupid things with money. It would get so fragile that you would eventually have a crash. So markets have to pull back, economies have to pull back. Life is very cyclical.

If you have additional questions on how the market might influence your portfolio and broader plans, your Baird Financial Advisor is only a phone call away. For more insight into managing your portfolio, check out our articles on bairdwealth.com and the latest issue of Digest.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.