Five for Friday

March 6, 2026

Energy, War and Markets, Growth, "Plummeting" and Energy

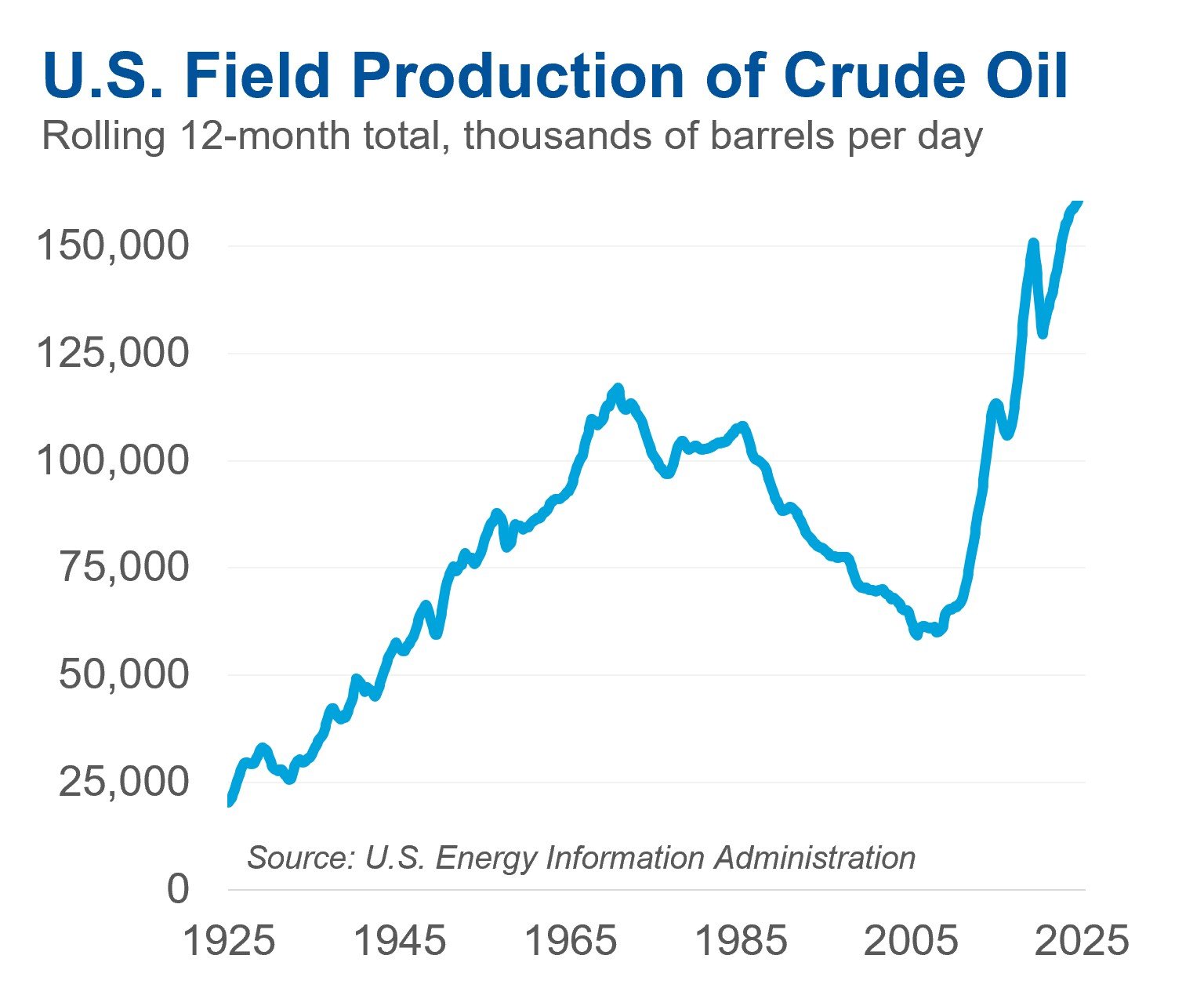

1. Energy

The primary way that geopolitical crises abroad impact U.S. investors and consumers is via the price of oil. For most of the post-WWII era, the U.S. relied heavily on imported oil, so turmoil in the Middle East often meant near-immediate pain for the American economy: gas shortages, recessions, etc. Today, because the U.S. produces more natural gas and crude oil than any other country, those same shocks hurt far less directly. Robust domestic energy production acts as a buffer to shocks in the Middle East – with lower risk of physical shortages at home and often smaller price spikes for U.S. consumers. Now, crude oil remains a globally priced commodity, so major disruptions can still hit U.S. prices (a la Russia-Ukraine in 2022) and strategic chokepoints like the Strait of Hormuz still matter greatly for global stability. Gas prices may yet pop if this conflict stretches from days into weeks (or months). But compared with past decades, these events tend to represent potential economic headwinds for the U.S., not existential energy threats.

2. War and markets

Even before the change detailed above, the impact of geopolitical crises on U.S. markets was mixed. Here’s a trivia question: what do the Korean War, Cuban Missile Crisis, Vietnam War, Invasion of Panama, Gulf War, War in Afghanistan, and War in Iraq all have in common? Besides all being geopolitical events with far-reaching implications, the S&P 500 was higher six months after each event began. What makes the news is not always what moves the market (see my colleague Mike Antonelli’s piece from this January) and surprise events tend to do more to reinforce the trends already underway (in this case the trend is a broad, rotational bull market) rather than introduce something new.

3. Growth

The Institute for Supply Management conducts widely considered (and often market-moving) monthly surveys of supply chain executives as a gauge of whether U.S. manufacturing and services activity is expanding or contracting. In the last few months, activity for both the services sector (e.g., information, real estate, travel/food) and manufacturing sector (e.g., machinery, electrical equipment, apparel) hit their highest readings since summer 2022. It’s two data nuggets in a sea of information, but these readings have typically been solid leading indicators and are today reflecting broad demand and growing momentum across a multitude of industries. We’ll take it.

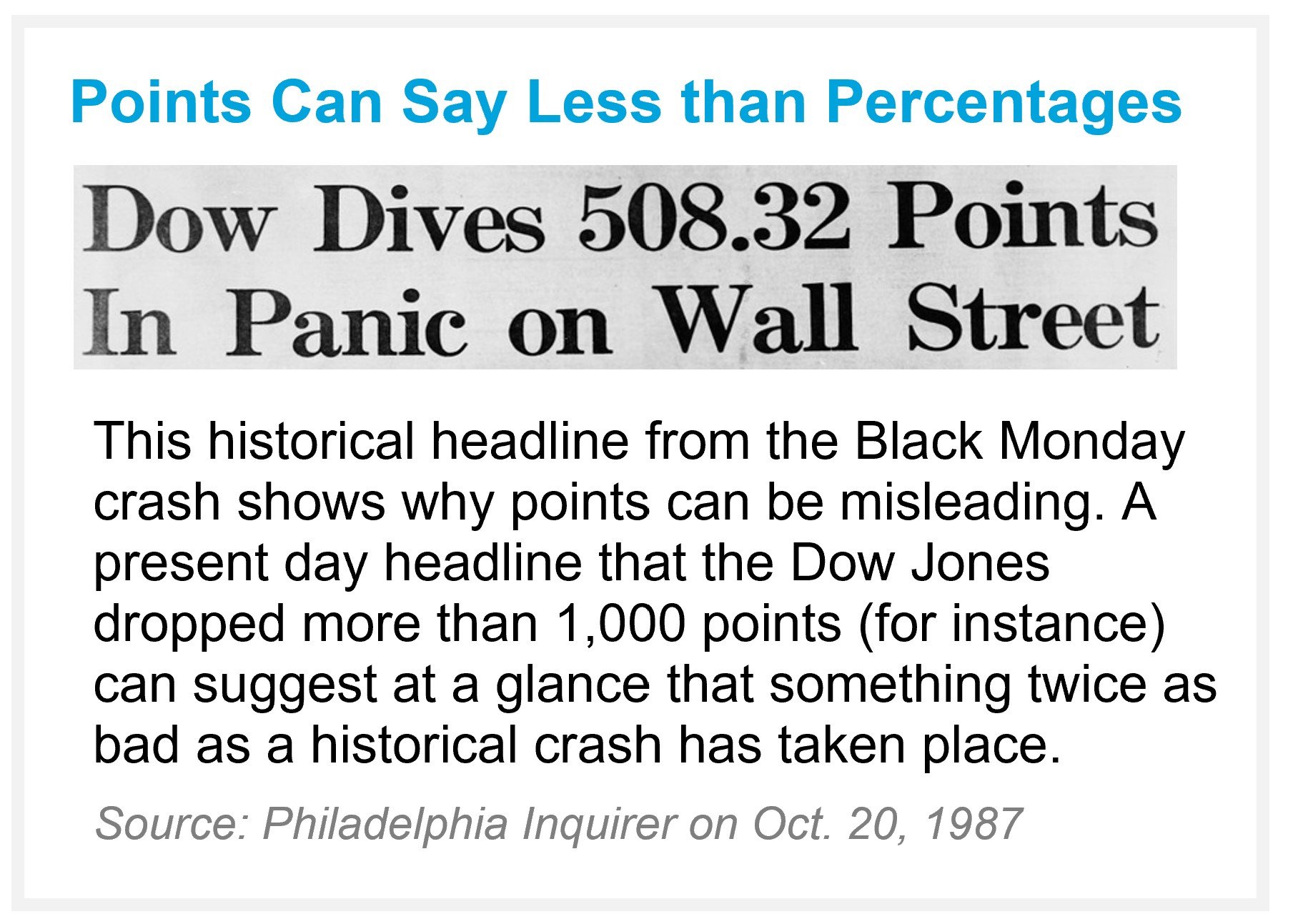

4. "Plummeting"

One of my biggest pet peeves during markets selloffs is the media’s insistent use of “points” to describe the drop – as in “DOW PLUMMETS 1,000 POINTS.” The U.S. stock market has risen over the last century to such a degree that it takes many more “points” now to reflect the same percentage change (a classic case of denominator blindness). In 1987, Black Monday saw the Dow plummet 508 points in a day – a loss of 23%. Today, a 508 point drop would be barely a 1% dip. How the headlines are phrased doesn’t change what the market’s done but it’s a frustrating example of the media going for clicks over context and potentially sparking unwarranted fear among investors. Remember the old adage: points make headlines, but percentages tell the story.

5. Speaking of energy

Did you know that the broad Appalachia region of U.S. produces more natural gas than every country except Russia? Not half bad for a place known more for hiking, horses, and Hershey than for hydrocarbons.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Market and economic statistics, unless otherwise cited, are from data provider FactSet.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2025 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.