Five for Friday - May 3, 2024

Growth, Europe, Market Vs. Economy, Pets, and Derby

1. Stag vs. flation

Per Bank of America, news stories mentioning “stagflation” (an environment of stagnant economic growth + high inflation) are at their highest level since mid-2022. This was prompted by the most recent GDP report that showed economic growth coming in below expectations and inflation data above expectations. Now, the “flation” part checks out – inflation is too high, too sticky, and is the primary reason why expectations have shifted from 6+ rate cuts this year to potentially zero. But you can’t have stagflation without “stag,” and the U.S. economy is simply growing too fast for that label. Retail sales jumped in March, manufacturing activity is percolating, and the labor market refuses to crack. Even the soft GDP number was primarily just a quirk of calculation (the U.S. imported more than it exported, which lowers GDP), but the core drivers of the U.S. economy—consumption and private investment—remained rock solid. There’s always a rush among pundits to be the first to call a big shift, especially if its negative. That day may come, but it’s not here yet.

2. Europe

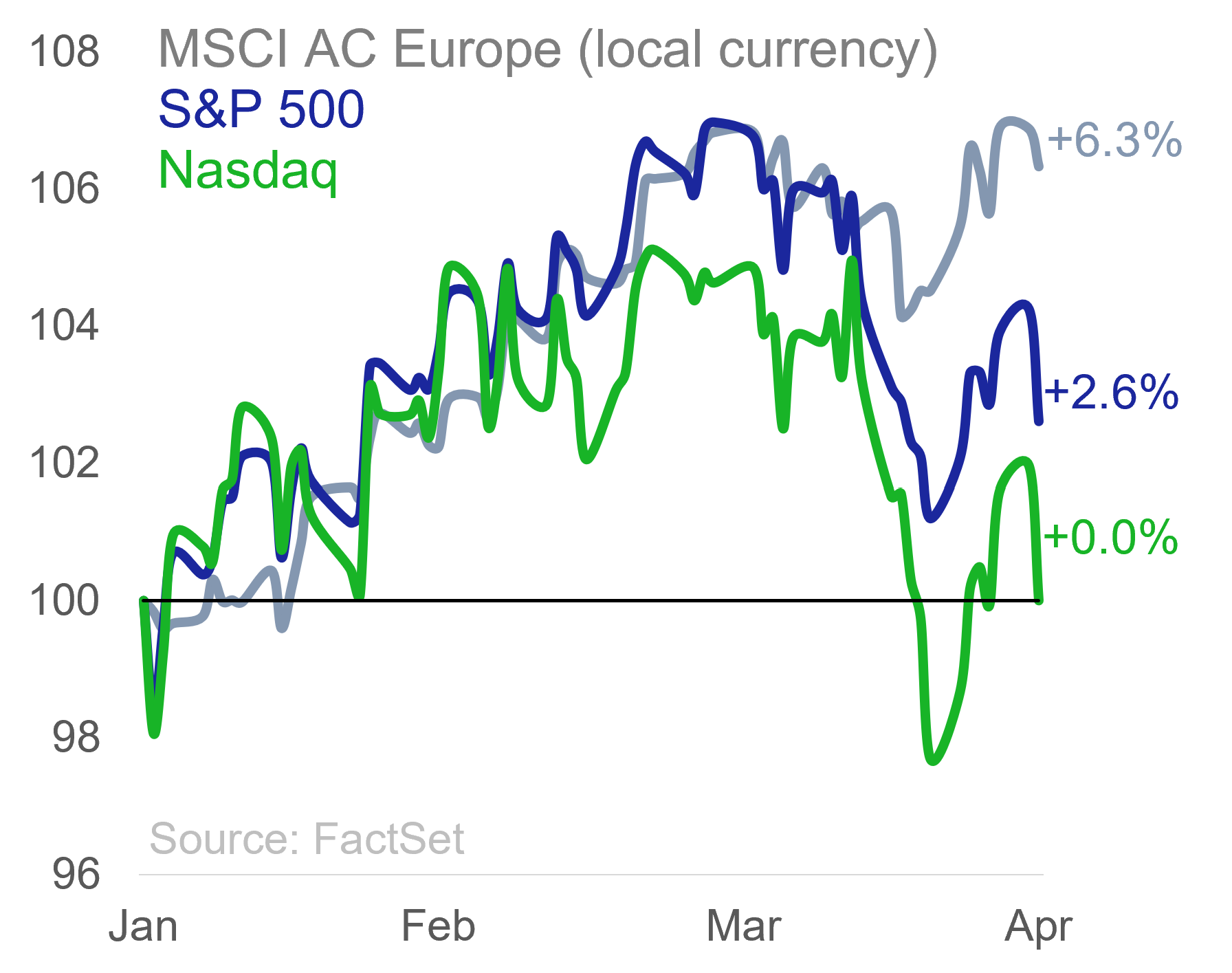

On the other hand, there have been real whiffs of stagflation in Europe the last few years, where pandemic after-effects and the war in Ukraine fueled both an inflation spike and a minor recession. However, the tide looks to be turning. Just this week, eurozone inflation data beat expectations to the downside (all but guaranteeing a July rate cut), while economic growth surprised to the upside. This is beginning to be reflected in the market. Over the last 3 months, the MSCI AC Europe Index has outperformed the S&P 500 by 2 percentage points…despite the U.S. dollar rising by 2.5% over the same period (a huge hinderance to international returns). In local currency terms, the MSCI Europe is outperforming by even more. U.S. investors tend to be underweight international stocks to start (aka home country bias), but international exposure remains a bedrock of a diversified portfolio —and this might be a timely opportunity for investors to revisit that case.

3. Markets

Two interesting data points from Apollo Global Management. First, only 13% of U.S. companies with at least $100 million in revenue are publicly traded (i.e., are stocks you can buy). Second, only 18% of the U.S. labor force works for S&P 500 companies. This reinforces a key lesson, which is that the stock market is not the economy. While they’re correlated and usually track over the long-term, they also vary widely in many ways (the stock market is full of multinational firms while the economy is U.S.-only; the stock market is a forward-looking mechanism while economic data is backward-looking, and so on). Case in point: in the last 75 years, there have been ten in which the U.S. posted negative real GDP growth. The average S&P 500 return in those years was 25%. A good reminder of a key lesson for investors to internalize.

4. Pets

A recent Consumer Confidence Survey asked respondents where they’d be most and least likely to reduce spending to save money. After childcare, education, and health care, people were least likely to reduce spending on pet expenses—behind things like utilities, phone service, and internet. Major themes like Artificial Intelligence and Deglobalization get a lot of attention, but an under-the-radar and structural theme is the human-ification of pets over the last several decades. The U.S. Chamber of Commerce recently noted that over 114 million U.S. households own a dog or cat, and personal spending on pet care has well outpaced overall consumer spending in the last 30 years. Nothing is slowing this trend down, and it’s a good a reminder that not all themes need to be flashy to be investible for the long-term.

5. Racing

I write this from Louisville, Kentucky, where this weekend will feature the 150th running of the Kentucky Derby. The equine industry generates roughly $6.5 billion in total economic impact for the state and supports over 60,000 jobs. I’d give a pick for the race, but I don’t feel like jinxing any of the horses or jockeys in contention. Happy Mint Julep Day!

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Baird does not currently recommend the purchase of cryptocurrencies, products that attempt to track cryptocurrencies or cryptocurrency custodians. Baird does not custody cryptocurrencies, such as Bitcoin.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2024 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.