All That Matters: Your Greatest Challenge

This month Mike and Ross tackle what they think is the greatest challenge: in a noisy world, how can investors overcome the negativity?

Mike: In this series, we’ve talked about a lot of key issues like the national debt and elections, but today we’re going to talk about what I think is the greatest challenge for our clients: existing and investing in a world that’s steeped in negativity and disinformation. And we’re going to tackle this challenge in three ways: the current state of the world, what the data tells us, and how to deal with all this information.

The Current State of the World

Mike: It’s really difficult for someone to hear that all they need to do is save their money for 20 years and they’ll reach all of their goals. It doesn’t acknowledge that each day and month that goes by is difficult. I saw this tweet by a friend of the show, Morgan Housel, where he says the four most dangerous financial traits are:

- FOMO (Fear of Missing Out)

- Demanding certainty when none exists

- Impatience

- Gullibility

Ross: Off the bat, number two stands out the most to me: Demanding certainty in a world where there is none. There never has been that certainty and there never will be, and yet we have to put our money to work for long periods of time regardless of that uncertainty. As humans we crave certainty and predictability, but the world is just unwilling to give it to us. And on top of that, we have hindsight bias, where everything in hindsight appears more certain or more obvious than it was at the time. Which one stands out to you?

Mike: I think gullibility is the most dangerous of the four financial traits. Because it means that you soak up a lot of disinformation and think that you need to do something. It’s very easy in a hyper-informed world to think that everything matters. It’s just not the case. It’s why we named the series All That Matters – because we wanted to produce something once a month that actually matters to you. We are trying to avoid adding noise in the world, and focus our clients on what’s important.

Throughout history we have been a risk-averse species. We’ve learned to run from dinosaurs and not touch fire and keep out of danger. That gut feeling you often have is your risk-averse brain trying to keep you out of trouble. But today we are literally inundated with negative news – in fact, we get more news in one day than somebody in the 1800s did all year.

Ross: You’re right. There’s endless amounts of information. And while we’re here today because of this risk-averse mentality – we ran and we hid and we survived. But in today’s world, that fear is not the same asset that it was 100,000 years ago. In just the last 20 years we’ve created social media and mobile phones and the 24-hour news cycle that is completely counter to what our brain has trained us to do. So it creates this friction that makes investing over long periods of time really hard. Probably the hardest it’s ever been in history.

What the Data Tells Us

Mike: We’re all dealing with this. And how we get through this and overcome it is important. We’ll get to that, but before we do, we have a couple charts that highlights this negative mindset about the world we live in.

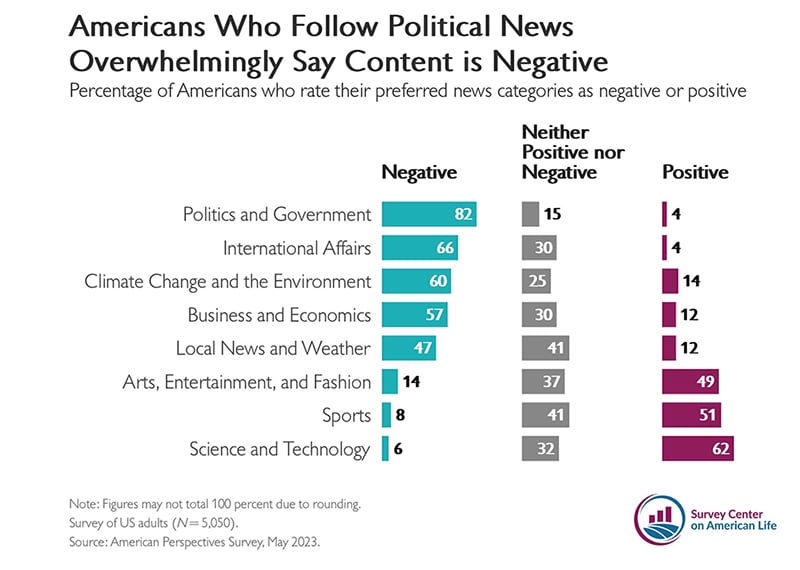

This first chart focuses on Americans who follow certain types of news, and their perception of whether it’s negative or positive. Politics and government is overwhelmingly negative, and is followed by international affairs, climate change, business and economics as negative as well. But towards the bottom, you see that news focused on arts, entertainment, fashion, sports, science and technology are overwhelmingly positive.

Ross: And yet we keep going back to the well. It’s a doom loop of negativity where we spend our time with negative news and get trapped in an echo chamber. And this is important information – it’s geopolitics, it’s business – that we feel we should be paying attention to, and yet it’s viewed as negative by the people consuming it.

Mike: And there is every incentive to keep it negative. When the news is negative, you watch more. When you watch more, the stations get higher ratings. I don’t want to get too cynical, but it’s important to remember that for the things that feel like they really matter, it’s going to skew negative because that’s what captures attention. You have to navigate that and uncover what’s important, and what’s not. What actually matters to your money, and what doesn’t.

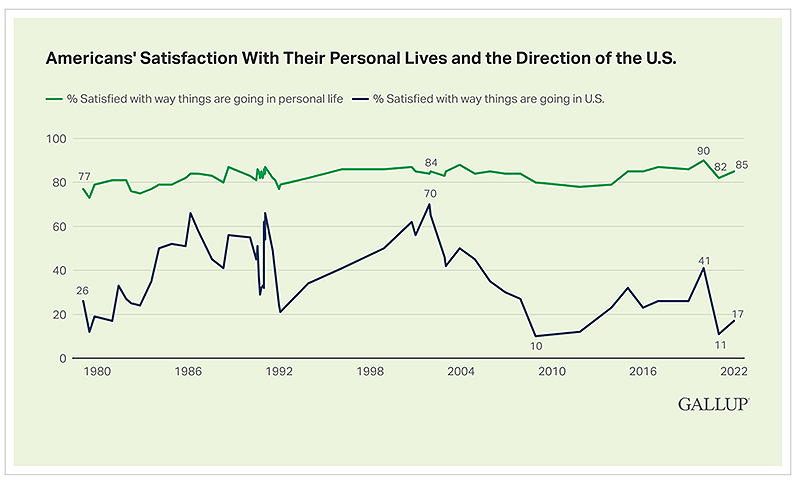

This next chart is really interesting – it assesses Americans’ satisfaction with their personal lives, and how they view things are going for the country as a whole. When it comes to personal lives, it has barely moved since 1980. In other words, 77-80% of people think their life is fine. And yet, the percentage of people satisfied with the way things are going in the U.S. has plummeted.

Ross: It goes back to this idea of “vibes” that we’ve talked about in the past. Everybody is reporting that they’re miserable and things are bad, and yet the economy’s booming, the job market is booming, and the stock market is going up. The disconnect is seen in this chart. I’m glad everyone continues to feel positive about their own personal situation – that drives consumer spending and engagement in communities and all the things that actually matter. But as far as how people view the world or the direction of the U.S., it’s tricky. We’ve had a couple of big market bottoms recently, but the investor in me looks back at the early 80s, the early 90s, 2009 , 2020… those were all great times to invest. The most negative times have been the worst opportunities to get out of the market or make a rash decision.

Mike: It’s the most fascinating look into human behavior that I can think of. People are basically saying “I’m fine. I’m satisfied with my life, my community, and the things around me. But when I look at things in aggregate, I’m dissatisfied.” How can everybody be happy with the way things are going personally, but think things are going poorly in aggregate? It hammers home our point: if you were told things are good, you’d stop watching. In the aggregate, we’re all mad.

That’s not to say there aren’t pains in the economy. When someone pays 12 bucks for bacon – or if gas is increasingly expensive – that hurts people. We try to stay in touch with that and acknowledge that dissatisfaction. We’re not here to say everything is fine, but we’re trying to illustrate that the world is always going to tell you that things are negative.

How to Deal With This

Ross: Let’s start by drawing a distinct line between skeptical and distrustful. We are not anti-mainstream media in any way, but we encourage you to be skeptical with the information you consume. There is a healthy amount of disinformation in the world today, and the problem is that it’s not going to get better with time, especially with the proliferation of AI, bots and social media. It’s very easy for disinformation to spread and thrive in echo chambers. So be skeptical, and look for different people with different world views. Check sources. Evaluate if the information presented is opinion or fact.

Mike: One of the hallmarks of a great investor is a healthy amount of skepticism. If someone tells you that the dollar is losing its reserve currency status, your default assumption should be skepticism. Why are you saying that? Why do you think that's true? What knowledge do you have? How could it possibly affect me? Who are you to make this statement?

Another consideration is avoiding the trap of thinking everything matters to your money. Anything you see on social media or on the news – be it a war, central bank digital currencies, social credit scores – often gets thrown at us and presented as something that matters to your money or to the companies of the United States of America. Talk it out with somebody, talk it out with us, talk it out with your advisor, talk it out with a friend. Surround yourself with a diverse set of views: young, old, different political ideologies, different socioeconomic statuses.

Ross: Something that I've heard you say before and I think is valuable is you're the average of the three to five people or views that are in your inner circle. So that could be a news source. It could be your family, your close friends, a colleague that you talk to every day. If those aren't diverse, you end up with an echo chamber. But to your bigger point, I mean, so much of the news just doesn't matter for the long-term investor. The shelf life of most of the news that hits social media or even the news channels is so much shorter than the shelf life of your money. And that has to be the thing at the front of your mind every time. Ask yourself: Will I care about this news in five years or 10 years when it comes to my money? Usually not.

Mike: Yeah, which brings us to our final point. I saw this online, and I thought it was phenomenal: Your most important resource is not money or time. It's your attention. Your attention is a finite resource, it's spendable. Think about where you're spending your most important resource. If it’s news and negativity, you’re consuming a bunch of worries about the world, which not only makes investing hard, but it’s probably going to make you a cynic about the world.

So this is your greatest challenge. But we are here to help you. All of us at Baird think about this. We think about this being your greatest challenge and we’re here to help you navigate the ups and downs of the market and the news and help you stay focused on what really matters to you.

If you have additional questions on how the market might influence your portfolio and broader plans, your Baird Financial Advisor is only a phone call away. For more insight into managing your portfolio, check out our articles and the latest issue of Digest.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.