All That Matters: Is This the Top?

With the market at all-time highs, it’s natural to think about age-old adage, “What goes up must go down.” In this month’s episode, Mike and Ross explore the factors driving strong market performance, analyze potential risks that could derail the market, and why they continue to be optimistic about the future.

Why Are Stocks Doing So Well?

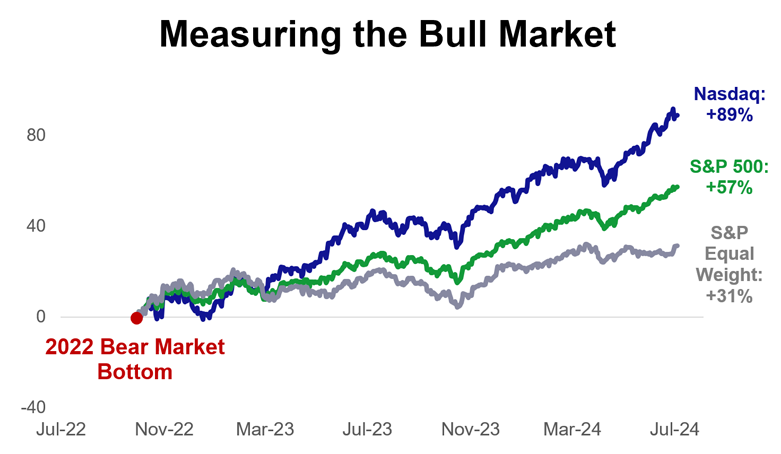

Ross: To kick us off, I have some quick stats. Since the market low in October 2022:

- The S &P 500 is up nearly 60%.

- NASDAQ is up nearly 90%.

- Dow Jones is up nearly 40%

While we tend to focus on the negatives in the world, we have a lot of good news to talk about. My question for you today: why are stocks up so much?

Mike: Before we get into it, I want to acknowledge that while stocks are at all-time highs, it’s possible your portfolio isn’t at an all time high. We can’t talk about everyone’s individual portfolio and investment strategy, but we can talk about total market performance through market indices. And in the summer of 2024, I see a couple reasons for why the overall stock market is doing so well.

- Positioning. Positioning is simply how people are invested: whether it’s cash, stocks or bonds in the market, et cetera. Right now we’re getting more attractive yields in savings accounts than we have in a long time – roughly 4-5%. While a lot of people have been parking their cash in these savings accounts, they’re also noticing that stocks are performing well and feeling a bit of FOMO, and so we’re seeing more of this cash move into the stock market.

- Strong Consumer Data. We’re also seeing healthy balance sheets and a strong position for consumers: home prices are rising, unemployment is low which contributes to a strong economy.

- Potential for Rate Cuts. Perhaps one of the most important drivers is rate cuts. The Federal Reserve believes this inflationary period is about to finally end, and so they’ll engage in rate cuts. Most bull markets start on rate cuts, and we haven’t had one cut yet. Now that we’re about to have one, it might broaden out this bull market further.

- Rising Earnings. Companies are expected to report higher profitability. We see this especially in the pharmaceutical space with the increase in GLP weight loss drugs, as well as the tech space with AI.

Ross: AI is one that stands out – I mentioned the NASDAQ has nearly doubled since October 2022 – and it’s a result of a lot of tech growth stocks that are focused on AI innovations. Naturally, there is some skepticism about whether AI is a bubble, especially as larger companies leverage the hype around AI. I tend to think about it differently. You need to be invested to experience the gains that accumulate to the winners of big technology advancements – think about the internet or steam engine and its effect on the economy. These innovations are not just hype and enthusiasm – there are real earnings being delivered to the companies invested in this space.

There are also questions about the market being overly concentrated. But even the S&P equal weight – where every company gets equal weighting regardless of size – is up 30+% off the lows. That’s not AI so much as the overall strength of the economy and company earnings.

Mike: You’re right that the biggest complaint lately has been that only a few companies are driving the big cap weighted index, and strategists often hyper focus on that. But the equal weight index is also outperforming. Said another way: if you were to take 500 of the biggest companies today and weigh Apple as much as the utility company down the road, you will still see these record highs. I think this is in part because we’re expecting rate cuts. When rate cuts happen, it’s generally good for the economy. Lending conditions are loosened, and companies get a little bit more optimistic.

There’s a whole host of reasons why the market is doing well; let’s talk about what could potentially derail the market.

What Could Derail Stocks?

Ross: Number one is a strategist platitude: the biggest risk to the market is always the one that it doesn’t see coming: 9/11, COVID-19, or any event you can think of that was out of left field and impacted the consumer in a way that the market hadn’t already priced in. That is always a risk.

But what are the things we can identify as risks today? You mentioned that interest rates going down is a positive, but rates have been volatile. If inflation were to tick back up and rates stay high, it’d be a drag for the market. And while there’s reason to be enthusiastic about AI, we also have to remember the adage that we tend to overestimate the impact of technology in the near term and underestimate its effect in the long term.

Mike: I try to keep my macro perspective very simple. I look at jobs and housing. When it boils down to it, if you have a job and if you have a house and you’re confident in your home price, you spend more. You go to the movies, you’re eating out, you’re paying your bills. And the unemployment rate has ticked up a bit lately, and that’s something that most of Wall Street watches. The more the unemployment number ticks up, the more nervous we get. When you lose confidence in your ability to have a job or have stability in your home price, you start to get bad outcomes in the economy because everybody basically pulls back, and that affects the market.

Ross: We’re talking in aggregate – not everybody has a home, not everybody has a job, but in aggregate we’re seeing a strong balance sheet and strong economy that hasn’t fueled any of those risk indicators.

Is This the Top?

Ross: When we see these all-time highs in the S&P 500, the S&P equal weight, the NASDAQ, the Dow… a natural next step is for people to ask, “is this the top?”

Mike: While we can fact check this recording months and years from now, I’m going to say that I don’t think we’re at the top for all the economic catalysts I’ve already mentioned. Now, I could be wrong if we experience some sort of macro shock that nobody forecasted, like COVID-19. Or if the jobs or housing market ends up taking a turn, that could be the start of a recession. And while I think we should be prepared for sell-offs – which are a natural part of the market and happen every year – I don’t think we’re near the top.

Ross: I agree with you. If this bull market were to end tomorrow, it would be a historically short bull market. There’s a lot of momentum behind the market, without many traditional signs that things may be petering out. Our partners at Strategas put something together called the bull market top checklist – it looks at earnings (which are on the way up, not down), credit spreads and borrowing (which are historically in a good place), and it looks at things like enthusiasm. When I look at the tops of big market runs in the past, there’s always been this euphoria. People are excited about AI, but it’s not euphoric.

Mike: As an evidenced-based guy, I like to look at what history tells us about the market. And when it comes to bull markets like the one we’re in right now, the average length is 1,300 days from the very bottom of a bear market to the very top of a bull market, with an average of 111% in gains. When we look at the bull market we’re in now, we’re about 640 days off the lowest part of our last bear market, and we’ve see 57% in gains. So if this run were to end today for some reason that we couldn’t or didn’t forecast, it’d be one of the shortest bull markets ever.

Bull Market Stats

| Bull Market | Return (%) | Length (Days) |

| Current | 57 | 641 |

| Average | 111 | 1311 |

Aside from all that – if you’re only focused on worrying about being in a bull market or a bear market, you’re never going to reach the kind of goals you really want to obtain. That’s why you work with your Baird Financial Advisor – we help you reach those goals. Focusing on bull and bear markets will only lead to struggle in a chaotic world. While we’ve seen that the world can be chaotic, we know that wealth can still grow.

Ross: Agreed. And while we may experience some sell-offs, it’s actually been a very calm year, historically speaking. You may need to buckle up for some volatility, but that’s always been the cost of participating in the market.

If you have additional questions on how the market might influence your portfolio and broader plans, your Baird Financial Advisor is only a phone call away. For more insight into managing your portfolio, check out our articles on bairdwealth.com and the latest issue of Digest.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.