In the Markets Now: The Selloff

We believe in the old saying: a picture is worth a thousand words. Here, we aim to recap recent market action and provide some perspective to investors.

On the Recent Market Selloff

It would seem the old saying that “markets ride an escalator up and an elevator down” is again proving true. The selloff in global stocks over recent days has been sharp and swift, and volatility has spiked to levels unseen since 2020.

The apparent root cause is the fear that the Federal Reserve has found itself behind the curve, raising the risk of a “hard landing” (aka recession). The Fed raised interest rates aggressively to combat inflation and has held them at 20-year highs since last year. Though economic growth has remained resilient in spite of higher interest rates, the downside risks are always elevated in such an environment – higher rates squeeze on borrowers, whether consumer or corporate, with the goal of slowing economic activity. The Fed kept interest rates steady last week despite signs that the labor market was cooling, and when Friday’s July nonfarm payrolls report (the pre-eminent labor market data point) showed a rising unemployment rate and weak jobs growth, markets found a reinvigorated belief that the Fed was well behind the curve, and with little opportunity to change things in the near-term (the Fed doesn’t meet again until mid-September). Stocks didn’t like that.

This “growth scare” is potentially compounded by geopolitical tensions and growing A.I. skepticism (i.e., can the huge invest-ment in infrastructure be justified by near-term profits?). Many will speculate that U.S. politics are playing a role, but it seems unlikely to us. Further, aggressive moves to the downside almost always have a technical aspect to them – some investors find themselves offside and closing out positions that cascade through markets in surprising and previously unforeseen ways (in this case, the Japanese yen seems one of the most likely culprits, with the Bank of Japan’s decision to raise interest rates a catalyst). This is, more often than not, a root cause of the “elevator down” effect – not just bad news, but bad news catching investors somewhat asleep at the wheel. The biggest risks are always the ones the market is least prepared for.

But equity markets are also always more volatile than the underlying fundamentals. The unemployment rate remains low by historical standards and the U.S. still added over 100,000 jobs in July. Consumer spending remains solid, corporate earnings – i.e., the reason we own stocks – are growing at a healthy clip, and interest rates are now markedly lower than they’ve been in recent months (a boon to borrowers and economic activity). Further, the market, while down meaningfully in recent days, is still up quite a healthy percent over the last year. A move from possibly-overvalued to more-fairly-valued need not be met with angst – as investor Cullen Roche once quipped, “the stock market is the only place where things go on sale and all the customers run out of the store.”

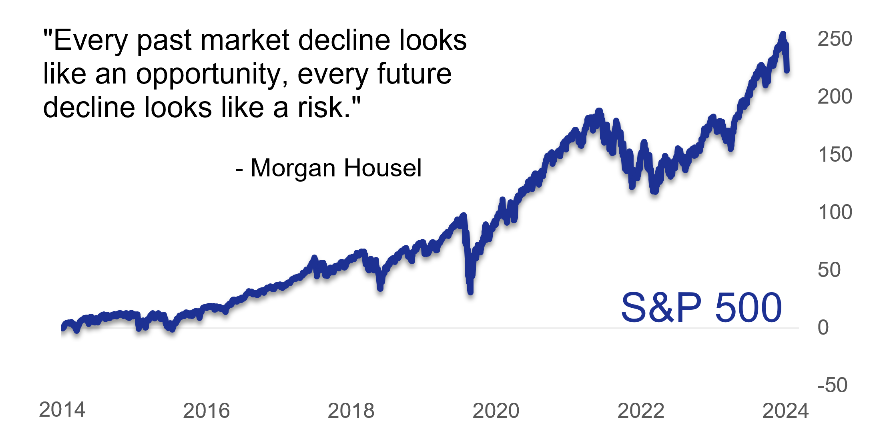

Source: FactSet

And much more importantly, it remains as true as it’s ever been that the volatility in the market is merely the price paid for its long-term gains. Opportunity to compound wealth in stocks would not be so outsized if there weren’t risk and volatility; an investment that grows at 10%+ a year with zero downside risk can only reasonably be called one thing – a scam. Selloffs are not fun, but they are part of the investing process: the average intra-year drawdown for the S&P 500 over the last four decades is 14%. Perhaps Morgan Housel said it best: “every past market decline looks like an opportunity; every future decline looks like a risk.” Stick to your plan and lean on your Baird advisor in times of strain. We’ll keep an eye on markets in the meantime.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Unless otherwise cited, market and economic statistics come from data provider FactSet.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2024 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.