Key Takeaways from Strategas Research Areas

At Strategas, we look at the markets and the economy from several angles. Periodically, we gather our research areas into one note that serves as a snapshot of where we are today and an outlook for the months ahead.

March 19, 2025

Investment Strategy

Jason Trennert, Chairman, Chief Investment Strategy

Tariffs. It’s safe to say that the animal spirits spawned by President Trump’s election have given way to concerns about the economy. At the heart of these concerns is a question: Has the administration’s tariff policy been a bluff designed to drive a hard bargain in negotiating with foreign powers, or is the president ideologically wedded to tariffs as the basis for a new economic system? If the first Trump term was any indication, a case can be made for this term’s tariffs being a bare-knuckled negotiation tactic that will resolve favorably for most of America’s trading partners, apart from China.

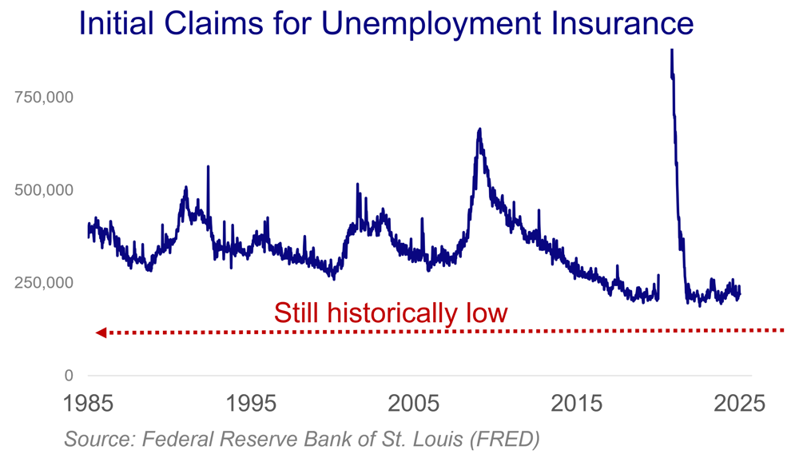

Uncertainty. There is little question that tariffs are having a chilling effect on business and consumer confidence. We have increased our recession odds to 25% (from 15% at the start of 2025) largely based on risks to business investment. Having said that, our Holy Trinity of economic indicators—unemployment claims, corporate profits, and corporate credit spreads—suggest that the economy is in fine shape in absolute terms. Tariff announcements expected on April 2 will be critical in determining the scope of future tariff policy, and whether prolonged tariff anxiety will further affect our odds of recession (more on this in the next section, but we believe that reciprocal tariffs are likely to be far less disruptive to the global economic system than universal tariffs).

Uncertainty. There is little question that tariffs are having a chilling effect on business and consumer confidence. We have increased our recession odds to 25% (from 15% at the start of 2025) largely based on risks to business investment. Having said that, our Holy Trinity of economic indicators—unemployment claims, corporate profits, and corporate credit spreads—suggest that the economy is in fine shape in absolute terms. Tariff announcements expected on April 2 will be critical in determining the scope of future tariff policy, and whether prolonged tariff anxiety will further affect our odds of recession (more on this in the next section, but we believe that reciprocal tariffs are likely to be far less disruptive to the global economic system than universal tariffs).

Fiscal. We are concerned about the spiraling interest costs of U.S. debt given the short-term nature of much of the outstanding debt. Without productivity or employment growth, the bill for past spending will eventually come due, either through higher interest rates, higher inflation, or the crowding out of public spending and private investment.

Valuation. Economic worries seem to be refocusing investor attention on valuation. By almost any metric, the S&P 500 is trading rich relative to its history. It is difficult to make a strong case for multiple expansion when we’re starting from an S&P 500 price-to-earnings ratio of 20.8x (next-12-months) and a 10-year Treasury yield of 4.3%. From here, returns in line with earnings growth are more likely than multiple expansion. We estimate that S&P operating earnings will be up about 10% in 2025, falling to 2% if all proposed tariffs are put into place. However, given the low levels of long-term interest rates (relative to history), we believe the market can stay “expensive” longer than what would have been possible in the past.

Government. Structural issues may make it difficult for the Fed to ease as much as the market anticipates. We now expect three additional rate cuts this year. A potential offset could be easing of regulatory policy for companies in the Financials sector (especially regional and community banks) and the Energy sector (midstream energy, coal, and liquefied natural gas exporters).

Washington Policy

Dan Clifton, Head of Policy Research

Abrupt policy transitions. With a U.S. budget deficit near 7% of GDP, President Trump is trying to shift to tighter fiscal policy via spending cuts and higher tariffs while pressuring the Fed to loosen monetary policy. We expect the Fed to end quantitative tightening, with rate cuts coming as early as next quarter. Elsewhere, Treasury Secretary Bessent is pushing for regulatory changes that would allow banks to expand their balance sheets and would boost demand for Treasury securities. But the transition is abrupt.

Low visibility on tariff impact. We expected Trump to make tariffs a pillar of his agenda but the sheer size of the tariffs—coupled with a lack of plan for implementation—has upended investors. Trump is making clear there will be more tariffs than in his first term, and he is enacting these tariffs without significant support from fiscal policy (i.e., tax cuts). Investors have little visibility into how to account for economic impacts that may be coming.

Cracking support. A slip in net approval is not unusual for a new president but the change in Trump’s approval rating on the economy is noteworthy. Trump’s March net approval on the economy is -8, lower than it ever was in his first term. Voters elected Trump in part to bring down inflation, but tumultuous actions on tariffs—as well as funding freezes, spending cut threats, and layoffs –have muddied the economic outlook.

Liquidity cushion until April. Due to the debt ceiling being hit on January 21, the U.S. is unable to issue net new debt and must spend down the Treasury General Account to pay the bills. Year-to-date this has resulted in a $430 billion liquidity injection (as new money enters the financial system from outside of traditional entry paths), which has cushioned tariff chaos by keeping a ceiling on the dollar and lowering bond yields. There is still about $250 billion of liquidity in the pipeline before TGA is depleted. However, April tax payments will create a temporary liquidity drain, leading to higher yields and a stronger dollar for a time.

Reciprocal tariffs. Trump’s move to give USMCA-compliant goods a one-month reprieve from 25% tariff shows, to us, an increased sensitivity to markets and company lobbying. We still expect tariff escalation but it may come in the form of a reciprocal tariff rather than universal tariff. The reciprocal approach targets fewer goods from a handful of countries at a time rather than all imports into the U.S. at once. The expected April 2 announcement may dispel some uncertainty.

Tax cuts. Market selloffs and cracks in the economy are raising concerns among Republicans. Extending expiring TCJA individual tax cuts prevents a huge tax hike, but does not add new stimulus—and proposed “pay-fors” could even have the opposite impact. We are seeing new tax proposals to help make the reconciliation bill more pro-growth, such as reinstating expired TCJA corporate provisions like 100% capital expensing and immediate expensing of R&D expenditures, along with expanding the child tax credit and a domestic manufacturing corporate rate cut. Deficit concerns and fiscal hawks in the party will be limiting factors.

Economics

Don Rissmiller, Chief Economist

Growth. U.S. data have shown rolling weakness in housing and manufacturing. There is further downward pressure on activity in 2025, including post-election fiscal tightening. We are using a 25% chance of a U.S. recession, 60% soft landing, and 15% upside surprise in 2025. For 2026, our odds are 20% recession, 60% soft landing/expansion, and 20% upside.

Inflation. The first wave of U.S. inflation appears to be over (inflation expectations still look anchored), but history suggests that once inflation gets going, a second wave tends to build over the next several years (87% of the time, globally). We’re in the lull between waves, but remain attentive longer-term, especially to factors that have heavy weights like rents. Supply chain problems due to trade disruptions could also create upward price pressures over time.

Policy. 2024 saw the Fed lower rates, justified first by inflation coming down and reinforced by cracks in the employment situation. Getting monetary policy back to a neutral setting would likely require several more rate cuts in 2025.

Risks. Fiscal supports that allowed prior growth have not been cost-free. The U.S. federal budget deficit remains large and threatens to crowd out other economic activity (though this does not appear to be happening yet). Fixing this abruptly risks an economic stop. Alternatively, inflation could return.

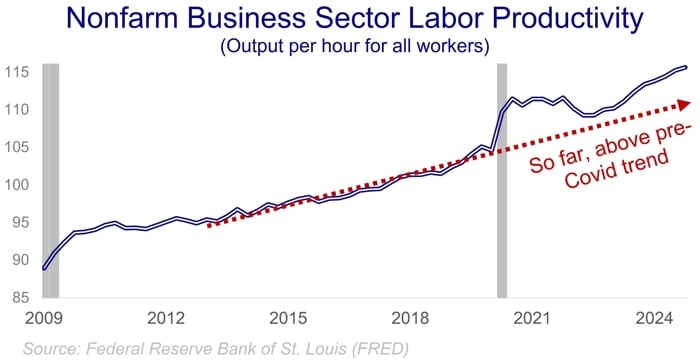

Hope. Productivity could mitigate a second inflation wave by allowing workers to produce more goods and/or services for a similar or lower cost profile. Too much money chasing too few goods (i.e., inflation) can be stymied…by producing more goods. While there is promise on this front from technological advances, we need to see better and more pervasive performance in the economic data. We would like to see the profits of both the producers of AI technology and the users of that technology growing at the same time. There’s promise, but it is early to see how new technologies such as AI will ultimately change the labor landscape.

Asset Allocation

Nicholas Bohnsack, President, Head of Portfolio Strategy

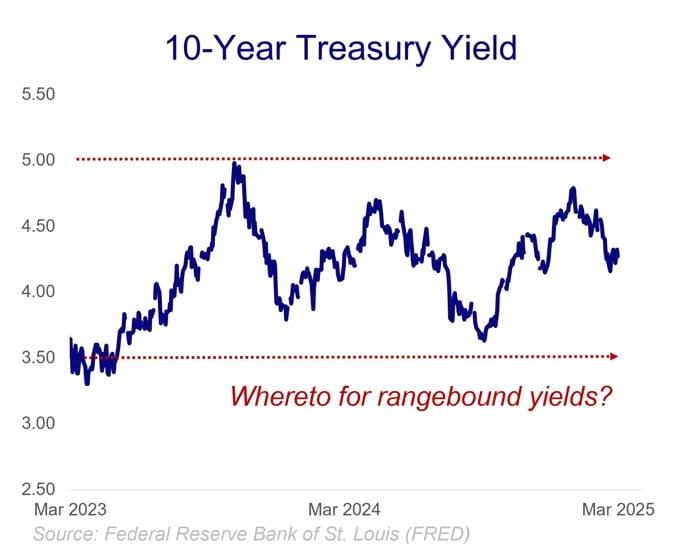

Bullish. We remain bullish on the market and the economy, but the performance profile has clearly changed. Inflationary pressures are mounting, though slower segments are keeping the headline numbers at bay. The Fed is oscillating on next steps in a potentially pre-stagflation vacuum (i.e., their worst-case scenario). Policy uncertainty doesn’t help. That said, yields remain rangebound-to-lower and corporate credit remains in reasonable shape (though spreads have widened modestly).

Diversification. The short-term (pre-tax season) lift from Treasury liquidity should help U.S. shares find a bottom. Relative strength has shifted abroad and is likely to continue with international stimulus programs expanding. We would redeploy exposure into non-U.S. shares, in both Developed and Emerging markets. We remain bullish on Gold as a portfolio staple during this accelerating, multivariate phase of deglobalization.

Technical Strategy

Chris Verrone, Head of Macro And Technical Strategy

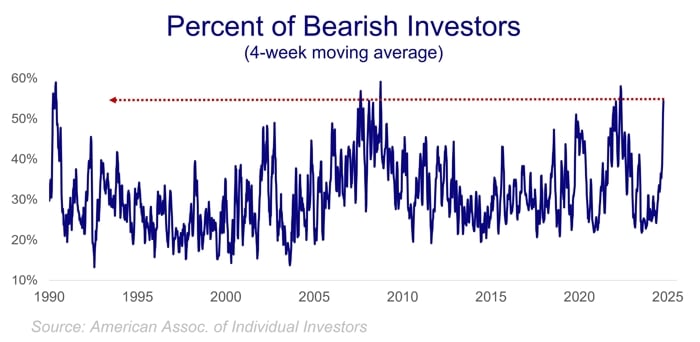

Correction. After a -10% correction, the market is in the ballpark of a tactical low—last Friday’s strong response (91% of S&P 1500 advancing) was a helpful first step in establishing a good first quarter low. The sentiment call is also coming together. Excessive enthusiasm was the big risk entering the year but after a sharp drawdown, we now have investor surveys, volatility, and volumes all showing bearishness—a contrarian indicator that’s positive for forward returns. However, corrections are a function of price and time. On the price side we’re likely in the ball park, but we wonder if the time consideration lingers.

Correction. After a -10% correction, the market is in the ballpark of a tactical low—last Friday’s strong response (91% of S&P 1500 advancing) was a helpful first step in establishing a good first quarter low. The sentiment call is also coming together. Excessive enthusiasm was the big risk entering the year but after a sharp drawdown, we now have investor surveys, volatility, and volumes all showing bearishness—a contrarian indicator that’s positive for forward returns. However, corrections are a function of price and time. On the price side we’re likely in the ball park, but we wonder if the time consideration lingers.

Recession? Credit and Financials were not immune to market weakness, but the level of weakness was in line with what’s historically been seen in -10% corrections. It’s important that credit and Financials both remain firm in the weeks ahead, as deterioration would lead us to wonder if something more serious is lurking out there. So far, we’re okay. From a risk perspective, we also think it’s important for Bitcoin to hold here, major support in the $70- 80k range. Gold is in a clear bull market but flows are now aggressive. Finally, Industrial Metals are improving, which makes it difficult to suggest global growth is materially slowing.

Sectors. Technology and Financials are equally flushed and likely to rally, with an important distinction—Financials entered this correction as a sector leader (and has held its own), while Technology’s relative performance peaked all the way back in July 2024. We’d be surprised if Tech came out of this again carrying the flag of leadership. (As an aside, Tech’s relative peak in July 2024 also coincided with the peak in U.S. dollar vs. Japanese yen. We have been and remain yen bulls; it should not be underestimated the degree to which a stronger yen is impacting how capital flows around the world after decades of hyper-low interest rates in Japan.)

Rates and international. On interest rates, we lean bullish and would be surprised to see 10-year yields breach 4.50% on the high side. Japanese and German yields look different, however. Speaking of international, we have been and remain Chinese equity bulls. It’s not been for the faint of heart (or even for most individual investors), but we continue to believe a major turn has taken shape over the last 12 months and we’re encouraged to see that Chinese 2-year bond yields are now on the rise.

Fixed Income

Tom Tzitzouris, Head of Fixed Income Research

Soft landing vs. recession. The outlook for the bond market comes down to this: what arrives first, liquidity and labor market weakness or inflation and deficits? What if inflation and Treasury supply are both rising while the labor market is weakening? Although this isn’t a trivial question, our base case is still for 1) temporary seasonal economic weakness and supportive liquidity, followed by 2) return to trend growth in mid-2025, followed by 3) return of inflationary pressures in late-2025 due to strengthening demand for labor—just as coupon auctions begin to rise.

Liquidity. Liquidity is arriving now in the first quarter of 2025, with additional rate cuts expected later in the year, and an end to Fed balance sheet reduction (i.e., quantitative tightening) by early spring. This should keep 10-year yields below 4.5% for the rest of Q1, and assuming that the debt ceiling has NOT been raised by the time tax season passes, we should see yields continue to migrate lower, making a material move towards 4.0% no later than early May.

Liquidity. Liquidity is arriving now in the first quarter of 2025, with additional rate cuts expected later in the year, and an end to Fed balance sheet reduction (i.e., quantitative tightening) by early spring. This should keep 10-year yields below 4.5% for the rest of Q1, and assuming that the debt ceiling has NOT been raised by the time tax season passes, we should see yields continue to migrate lower, making a material move towards 4.0% no later than early May.

Pressure. Once the debt ceiling has been raised, presumably by early summer, the process of pulling liquidity out of the system will begin. This should gradually put upward pressure on intermediate- and long-term bond yields again starting in the summer, but the end to Fed balance sheet reduction, along with another 25 bps of rate cuts in the middle of the year, should help to slow the rise in yields. Likewise, a delay in the much-anticipated increase in coupon auctions should also continue to keep 10-year yields anchored below 4.5%.

Auctions. By middle of Q3, the Treasury is likely to announce a raise in coupon auctions, to start in middle of Q4, or even sooner, and the process of the bear steepening (i.e., when long-term interest rates rise faster than short-term rates) should resume, likely bringing 10-year yields back above 4.5% by the end of the year. This move should be amplified by the labor market returning to growth after a prolonged seasonal soft patch in the first half of the year.

Spreads. Despite the economy being likely to avoid recession, the widening in credit spreads that began in February is likely to persist due to the return of the Treasury supply-induced bear market steepener. This should lead to a mild correction in investment grade credit spreads from current levels, but nonetheless one that results in spreads finishing the year near but north of 100 bps. Mortgage-backed security (MBS) spreads should also see some widening before the year ends, largely due to the aforementioned yield curve steepener, and the return of yield volatility, along with reduced liquidity in the bond market. We see MBS spreads finishing the year around 45 bps, or about 10 bps north of where we stand today.

Appendix – Important Disclosures

Past performance is not indicative of future results. This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent. This communication is provided for informational purposes only and is not an offer, recommendation or solicitation to buy or sell any security. Unless otherwise cited, market and economic statistics come from data providers Bloomberg and FactSet. This communication does not constitute, nor should it be regarded as, investment research or a research report or securities recommendation and it does not provide information reasonably sufficient upon which to base an investment decision. This is not a complete analysis of every material fact regarding any company, industry or security. Additional analysis would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any particular client and is not presented as suitable to any other particular client. Investment involves risk. You should review the prospectus or other offering materials for an investment before you invest. You should also consult with your financial advisor to assist you with your analysis, risk evaluation, and decision-making regarding any investment.

Baird does not currently recommend the purchase of any cryptocurrencies, products that attempt to track cryptocurrencies, or cryptocurrency custodians. Baird does not custody Bitcoin or any other cryptocurrencies.

The performance and other information presented in this communication is not indicative of future results. The information in this communication has been obtained from sources we consider to be reliable, but we cannot guarantee its accuracy. The information is current only as of the date of this communication and we do not undertake to update or revise such information following such date. To the extent that any securities or their issuers are included in this communication, we do not undertake to provide any information about such securities or their issuers in the future. We do not follow, cover or provide any fundamental or technical analyses, investment ratings, price targets, financial models or other guidance on any particular securities or companies. Further, to the extent that any securities or their issuers are included in this communication, each person responsible for the content included in this communication certifies that any views expressed with respect to such securities or their issuers accurately reflect his or her personal views about the same and that no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this communication. This communication is provided on a “where is, as is” basis, and we expressly disclaim any liability for any losses or other consequences of any person’s use of or reliance on the information contained in this communication.

Strategas Securities, LLC is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), a broker-dealer and FINRA member firm, although the two firms conduct separate and distinct businesses. A complete listing of all applicable disclosures pertaining to Baird with respect to any individual companies mentioned in this communication can be accessed at http://www.rwbaird.com/research-insights/research/coverage/third-party-research-disclosures.aspx. You can also call 1- 800-792-2473 or write: Baird PWM Research & Analytics, 777 East Wisconsin Avenue, Milwaukee, WI 53202.