Social Security Changes Are Unlikely

Washington Policy Research

A lot of headlines are focused on potential changes to Social Security, the solvency of the Social Security Trust Fund, and efforts to root out fraud and waste in the Social Security Administration. However, changes to Social Security are unlikely, as outlined below.

President Trump has said that he will protect Social Security benefits.

While President Trump is focused on eliminating fraud and waste across federal agencies and implementing federal spending cuts, he has stated that he does not want to reduce benefits for Social Security (or Medicare) or to cut staff that would impact the provision of Social Security benefits. The Department of Government Efficiency (DOGE) is specifically looking at Social Security payments to individuals over the age of 100, but not all of the individuals meeting that criterion are receiving benefits, and DOGE is expected to only cut benefits for individuals receiving benefits fraudulently. A 2024 Social Security inspector general report found that $71.8 billion in improper payments were made between fiscal years 2015 and 2022, less than 1% payments made in that time period.

The budget reconciliation process cannot be used to make changes to Social Security.

To enact Trump’s legislative agenda, Republicans in Congress will use the budget reconciliation process that allows for legislation to pass with 51 votes (rather than 60) in the Senate. However, that process includes rules that Congress must abide by, and one of those rules is that it cannot be used to make changes to the Social Security program. Therefore, changes to Social Security benefits cannot be included, nor can Trump’s proposal to eliminate taxes on Social Security benefits. Although there are a few opportunities for legislation to pass this year via regular order (60 votes in the Senate), such as the fiscal 2025 spending bill and the National Defense Authorization Act, those bills require bipartisan support and will not include cuts to Social Security.

Congress will act before allowing Social Security to become insolvent.

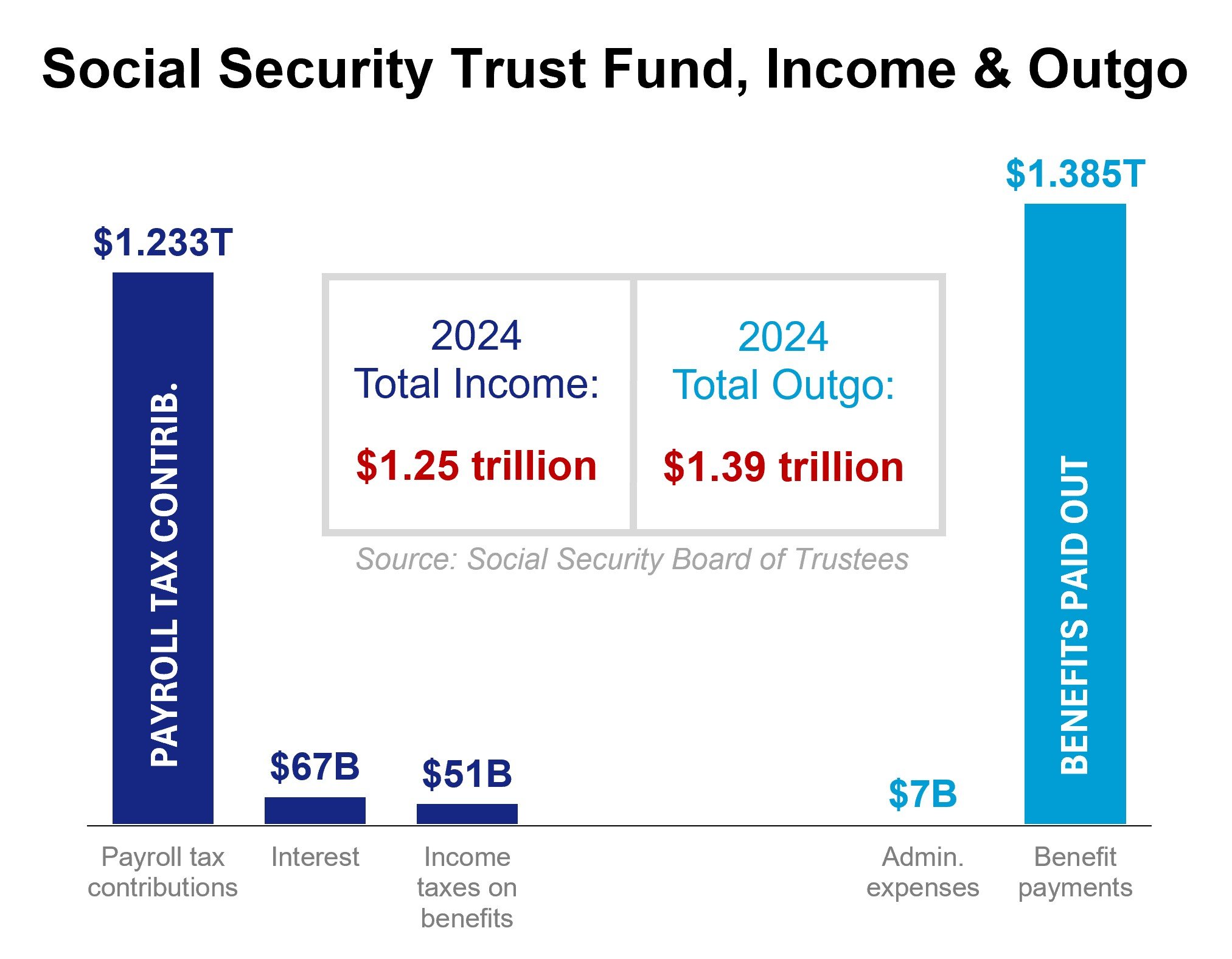

The Social Security Board of Trustees forecasts that the Social Security retirement and disability trust funds will become insolvent in 2035. The Congressional Budget Office projects that insolvency would come a year earlier, in 2034. If that were to happen, the Congressional Budget Office estimates that benefits would be cut by 23% beginning in 2035. Trump’s proposals to end taxes on Social Security benefits, on tips, and on overtime could decrease Social Security Trust Fund revenues (without additional revenue sources as offsets) and accelerate insolvency. However, in 1983, as insolvency loomed and the program faced an inability to pay full benefits, Congress passed legislation to avoid cutting benefits. This included the majority of the recommendations of the Greenspan Commission created in 1981 to improve the financial integrity of the program. We would expect Congress to act again if insolvency becomes imminent.

APPENDIX – IMPORTANT DISCLOSURES

Past performance is not indicative of future results. This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent.

This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent. This communication is provided for informational purposes only and is not an offer, recommendation or solicitation to buy or sell any security. Unless otherwise cited, market and economic statistics come from data providers Bloomberg and FactSet. This communication does not constitute, nor should it be regarded as, investment research or a research report or securities recommendation and it does not provide information reasonably sufficient upon which to base an investment decision. This is not a complete analysis of every material fact regarding any company, industry or security. Additional analysis would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any particular client and is not presented as suitable to any other particular client. Investment involves risk. You should review the prospectus or other offering materials for an investment before you invest. You should also consult with your financial advisor to assist you with your analysis, risk evaluation, and decision-making regarding any investment.

The performance and other information presented in this communication is not indicative of future results. The information in this communication has been obtained from sources we consider to be reliable, but we cannot guarantee its accuracy. The information is current only as of the date of this communication and we do not undertake to update or revise such information following such date. To the extent that any securities or their issuers are included in this communication, we do not undertake to provide any information about such securities or their issuers in the future. We do not follow, cover or provide any fundamental or technical analyses, investment ratings, price targets, financial models or other guidance on any particular securities or companies. Further, to the extent that any securities or their issuers are included in this communication, each person responsible for the content included in this communication certifies that any views expressed with respect to such securities or their issuers accurately reflect his or her personal views about the same and that no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this communication. This communication is provided on a “where is, as is” basis, and we expressly disclaim any liability for any losses or other consequences of any person’s use of or reliance on the information contained in this communication.

Strategas Securities, LLC is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), a broker-dealer and FINRA member firm, although the two firms conduct separate and distinct businesses. A complete listing of all applicable disclosures pertaining to Baird with respect to any individual companies mentioned in this communication can be accessed at http://www.rwbaird.com/research-insights/research/coverage/third-party-research-disclosures.aspx. You can also call 1-800-792-2473 or write: Baird PWM Research & Analytics, 777 East Wisconsin Avenue, Milwaukee, WI 53202..