Tariff Uncertainty Could Lead to More Pro-Growth Tax Policies

Washington Policy Research

Trade uncertainty is rattling investors, consumers, and businesses. On April 2, President Trump is expected to announce reciprocal tariffs and potentially sectoral tariffs, which could provide more certainty in terms of what goods will be targeted. Higher tariffs and the current economic growth scare could drive Congress to include more pro-growth tax policies in its tax bill this year.

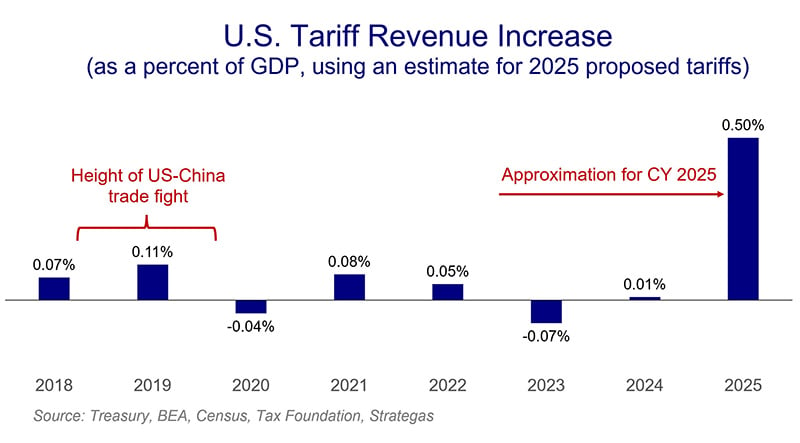

President Trump’s tariff policy is creating significant uncertainty for investors, consumers, and business. While we expected President Trump to make tariffs a key pillar of his policy agenda, the sheer size of the tariffs, coupled with a haphazard implementation plan, has created market turmoil and made it difficult for companies to plan for the future. The chart on the right shows the annual increase in tariffs since Trump began imposing them in 2018. For 2025, we handicapped what the likely outcome of the administration’s China, USMCA, reciprocal, sectoral, and commodity tariff increases would be, and we find that the size of the tariff increases are multiples larger than 2018-19 period.

We categorize Trump’s tariffs into five buckets:

- China. China is a particular target for Trump as he would like to move supply chains out of China. China is also increasingly seen in a bipartisan fashion as a threat to America’s broader economic and geopolitical interests.

- Canada and Mexico. While the US has trade deficits with both countries, Trump is also using tariffs to focus on border issues, renegotiations of USMCA, the transshipment of Chinese goods into the US via Canada and Mexico, and defense.

- Commodities. Trump’s tariffs on steel, aluminum, copper, and lumber are designed to protect US industry and products deemed important to national security.

- Reciprocal Tariffs. Trump wants countries that apply high tariff rates on US goods to lower those rates and he is likely to impose reciprocal tariffs on these countries to push them to do so.

- Sectoral Tariffs. Trump is targeting countries with which the US has a large trade deficit even if that country imposes low tariffs on the US. Trump will look to apply high tariffs on pharmaceuticals, semiconductors, and other sectors to address such trade deficits.

Congress likely to include additional pro-growth tax policies in its tax bill if the economy weakens from tariffs. Congress is set to enact a tax bill this year to extend the 2017 TCJA tax cut provisions that expire at the end of 2025. Although that legislation will prevent a large tax increase in 2026, extending current policy will not add new stimulus to the economy. However, policymakers are paying attention to the growing cracks in the economy and recent market action related to tariffs. If the economy weakens because of tariffs, they are likely to include additional pro-growth policies in the tax legislation. Among the ideas under consideration are: 100% expensing for capital equipment purchases, accelerated depreciation for structures to incentivize factory construction, immediate expensing of research and development (R&D) costs, and/or a lower corporate tax rate for domestic manufacturers. Combined, the impact of these tax cuts can nearly offset the entire tariff increase in the first year of implementation.

APPENDIX – IMPORTANT DISCLOSURES

Past performance is not indicative of future results. This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent.

This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent. This communication is provided for informational purposes only and is not an offer, recommendation or solicitation to buy or sell any security. Unless otherwise cited, market and economic statistics come from data providers Bloomberg and FactSet. This communication does not constitute, nor should it be regarded as, investment research or a research report or securities recommendation and it does not provide information reasonably sufficient upon which to base an investment decision. This is not a complete analysis of every material fact regarding any company, industry or security. Additional analysis would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any particular client and is not presented as suitable to any other particular client. Investment involves risk. You should review the prospectus or other offering materials for an investment before you invest. You should also consult with your financial advisor to assist you with your analysis, risk evaluation, and decision-making regarding any investment.

The performance and other information presented in this communication is not indicative of future results. The information in this communication has been obtained from sources we consider to be reliable, but we cannot guarantee its accuracy. The information is current only as of the date of this communication and we do not undertake to update or revise such information following such date. To the extent that any securities or their issuers are included in this communication, we do not undertake to provide any information about such securities or their issuers in the future. We do not follow, cover or provide any fundamental or technical analyses, investment ratings, price targets, financial models or other guidance on any particular securities or companies. Further, to the extent that any securities or their issuers are included in this communication, each person responsible for the content included in this communication certifies that any views expressed with respect to such securities or their issuers accurately reflect his or her personal views about the same and that no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this communication. This communication is provided on a “where is, as is” basis, and we expressly disclaim any liability for any losses or other consequences of any person’s use of or reliance on the information contained in this communication.

Strategas Securities, LLC is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), a broker-dealer and FINRA member firm, although the two firms conduct separate and distinct businesses. A complete listing of all applicable disclosures pertaining to Baird with respect to any individual companies mentioned in this communication can be accessed at http://www.rwbaird.com/research-insights/research/coverage/third-party-research-disclosures.aspx. You can also call 1-800-792-2473 or write: Baird PWM Research & Analytics, 777 East Wisconsin Avenue, Milwaukee, WI 53202.