Debt: Not Necessarily a Four-Letter Word

Debt can be an important tool to creating the future you want – if you manage it wisely.

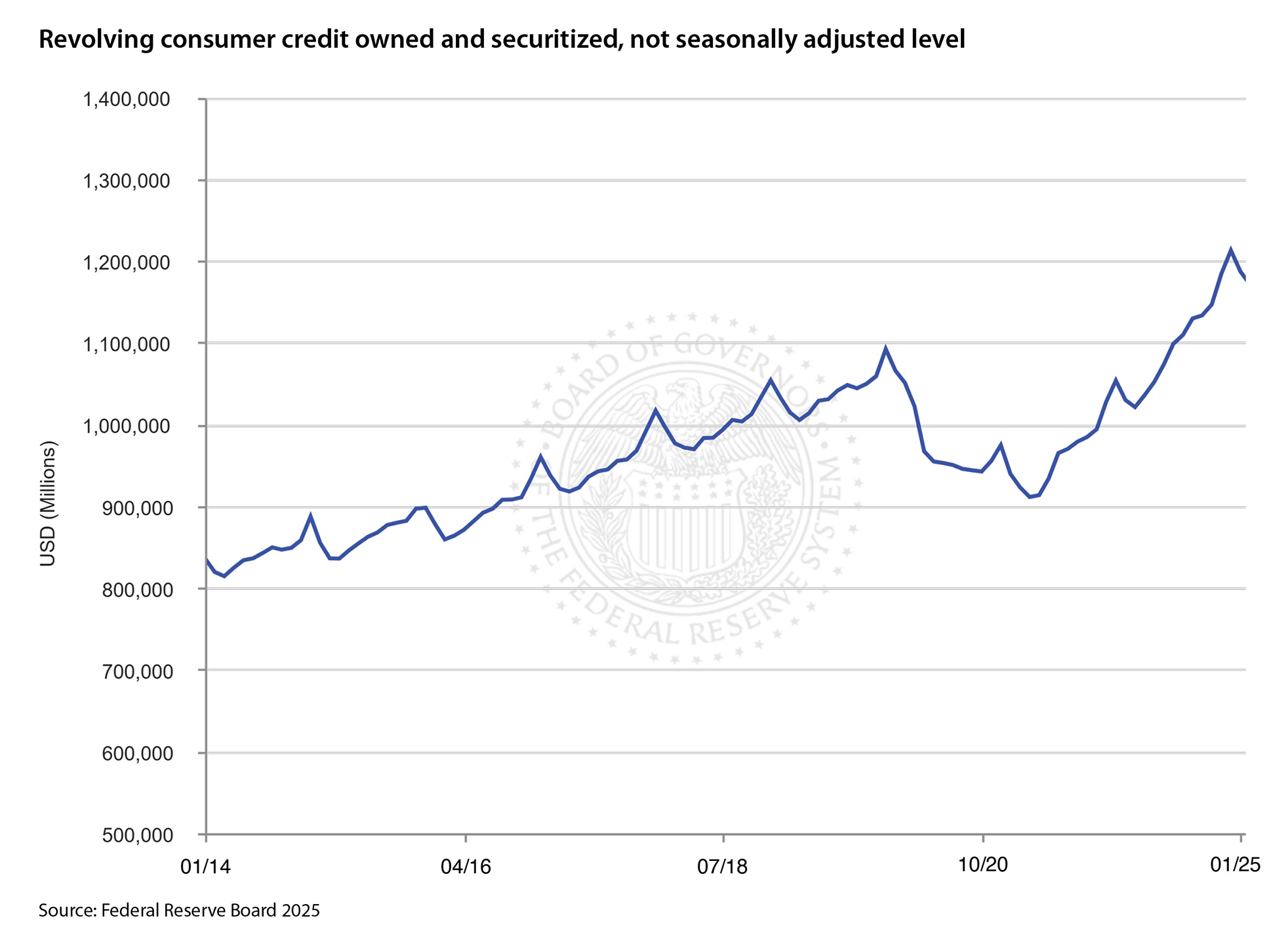

According to a Federal Reserve report, Americans' credit card and other kinds of revolving debt has reached over $1.3 trillion – an all-time high – with no signs of slowing down. While debt is often necessary to achieve important life goals like buying a home, if left unchecked it can cost you both money and peace of mind. Here are six strategies to help you keep your debt under control and working for you.

Revolving consumer debt is at record levels. Source: Federal Reserve, January 2024.

- Choose Your Debt Wisely

Be careful about taking on new debt, especially if it’s for a depreciating asset like a car or clothes. Some purchases aren’t nearly as good a deal once you factor in interest, so if you have to use credit to buy something, make sure it’s worth the added costs. While loans for assets that tend to appreciate over time, like housing, or for educational opportunities may be considered “good debt,” they can still be mismanaged – be sure you have a plan for paying them off, and stick to it. - Understand Your Debt

Ask questions to make sure you understand what you’re getting yourself into. When are payments due? Are there prepayment penalties or late fees? How long before the debt is retired? Is the interest tax-deductible? Answers to these questions can help you make a reasonable budget and prioritize which debts to pay off first. - Be Strategic About Paying Down Debt

Pay off loans with the highest interest cost first. Whenever possible, consider remitting more than the monthly minimum, either by making an extra payment or by rounding up your monthly payments to the next $100. Be wary about only paying the required minimum on credit cards, as it may take years to pay off the debt that way, leading to substantial interest expenses.

Remember that loans with the highest interest rate may not always have the highest cost. For example, your mortgage and your car loan may have similar interest rates, but the mortgage interest will likely be tax-deductible while the car loan interest probably isn’t. In that case, you’ll likely be better off putting extra money toward your car loans first.

- Use Credit Cards for Convenience

Credit cards aren’t inherently bad – in fact, they’re often necessary if you need to rent a hotel room or a car. Just make sure you use them wisely by paying them off every month (thus avoiding interest charges) and setting up automatic payments. Resist the urge to carry a lot of cards, and make sure you take full advantage of the rewards programs on the (few) cards you keep. Building up an emergency fund can keep you from having to rely on credit cards in a pinch. - Keep an Eye on Your Credit Score

FICO® scores range from a low of 300 to a perfect score of 850. Shoot for a minimum score of 740, which is a rough breakpoint to getting better-than-average interest rates on a loan. If your score dips to 650, it could mean a 1% increase on the interest you’re paying – which could result in thousands of dollars over the life of a loan. Making payments on time and properly managing your debt are key to maintaining a high score. - Consider Keeping Some Debt in Retirement

While it’s not uncommon for people to retire once they’ve paid off their mortgage, there’s an argument to be made for keeping some debt after you stop working. Having access to credit after you no longer have regular income – and at a time in your life when it’s harder to secure a loan – could be a lifesaver should you face an unforeseen expense like an emergency home repair or health concern. Paying off your debt is a laudable goal, but maintaining some financial flexibility in retirement could be especially valuable.

No matter where you are in your financial journey, the ability to manage debt wisely will play a significant role in achieving the future you envision for yourself. Your Baird Financial Advisor can work with you on keeping your debt in check and making smart spending decisions in the future. Not a Baird client? Find a Financial Advisor.

Editor’s Note: This article was originally published March 2020 and was updated April 2024 with more current information.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.