Nvidia and Hindsight Bias

Imagine you’re headed out for a night at the movies in January 1999. You break out your favorite pair of acid-wash jeans, layer your short-sleeved t-shirt over your long-sleeved t-shirt, dig out your Brittany Spears CD for the car…but before you leave, you call your broker to invest in a company that you read was making parts for the Sega Dreamcast you’ve been obsessed with lately. By the time you settle in your seat to watch the Julia Robert tour-de-force “Erin Brockovich,” you have ten shares of Nvidia stock in your portfolio.

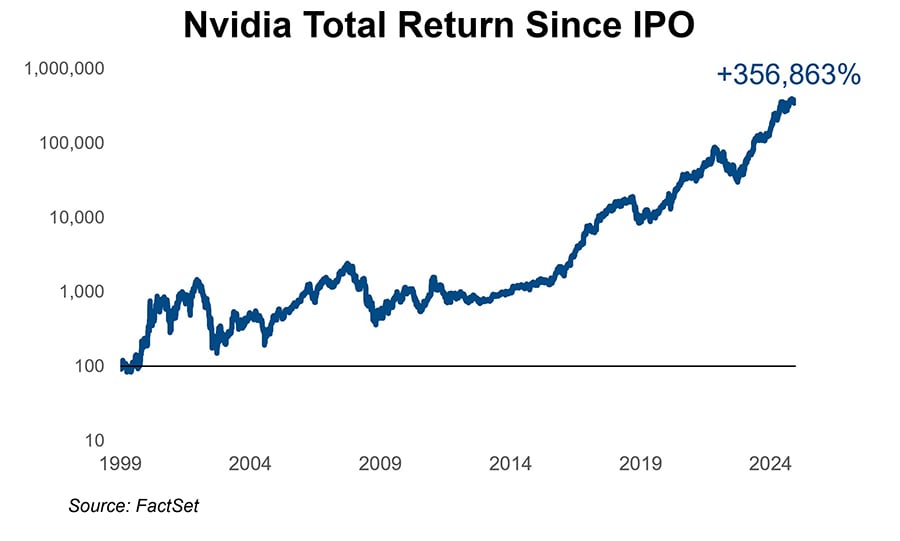

The rest, of course, is history. Despite the imminent collapse of the dot-com bubble, Nvidia would go on to rise over 350,000% from its January 1999 IPO through year-end 2024, transforming from video game chipmaker into the preeminent face of the artificial intelligence revolution and one of the biggest companies of all-time.

It’s easy to look back and scold yourself for not investing in Nvidia or any number of companies that have proven wildly successful over the years. This is known as hindsight bias, the inclination to view past events as having been more predictable than they really were. It’s especially prevalent among investors who, when looking back at their portfolio misses, shake their head and mutter “I should have seen that coming.”

Nvidia Stock Chart, from its January 22, 1999 IPO through December 31, 2024.

Misconception No. 1: “I Should Have Seen It Coming”

Perhaps the primary fallacy of hindsight bias is that things that are obvious to you now would have been obvious to you then. We can look at what Nvidia has become today and marvel at its both its foresight and technical prowess. But to anticipate its transformation from video game chip supplier to AI powerhouse, investors would have needed to foresee both levels upon levels of future innovation – from the mobile internet revolution to advances in extreme ultraviolet lithography – and the wider use of GPUs beyond gaming applications (e.g., parallel computing).

Further, Nvidia was just one of hundreds of hot internet stocks in the late 1990s, most of which didn’t make it. In fact, 0f the 5,724 companies to IPO in the 1990s alongside Nvidia, just over 100 are in the S&P 500 today.

Not all tech stocks turn out to be winners. Investors sunk nearly $1 billion into Webvan through its IPO 1999. The company lost over $800 million and filed for bankruptcy in June 2001.

Misconception No. 2: “Successful Investing Is a Straight Line”

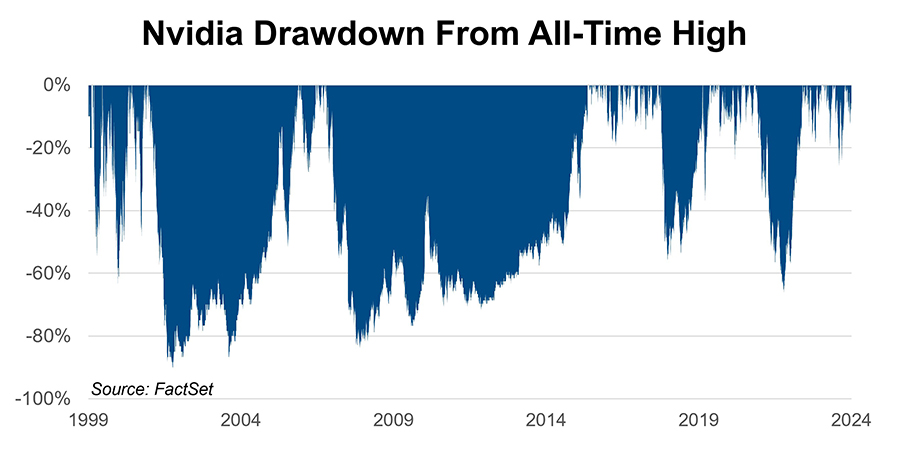

Baked into hindsight bias is an assumption that there are only two relevant points in time: the date a company went public and right now. There can be many years in between those two points, and for most companies, that increase in market value has a multitude of dips and valleys. From its previously all-time high, Nvidia was down 90% in 2002, 85% in 2008, and 65% in 2022 (with many other dips and mini-crashes along the way). And this is not unique to Nvidia – nearly all of the big stock many winners we admire today have experienced gut-wrenching drawdowns and crises of investor confidence. While Charlie Munger famously asserted that, “if you’re not willing to react with equanimity to a market price decline of 50% two or three times a century you’re not fit to be a common shareholder,” the patience to withstand such a high degree of volatility from an as-of-yet unproven company is not something most investors possess.

Nvidia investors had to withstand a great deal of volatility and down periods to realize its outsized returns.

That’s the allure of hindsight bias: It lets you gloss over the rocky road that led to superior performance. Which leads to the third misconception:

Misconception No. 3: “It’s Easy, Just Buy and Hold!”

The kind of thinking that lends itself to hindsight bias also lends itself to market timing. The premise behind both approaches is that if you “bought low” (in this case, at the IPO), you’ll have realized outsized gains in these investments. While this kind of thinking can be risky for many reasons, perhaps chief among them is that you have to be right twice: When to buy but then when to sell. Holding on during 80-90% declines is part of that equation, but so is resisting the urge to take profits when companies outperform. Over the last decade, Nvidia has hit nearly 300 new all-time highs, all while seeming quite overvalued by most traditional metrics. Hindsight is always 20/20 – because it’s never advising you on what to do next

This isn’t to say Nvidia or any other stock that has enjoyed major market success is now bound to go down, or that revisiting your past investment decisions is a fool’s errand. Just realize that hindsight bias tends to obscure the reality behind our investment decisions and, if left unchecked, can lead to reckless decision-making. We firmly believe you’ll be better served focusing on the why behind your investments – what and who you’re investing for – and the best course to achieve it. Your Baird Financial Advisor can help you draw up a portfolio that gives you some freedom to try to capture the next Nvidia or Amazon without compromising your ultimate goals.

This article was originally published in August 2020 and updated in February 2025.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.