Diversification: The "Free Lunch" of Portfolio Building

Diversification is the basic strategy of trying to limit exposure to risk by investing in an uncorrelated mix of assets. That might be a mouthful, but it just means owning investments that respond differently to different market pressures. It is the “don’t put all of your eggs in one basket” of the investing world.

It’s also known as “the only free lunch in investing” because, when done properly, diversification has the potential to reduce your overall risk while sacrificing little – if any – long-term return. Said another way, diversification aims to maximize your risk-adjusted returns.

Different investments face different threats: Stocks face bankruptcy risk, bonds face interest rate risk, agricultural commodities face weather risk, and so on. Any one of those risks can sink an overly concentrated portfolio. But by spreading your portfolio over many unrelated assets and asset classes, you can limit the damage any one risk can do and improve the consistency of your return stream.

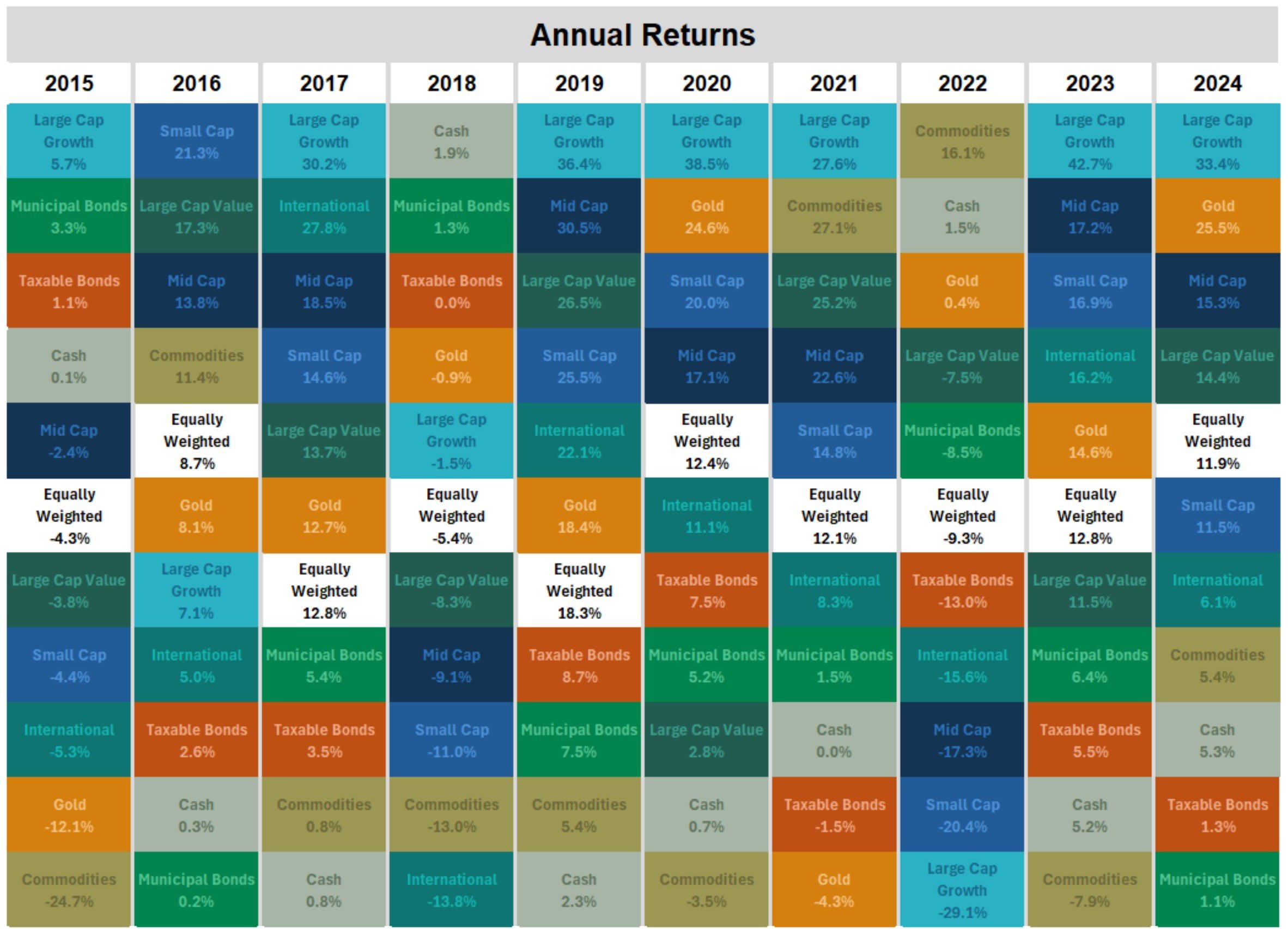

The chart below brilliantly visualizes this dynamic. Year-in and year-out, different asset classes and investment styles shine as the market reacts to ever-changing conditions. As you can see, it is colloquially called a “quilt chart” for a reason – year in and year out, the winners and losers shift around the leaderboard, patterning the page into an investment mosaic. The worst asset class in 2022, Large Cap Growth, was the best-performing in 2023. The best asset class in 2022, Commodities, was the worst-performing in 2023. In financial markets, last year’s winners often turn into next year’s losers.

Rolling Asset Class Returns, 2015-2024

Source: FactSet; Standard & Poor’s. As of December 31, 2023. Annualized return, volatility (as measured by standard deviation) and Risk-Adj. Return (as measured by Sharpe ratio) are calculated as of the most recent quarterend. Large Growth is represented by Russell 1000® Growth Index. Large Value is represented by Russell 1000® Value Index. Mid Cap is represented by Russell Midcap® Index. Small Cap is represented by Russell 2000® Index. Taxable bonds is represented by BBgBarc. Intermediate Govt/Credit Bond Index. Municipal bonds is represented by the BBgBarc Municipal Index. International is represented by The MSCI EAFE Index. Cash is represented by FTSE 3 month T-bills. Satellite is an equally-weighted return of the following indices, rebalanced monthly: ICE BofAML US High Yield (High Yield) DJ US Select REIT (Real Estate), Bloomberg Commodity (Commodities), and MSCI Emerging Markets (Emerging Markets). Indices are unmanaged and are used to measure and report performance of various sectors of the market. Past performance is no guarantee of future results and diversification does not ensure against loss. Direct investment in indices is not available. The Russell Indices are a trademark of the Frank Russell Company. Russell® is a trademark of the Frank Russell Company.

Proper diversification and regular upkeep can also keep a portfolio from skewing too far in favor of one style, asset class, or geography – even if unintentionally. Continuing the example above, Large Cap Growth was a dominant outperformer for the decade ending in 2021, only to see a steep reversal in 2022. Without regular rebalancing, a portfolio would have been overexposed to Large Cap Growth entering 2022 and felt the brunt of the selloff even more severely (and further, not rebalancing in 2022 would have left one underexposed to Large Cap Growth for its rally across 2023 and 2024). Diversification is a wonderful tool, but it requires regular upkeep to enjoy the benefits

In the end, the world is full of uncertainties and risks – investment-specific, country-specific, asset class-specific, etc. We cannot escape these uncertainties nor can we predict the future, but through proper diversification and regular rebalancing we can spread out our exposure and limit the damage done by any single risk at a given time. While it does not guarantee against loss, it is one of the best tools in an investor’s toolkit for building robust, resilient portfolios and reaching long-term financial goals.

This article was originally published in August 2020 and updated in February 2025.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.