The Dangers of Portfolio Tinkering

More often than not, continually tweaking your portfolio results in worse performance than if you just left it alone.

At Baird, we believe the key to investing is staying focused on the long term. Not only does the stock market historically trend positive, but far more often than not, it has handily outperformed both bonds and cash. By keeping a long-term mindset, we can focus on our larger financial goals and not on the bouts of short-term volatility or occasional steep dip.

Still, it can be beneficial to revisit this idea now and again, particularly in a 24-hour news cycle that encourages us to “buy now” in the face of uncertainty. The truth is, while this behavior might appeal to our innate human desire to tinker, it often leads to negative outcomes.

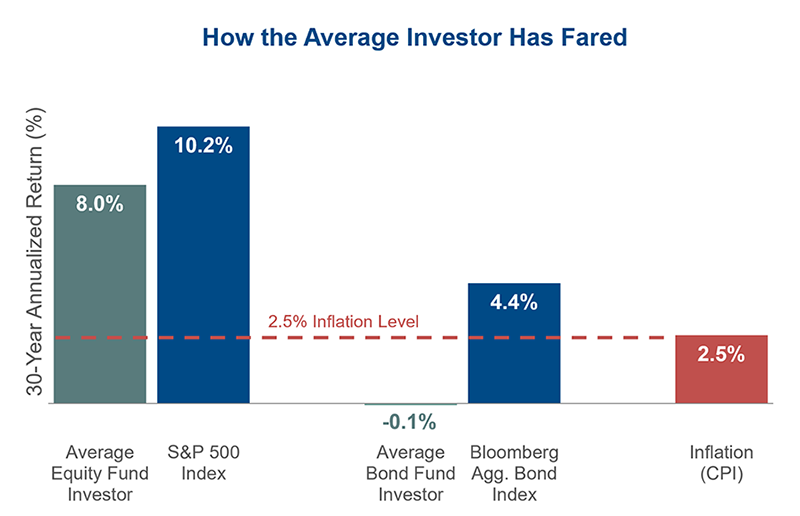

Case in point: While the S&P 500 returned greater than 10% between 1994 and 2023, the average investor didn’t fare nearly as well (see Chart 1). Over-trading, ill-advised market timing, fear-based decision-making and more have contributed to this phenomenon. While ongoing portfolio management can be beneficial (think asset allocation resets, or active management in certain areas), large or frequent changes are often detrimental, particularly when they’re motivated by emotion. To quote famed economist Eugene Fama, “Your money is like a bar of soap – the more you handle it, the less you’ll have.”

Chart 1: How the Average Investor Has Fared. Over the 30-year period ending December 2023, the average investor underperformed both the broad stock and bond markets. Bond investors also failed to keep pace with inflation. Poor investment selection and knee-jerk reactions are the key reasons for this underperformance.

Source: Dalbar, Inc. “Quantitative Analysis of Investor Behavior, Advisor Edition.” April 2024. Average equity and bond investor returns are calculated using data from the Investment Company Institute for the 30-year period ending December 31, 2023. The “average” investor refers to the universe of all mutual fund investors whose actions and financial results are restated to represent a single investor. These returns are represented by a change in assets, excluding sales charges, fees, expenses and any other costs. While we believe this information to be accurate, no guarantees can be made to its authenticity or accuracy.

While transaction costs and taxes are two obvious performance drags of constant portfolio tinkering, the sheer act of attempting to time the market can also be detrimental. Timing the market – the strategy of buying a security at its low point and selling at its peak – requires near-perfect foresight to succeed with any regularity. Plus, to do it effectively, you have to be right twice every time – not only when to get in (“buy low”), but when to get back out (“sell high”). This is a difficult, if not impossible, task.

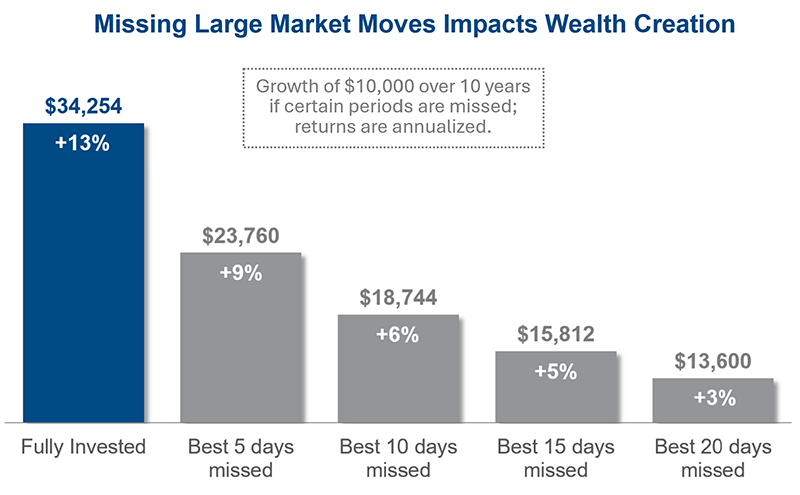

The other important factor to consider is the concentration of market gains in just a few short periods. As seen in Chart 2, missing just a handful of the best days is enough to significantly lower your portfolio’s performance. While no investor would have bad enough luck to miss just the best days, weeks or months, the point remains: Timing the market is incredibly difficult to do with regularity. The best way to ensure that you capture the all-important up days is to stick to your plan through the panic-inducing selloffs and remain invested for the long-term.

Chart 2: Missing Large Market Moves Impacts Wealth Creation. Attempting to time the market’s gains or losses is a tricky proposition and can come at great cost. This chart depicts how $10,000 invested in the stock market from 12/31/14 to 12/31/24 would have grown under various conditions, illustrating how missing even one week in the market can impact longer-term results. While ongoing portfolio modifications can be beneficial, large and frequent allocation changes are often detrimental.

Source: FactSet, Damadoran/NYU, Ibbotson SBBI

A thorough approach to investment management is a key piece of any successful financial plan. While this can take many shapes, there is more than enough evidence to suggest that high costs, over-trading, imprudent market-timing and emotional decision-making can lead to subpar results and long-term underperformance. Your Baird Advisor can help you craft a holistic plan aimed at accomplishing your long-term goals.

This article was originally published in October 2020 and updated in February 2025

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.