Can a Stock Market Selloff Be a Good Thing?

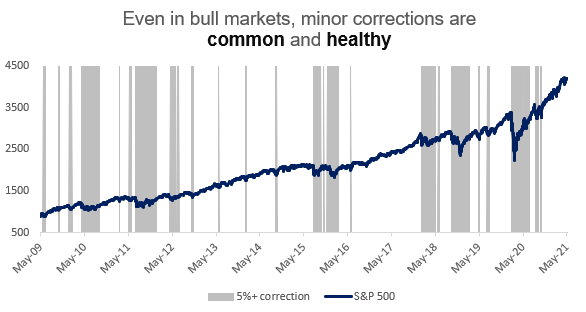

A healthy selloff is often one that knocks overly optimistic sentiment down a peg without damaging the underlying market trend. Irrational investor optimism leads to speculation, overextension and bubbles that ultimately pop. The occasional correction can let the air out of any bubbles before they grow too taut and help flush some of the shorter-term speculation out of the market. Think of it as a controlled burn to prevent a larger wildfire – near-term pain for long-term gain.

Furthermore, adjusting expectations and sentiment to better reflect reality is a good thing, even if that means prices must come down. As famed investor John Templeton said, “Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria.” A correction here and there is critical to restraining that euphoria and keeping stock prices somewhat connected with their fundamentals.

This is critical because stock prices can be both fickle and volatile, leading to short-term moves that aren’t in line with a company’s or economy’s fundamental long-term outlook. Because these ups and downs are to be expected, we can assess any selling pressure by asking:

- Has the big-picture economic story changed?

- Are there new, material risks to the market that hadn’t been properly accounted for?

- Has the earnings outlook for the firm meaningfully changed?

Answering these questions can get at the heart of the debate: healthy, sentiment-driven selloff vs. the beginning of something more dire.

Of course, in the end, trying to time a market top – regardless of the nature of the selloff to follow – is a difficult game. Markets are prone to instability, and the (often) intense volatility is just the price of entry for the market’s long-term gains. As long as humans have a hand in the process, big swings will be a feature of the market, and not a bug. As Morgan Housel put it, “If markets never crashed, they wouldn’t be risky; if they weren’t risky, they would get really expensive; when they’re really expensive, they crash. If assets didn’t crash they wouldn’t offer a big return. And since we want big returns we push them toward occasional crashes. Constant and guaranteed volatility, like a law of physics.”

Regardless of whether we’d label a market downturn as “healthy” or not, selloffs are scary events. And a tumbling 401(k) balance amid a glut of scary headlines can create a challenging environment for good decision-making. That’s why in times of uncertainty, we recommend reaching out to a Baird Advisor – robust financial plans are built for success in all market environments, the occasional healthy correction included. And for the long-term investor, these “market reset” moments should be celebrated – a healthy pause on the road to accomplishing larger financial goals.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.