Washington Policy Research – Nov. 16, 2021

A Revamped Approach to Raising Taxes

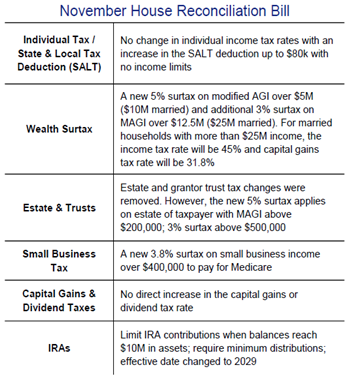

Back in September, the House of Representatives proposed tax increases on income, capital gains, dividends, small businesses (that would kick in at roughly $400k), and corporations, as well as estate tax reform (exemption lowered from $11M to $6.5M) and grantor trust reform. Over the past eight weeks, however, the politics have changed. When it became clear that the tax rate increases and estate tax changes were unlikely to pass, Congressional Democrats came up with an alternative way to raise money: taxing a smaller set of wealthy taxpayers with a surtax on their total income.

Latest Version Focuses on Wealth Surtax

The latest version of the reconciliation bill, which is expected to be voted on in the House in November, no longer taxes income, capital gains, dividends, or estates directly. Instead, a single taxpayer with $5M of total income or married couple with $10M of income will face a surtax of 5%. If the taxpayers’ income exceeds $12.5M (single) or $25M (married), the surtax increases to 8%. This surtax is applied on all income above the threshold with no deductions. As a result, capital gains above the threshold would face the additional 5% or 8% levy. The surtax would also apply to the estate or trust of a taxpayer with modified adjusted gross income above $200,000 and $500,000. Small businesses paying the individual income tax would still be subject to the originally proposed 3.8% Medicare tax although the small business deduction would not be eliminated.

IRAs Remain a Target

Individual Retirement Accounts of the wealthy remain a target. Congress did remove a provision forcing IRA holders to liquidate private (illiquid) securities. However, the proposal caps IRA contributions once the assets in an individual’s retirement plans reach $10 million and requires minimum distributions for those IRAs. The new proposal also includes workplace 401(k) Roth plans in calculating the total holdings. However, these provisions do not go into effect until 2029.

It is widely expected these proposed tax changes will pass the House sometime in November, but that is just the first step. The Senate will then also need to consider the legislation and further changes can be made. However, we believe at this point that the structure of the House bill is likely to remain intact. We will be watching these developments closely as activity picks up heading into the holidays.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2020 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.