Addressing Recent Market Volatility

It’s no secret that we’ve had a volatile start to 2022—in the financial markets and in the real world. Strategas Chairman and CEO Jason Trennert discusses recent geopolitical volatility, what it means for inflation and the Fed, and his outlook for equities for the rest of year.

How is Strategas thinking about the Ukraine-Russia situation?

There's no question the situation is a risk off development for the market, so we want to focus on high quality companies. This will prove especially prudent if the increase in inflation forces the Federal Reserve to raise rates aggressively (highly levered, lower quality firms have benefited from very low interest rates). We also think we could see, to a certain extent, an end of the globalization trend of the last 30 years, which will influence investors to stay closer to home. We think the US should be able to avoid a recession, but Europe may not be so lucky.

At a higher level, how should investors think about geopolitical uncertainty moving forward?

This is always a difficult question because we're not geopolitical experts. We make it easier on ourselves by focusing on what the markets are telling us over what an expert might be saying. We're watching credit spreads and the US dollar carefully, and while you can see stress developing, it looks manageable at the moment. The best advice is to focus on the facts—the observable and measurable—as opposed to the latest soundbite. It's been said that the first casualty of war is the truth, and I believe that.

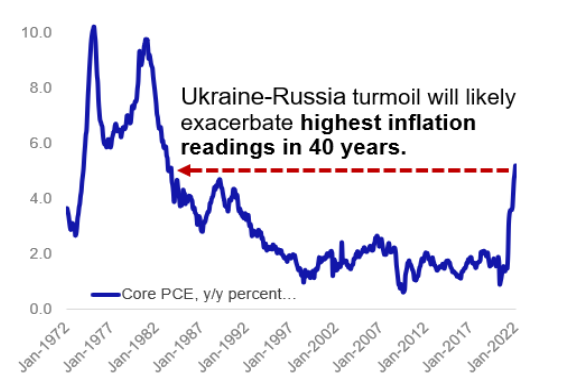

How does this affect your outlook for inflation and for the Federal Reserve?

How does this affect your outlook for inflation and for the Federal Reserve?

Inflationary pressures will increase for a variety of reasons.

- Geopolitical volatility impacts the price of oil (which is already moving higher) because, as I believe we've been limiting supply unnecessarily.

- I think you’ll see an increase in defense spending globally (especially in Europe and Japan), and government spending tends to be inflationary.

- To a certain extent we may see an end to the globalization trend of the last 30 years, causing companies to focus more of their production at home and keep supply chains tighter both of which come at a cost.

While the geopolitical turmoil may pressure global growth, we don ’t believe it will change the Federal Reserve’ s calculus on the need to tighten A s it stands today, we continue to think the Fed will raise interest rates five times this year.

With all of this in mind, what is your outlook for stocks for the remainder of 2022?

It looks like profits for the S&P 500 will be up about 8% this year, which is solid. However, I think the prospects for higher interest rates and inflation mean that investors will be willing to pay a lower multiple on earnings than they would otherwise. I hope I'm wrong, but I think single-digit returns are pretty likely in 2022, and perhaps beyond. So again, I want to focus on quality and on companies that provide earnings and cash flows. As an expression of that view, we currently have a bias toward Value-oriented sectors in the United States. Higher level, interest rates are still low, so equities will continue to be one of the better asset classes to be invested in. But I think some of the returns that we've become accustomed to over the last several years are unlikely to continue both because of inflation and because of the prospects for higher interest rates.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2022 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.