How To Deal With the Inevitable Volatility

Though they can be painful, market corrections are a natural and necessary part of long-term investing.

A favorite quote of ours at Baird (and we love quotes) is “short-term volatility is the cost to participate in the stock market’s long-term gains.” It’s our way of acknowledging that selloffs, corrections and even bear markets are not just normal – they’re a part of the process of being a long-term investor. If there were no volatility or risk, there would be no reason for stocks to perform so well over the long run.

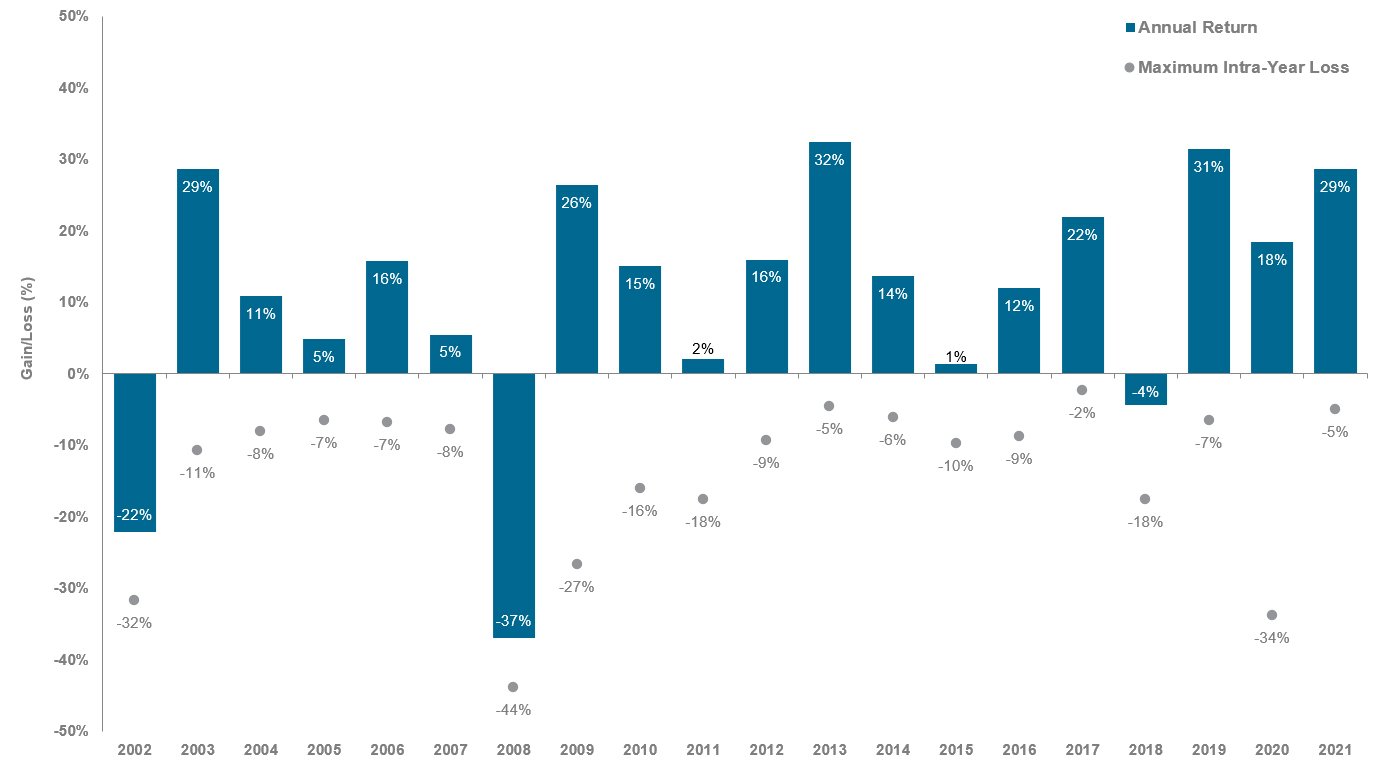

In fact, big selloffs are more than “normal” – they’re undeniably common! Just check out the chart below: Over the last two decades, the S&P 500 has averaged an annual gain of 11%. However, within those years, the average annual drawdown was -14% and four separate years saw monstrous -25% (or worse) bear markets. While some were longer and more difficult than others, the fact remains: Corrections are frequent and should be expected.

But just acknowledging that selloffs are normal is only a small fraction of the battle – actually living through big market corrections can be downright painful. Watching account balances plummet and unrealized gains evaporate is not for the faint of heart. In fact, this is likely the biggest challenge in long-term investing – not the moves themselves, but keeping the often violent fluctuations of the stock market from affecting your financial plan and mental health.

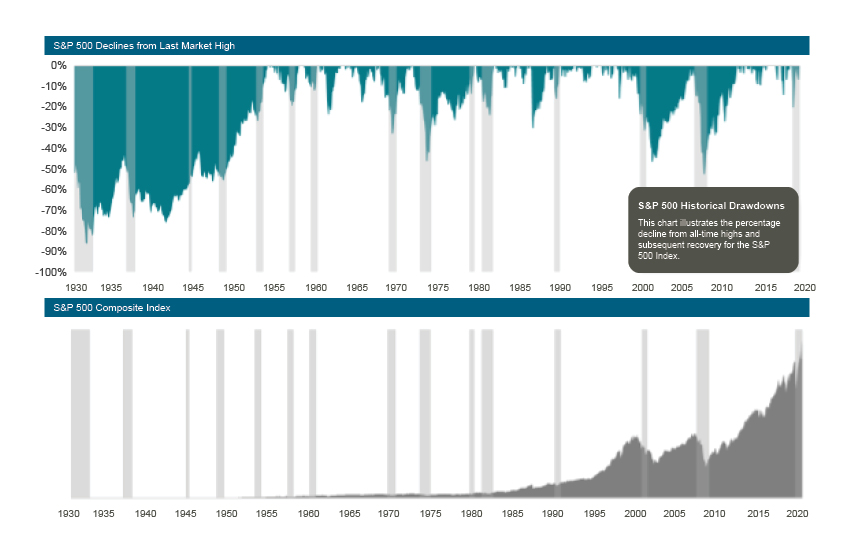

And it's not just the occasional correction that challenges investors’ mettle – crises have occurred like clockwork over the last century. In the image below, each gray bar represents a separate recession – a distinct period of negative growth, high unemployment and unique catalysts that fed the downturn (such as a housing crash, an oil embargo or rampant inflation). And it doesn’t take much imagination to understand how terrifying and fear-inducing the news headlines would have been during these crises, either. While the bottom half of the image shows how rewarding long-term investing can be, the top half shows just how hard it is to stay the course.

In the end, that's why working with a Financial Advisor is so critical. We believe investors with financial plans are more likely to make better decisions and are more confident about reaching their goals. Ultimately, this confidence is our best defense against the temptation to change things when markets go crazy – and they will go crazy. Your Baird Advisor can help you build a robust investment portfolio and create a plan built to survive and even thrive in the inevitable volatility to come.

Editor’s Note: This article was originally published February 2021 and was updated March 2022 with more current data.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.