The Dangers of Selling During a Market Drop

Any time stocks experience a major decline after hitting all-time highs, it’s understandable if you feel a moment of panic. Are they going to drop further? Should you get out now and salvage as much of your portfolio as you can? Is it already too late?

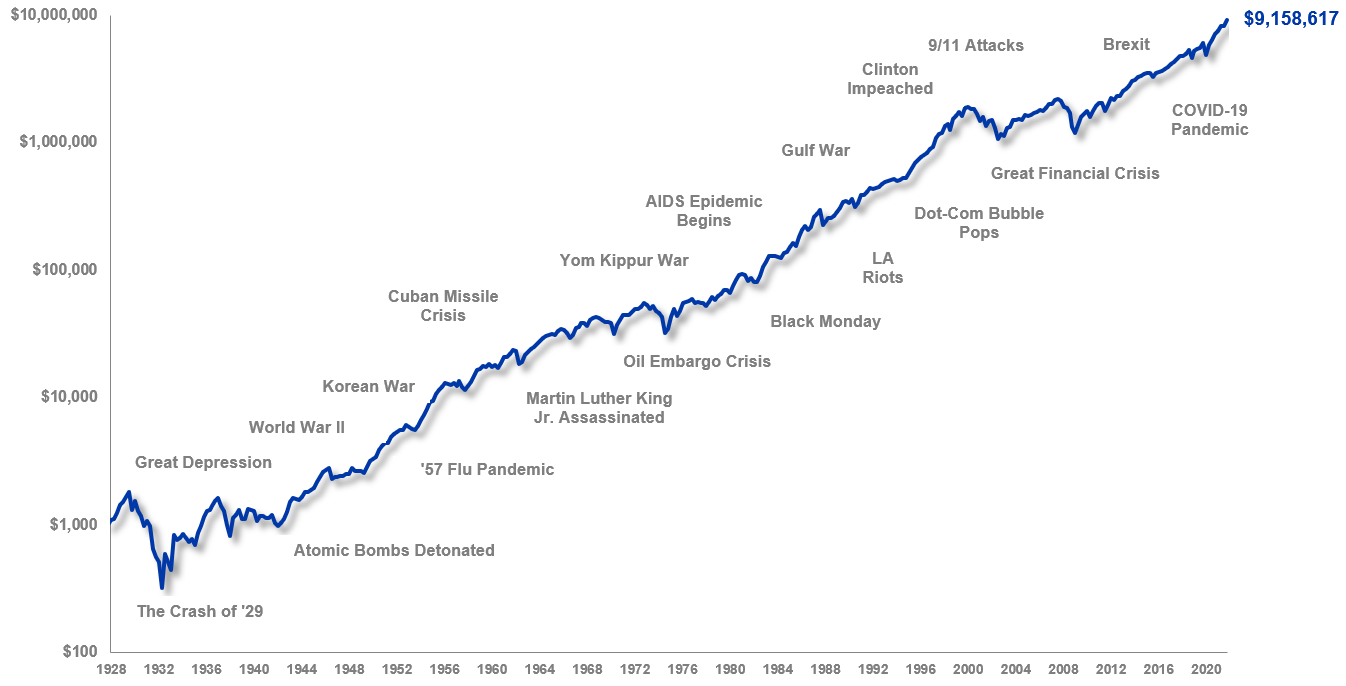

In those moments, it’s worth remembering two things: We’ve seen major selloffs before, and acting in a moment of panic often creates more problems than it solves.

At its essence, panic selling is an act of timing the market – you’re making a decision (in this case, pulling your investments) in anticipation of what the market might do next (experience further declines). The problem is, even in moments of major losses, the future is still unknowable, and many investors who have sold off after a decline missed out on an ensuing bounce.

Consider this moment in recent history: On March 28, 2013, the S&P 500 made a new all-time high for the first time in over five years, having skyrocketed 132% from the depths of the financial crisis. In the many years since then, the S&P 500 has experienced well over 300 new all-time highs – amid one of the longest bull market runs in modern financial history.

But despite this historic strength, the market still spent far more time over that same period (2,000+ trading days) in various periods of drawdown – from -1% blips to -30% crashes. Each time, there were perfectly sensible reasons to sell: debt and budget crises, geopolitical turmoil, U.S. elections, a global pandemic, and so on. But with the benefit of hindsight, we know how making that decision would have turned out: selling due to any of these events would have prevented an investor from seeing the next new market high and potentially sidelined them for one of the market’s great bull runs.

Source: Standard and Poor’s, Ibbotson Associates, Baird Research. As of December 31, 2020. Past performance is not a guarantee of future results. Performance is calculated on a total return basis with dividend reinvestment. The S&P 500, computed by the Standard & Poor’s Corporation, is a well known gauge of stock market movements determined by the weighted calculation of the 500 leading U.S, common stocks. Indices are unmanaged and are not available for direct investment,

Plus, selling after a drawdown introduces another issue – when to buy back in. Do you wait until the market starts to rebound, at which point you miss out on potential gains? How confident are you that the market won’t continue to fall after you’re back in? This is a second moment of market timing, which as we’ve discussed, is both incredibly difficult and impractical, as costs and taxes eat into potential gains.

Your risk tolerance, financial profile and life situation continually evolve, which means there will always be valid reasons to sell equities and rebalance your portfolio. And we encourage individuals to be opportunistic, long-term investors. That said, there’s something to be said about the old investing adage: Time in the market beats market timing.

If you’re feeling a moment of panic, be sure to reach out to your Baird Financial Advisor. They can offer sound, objective investment advice and guidance on making sure your portfolio is in alignment with both the current investing environment and your larger financial goals.

Editor’s Note: This article was originally published March 2020 and was updated April 2022 with more current information.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.