Parental Loans and Paying for College

The Perils of Parent PLUS

The Perils of Parent PLUS

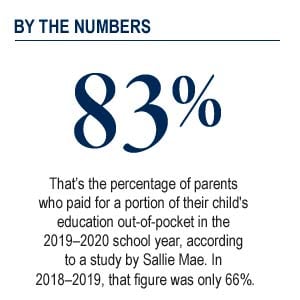

Many parents plan on contributing to their children’s education – according to Sallie Mae, parent income and savings covered 44% of the total cost of higher education in 2020. One significant source of that financial support comes through the federal parent PLUS loan program, also known as Direct PLUS loans, which let parents take out student loans on behalf of their kids. While this loan program does provide parents with options and financial flexibility, it also has drawbacks you need to be aware of:

- Direct PLUS loans are often more expensive than other forms of student loans. Not only do Direct PLUS loans typically have higher interest rates, but they also have an origination fee greater than 4% and require a hard credit check.

- The parent is 100% responsible for the debt. Unlike loans taken out in the student’s name, if a parent takes out a Direct PLUS loan, they are responsible for repaying the entirety of the loan, regardless of what educational and career choices the student makes.

- There are no forgiveness policies. Direct PLUS Loans are currently not forgiven under the Federal Teacher Student Loan Forgiveness Program or Public Service Loan Forgiveness Program.

- There are fewer repayment plan options. The federal government offers four different income-driven repayment plans for student loans. Direct PLUS loans are eligible for just one of these plans, and only after the debt has been consolidated into a federal direct consolidation loan.

Be Wary of Cosigning or Assuming Student Loans

Beyond Direct PLUS loans, parents might choose to cosign a student loan for their child or assume payment altogether. While the amount of financial help parents should give their kids will vary from family to family, understand that you are offering your good credit on these loans – and you will ultimately be on the hook for repayment. (Keep in mind that if a lending institution is requiring a cosign, it is because they believe the applicant is too great a default risk without one.)

You should use extra caution if you have other priorities you are funding as well, like retirement. Students have multiple options when it comes to college funding, including student aid, scholarships and grants, part-time jobs, work study programs, or even deferring college while they save money and build their work history. There are no Stafford loans or Pell grants for retirement, and the closer you get to leaving the workforce, the less time you have to make up lost income.

So What Are Your Options?

So What Are Your Options?

In many ways, the advice we give parents financing their children’s education is similar to the advice we offer the students themselves.

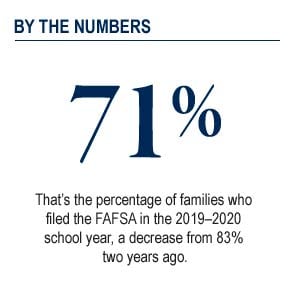

- Make sure your child fills out the Free Application for Student Aid (FAFSA) every year, even if you don’t think they will qualify for aid. At most colleges, the FAFSA is a prerequisite for receiving merit-based aid, such as scholarships and grants. In many cases, aid is awarded on a first-come, first-served basis, so the sooner you apply, the better.

- Prioritize aid that does not need to be paid back. Beyond scholarships and grants, this might include savings, support from family and friends, and earnings from part-time work during college. The less you or your child has to repay (with interest) upon graduation, the better.

- Some employers offer programs that help employees pay off student loan debt – something both working parents and children considering post-graduate employment should investigate. 2019’s Employer Participation in Repayment Act lets employers give tax-free student loan assistance up to $5,250 per year, per employee. The number of companies that provide this benefit has doubled over the past year, from 4% to 8%, according to the Society for Human Resource Management’s 2019 Employee Benefits Report. Both federal and private loans are eligible.

- If you have taken out a student loan, as a student or a parent, remember that the CARES Act provision that paused federal student loan payments (and interest accrual) ends on August 31, 2022. It’s unclear if this provision will be renewed in the future.

So what if you decide Direct PLUS loans aren’t right for you, but you still want to help your kids or grandkids with their student debt? Fortunately, you have options. This article offers several strategies for helping a family member with money, from lending cash to assuming monthly bills to providing nonfinancial help with budgeting. And be sure to check out our four tips for supporting your kids in college to make sure you’re giving them the support they really need without sacrificing your own future plans.

Editor’s Note: This article was originally published January 2021 and was updated May 2022 with more current data.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.