A Renewed Push to Pass a Smaller Build Back Better Bill

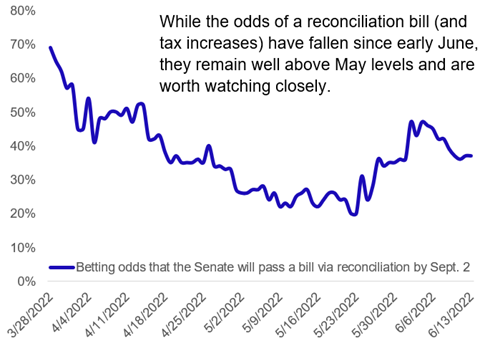

Negotiations on a slimmed-down “Build Back Better,” which the House passed in November, have resumed behind the scenes. Negotiations are focused on renewable energy and health care spending paid for with higher taxes and drug pricing limits. There are headwinds to passage, but with midterm elections approaching, Democrats want passage by early August.

In November, the House passed its version of President Biden’s $2T Build Back Better bill (which was scored as costing $5T if all of the spending provisions were made permanent). West Virginia Senator Manchin criticized the size of the bill, particularly in light of rising inflation, and said that he couldn’t support it. One of our policy themes for 2022 was that the legislation would have to both shrink in size and focus on a few key areas in order for it to pass Congress. Negotiations on a slimmed-down version of the bill were delayed due to high inflation readings this spring, and inflation remains a headwind for the bill’s passage (particularly after the May CPI reading showed inflation has not yet peaked). Senator Manchin now believes lowering the deficit leads to lower inflation and is negotiating a narrower package focused on renewable energy tax credits, tax increases, drug pricing changes, and subsidies for individuals to buy health insurance.

Tax increases will be back on the table with a revised bill.

This bill is moving through the reconciliation process, which requires only 51 votes in the Senate, but does demand the bill’s provisions be paid for (e.g., via tax increases). Further, Senator Manchin is calling for tax increases to be included as a means to reduce inflation. While we don’t agree that tax increases will lower inflation, it doesn’t change the fact that the risk of higher taxes is back on the table if this bill moves forward. The primary tax proposals are a 15% minimum corporate tax (book tax), higher taxes on US multinationals, a 1% buyback tax, a 5% surtax on income over $10M and 8% surtax on income over $25M, and a 3.8% tax on small business income. No other individual income, capital gains, or estate tax increases will be included. A partial reinstatement of State and Local Tax (SALT) Deduction is likely to be included. There also could be an effort to take the small business tax increase out of the package.

This bill is moving through the reconciliation process, which requires only 51 votes in the Senate, but does demand the bill’s provisions be paid for (e.g., via tax increases). Further, Senator Manchin is calling for tax increases to be included as a means to reduce inflation. While we don’t agree that tax increases will lower inflation, it doesn’t change the fact that the risk of higher taxes is back on the table if this bill moves forward. The primary tax proposals are a 15% minimum corporate tax (book tax), higher taxes on US multinationals, a 1% buyback tax, a 5% surtax on income over $10M and 8% surtax on income over $25M, and a 3.8% tax on small business income. No other individual income, capital gains, or estate tax increases will be included. A partial reinstatement of State and Local Tax (SALT) Deduction is likely to be included. There also could be an effort to take the small business tax increase out of the package.

Hurdles to passage remain; overall bill (and tax changes) could be reduced further.

A slimmed-down bill that includes renewable energy tax credits and health care subsidies will still amount to about $1T in spending. To offset the inflationary effect of new spending, Senator Manchin wants $900B of deficit reduction, which other Democrats have opposed. Senator Manchin has also not commented on extending Affordable Care Act subsidies, which most Democrats want to extend before they expire at the end of the year. Timing is also a significant hurdle, as the reconciliation instruction for this bill expires September 30.

For a deal like this to be enacted, Democrats will likely need to reach an agreement in principle in the coming weeks. Should the larger effort fail, there is an option to move to a health care-only package, an even more slimmed-down version than what is currently being negotiated. Passage of the bill is not guaranteed, and the situation remains fluid, but we want to be vigilant about the possibility of higher taxes.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2022 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.