BBB Tax Increases Off the Table for the Time Being

Senate negotiations on a slimmed-down “Build Back Better,” which the House passed in November, have led to agreement on enhanced Affordable Care Act subsidies and changes to the pricing of prescription drugs. The June CPI report, however, put the brakes on the inclusion of renewable energy and tax provisions, likely taking these items off the table for at least the next two years.

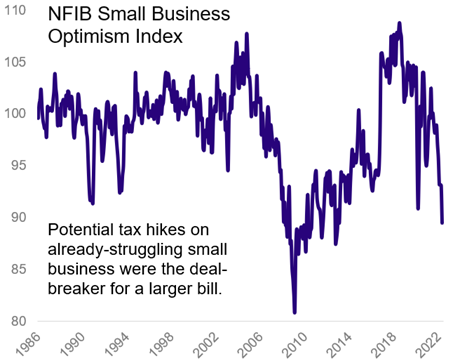

Senators Schumer and Manchin had been negotiating on a slimmed-down version of Build Back Better, the legislation that the House passed in November, focused on tax increases, climate spending, Medicare prescription drug price negotiation, and extension of enhanced Affordable Care Act (ACA) subsidies. However, following the release of the June Consumer Price Index (CPI) report, Senator Manchin (the key vote for Democrats) expressed his opposition to raising taxes on small businesses in a slowing economy with inflation still elevated. Manchin’s opposition to tax increases also removed the climate spending that those taxes were meant to fund. Thus, Build Back Better shrank even further to include only health care items like ACA subsidies and changing the structure of Medicare drug prices. Importantly for investors, this slimmed-down version of Build Back Better takes tax increases off the table through at least 2024, with Republicans, who are opposed to any new tax increases, likely to take control of Congress next year.

Companies will now have short-to-intermediate term visibility on their corporate tax rate for both US income and income earned overseas. Failure to act on taxing US multinationals also makes it more difficult to get a global minimum tax deal. Finally, investors can count on not seeing an increase in individual income, capital gains, dividends, and estate taxes.

Renewable energy spend is off the table unless there is a bipartisan deal including fossil fuels. Manchin has specifically said that he is not opposed to the renewable energy provisions, he just opposes the tax increases to pay for the spending. Without tax increases, it is unlikely that long-term incentives will be in place for renewable energy. Thus, renewable energy tax credits can only really move forward if there is a post-election bipartisan deal including fossil fuels. President Biden has vowed to move by executive action on climate change in light of congressional failure, but the reality is kicking in that a long-term climate funding package is not possible.

Reconciliation now includes Medicare drug price negotiation and enhanced ACA subsidies. Facing a September 30 deadline, President Biden has asked Congress to take the win and pass a healthcare-only bill with two key features: Extension of expiring health insurance subsidies paid for with a cram down on drug prices in Medicare. Without an extension of those subsidies, more than 10 million Americans are facing a large increase in their premiums for 2023. Drug price changes would be the method to pay for the increase in subsidies, but these changes could significantly alter the drug pricing structure within Medicare over time, leading to a lower return on pharmaceutical research and development. Congress will try to pass these wide-ranging changes before the August recess, which puts the measure on a tight timeline. We would also expect that interested parties will lobby to alter the provisions to their benefit.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2022 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.