The Big Winners of the Inflation Reduction Act

Earlier this month, Democrats passed a reconciliation bill that focuses on four key areas: 1) renewable energy tax credits, 2) an extension of current health care subsidies, 3) provisions to limit the price of drugs beginning in 2026, and 4) a 15% corporate minimum tax and a 1% buyback tax.

Clean Energy and Managed Care Are the Big Winners from the Inflation Reduction Act

In a matter of weeks, Democrats in Congress passed their long-debated reconciliation bill (originally called Build Back Better) and renamed it the Inflation Reduction Act. Two clear winners from the legislation are clean energy companies and managed care companies: the bill provides $369 billion for clean energy investments (primarily through tax credits) and it extends the more generous Affordable Care Act subsidies for three years. As a result of the legislation, there are now long-term incentives in place for solar, wind, and energy storage development, among other items. In addition, part of the deal between Senators Schumer and Manchin on the legislation is that Congress will vote on energy-permitting legislation in September to facilitate domestic fossil fuel production.

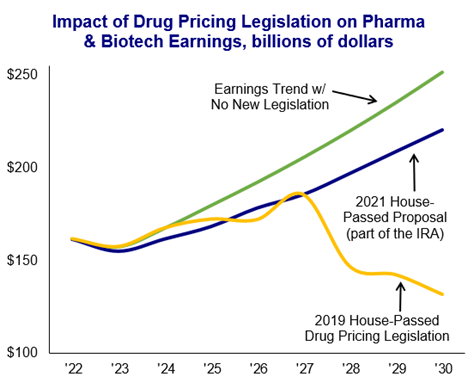

Biotech and pharma companies will face price controls starting in 2026. Managed care companies benefit from the extension of the more generous Affordable Care Act subsidies through 2025 that help individuals to afford health insurance. When those enhanced subsidies were enacted in 2021, 2.5 million more people registered for health plans in the individual marketplace. However, while managed care companies benefit, biotech and pharma companies will be negatively impacted by the reforms to prescription drug pricing included in the bill. The bill allows Medicare to negotiate prices of older, higher cost drugs beginning in 2026. Although the bill starts with a limitation on drug prices for just 10 drugs in 2026, the process accelerates quickly, with up to 100 drugs being impacted by 2031. This represents an 8% cut to pharma and biotech earnings over 10 years (and could double over the 10 years beginning in 2031). Still, the provisions in the IRA are a marked improvement from the 2019 House-passed legislation (see right) that would have cut pharma and biotech earnings nearly in half by 2030.

Biotech and pharma companies will face price controls starting in 2026. Managed care companies benefit from the extension of the more generous Affordable Care Act subsidies through 2025 that help individuals to afford health insurance. When those enhanced subsidies were enacted in 2021, 2.5 million more people registered for health plans in the individual marketplace. However, while managed care companies benefit, biotech and pharma companies will be negatively impacted by the reforms to prescription drug pricing included in the bill. The bill allows Medicare to negotiate prices of older, higher cost drugs beginning in 2026. Although the bill starts with a limitation on drug prices for just 10 drugs in 2026, the process accelerates quickly, with up to 100 drugs being impacted by 2031. This represents an 8% cut to pharma and biotech earnings over 10 years (and could double over the 10 years beginning in 2031). Still, the provisions in the IRA are a marked improvement from the 2019 House-passed legislation (see right) that would have cut pharma and biotech earnings nearly in half by 2030.

Tax increases remained in the bill but were reduced. When the reconciliation bill was first being debated last year, it was much bigger in terms of spending and it included a number of tax increases. From a macroeconomic perspective, the good news is that the final bill significantly cut the tax impact of the original proposal. Rather than looking at a 9% cut to S&P 500 earnings per share, we are now estimating just a ~2.5% cut. The bill imposes a 15% minimum tax on corporations with more than $1 billion in annual profits, which is the equivalent of a 2% increase in the effective tax rate in calendar year 2023. However, carve-outs exist for companies with heavy capital expenditure and for telecom companies to write off previous spectrum purchases. The bill also imposes a new 1% buyback tax beginning January 1, 2023. The delayed effective date on the buyback tax allows companies to pull forward buybacks into 2022 should they wish to do so.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2022 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.