Cold War 2.0 is a Tech War – Washington Policy Research

We are increasingly moving into an era of de-globalization, with the US decoupling from China and encouraging its allies to do the same. We believe this is setting up a new type of Cold War, one that we expect to play out particularly in the Technology sector over the coming years.

Decoupling from China. At the Beijing Winter Olympics in February, Vladmir Putin and Xi Jinping vowed to change the world order. We believe that this was their way of saying that Russia and China will challenge Western governments. China has been looking to gain dominance over the US in terms of global influence, economic might, and technological know-how. As a result, the US is increasingly of the view that it needs to counter China’s influence around the world and take active steps to prevent US-made technology from contributing to China’s technological advancements. In addition, the US is concerned that China will move to reunify Taiwan with the mainland, which could set in motion a much larger global struggle and threaten the West’s access to semiconductors (Taiwan produces 65% of the world’s supply). As such, the US is changing its long-standing policies of globalization and supply chain efficiency to de-globalization and supply chain resiliency. We are seeing signs of this process accelerating as firms increasingly move their supply chains out of China.

US actions to limit China’s tech access. During both the Trump and Biden Administrations, the US has begun to take actions to limit China’s access to US technology to address intellectual property theft and national security concerns.

2018: Congress/Trump enact Committee on Foreign Investment in the United States (CFIUS) reform

2019: Trump puts Huawei on a restricted trade blacklist

2020: Huawei export ban expanded to foreign companies using US technology

Aug. 2022: Congress/Biden enact CHIPS & Science Act to support domestic R&D, manufacturing of semiconductors

Aug. 2022: Biden bars Nvidia and AMD from exporting certain AI chips to China

Sept. 2022: Biden issues exec. order for CFIUS to consider additional national security factors in its review process

Sept. 2022: Biden bans export of KLA, Lam Research, and Applied Materials’ chipmaking equipment to China

Ongoing: Outbound CFIUS screening tool under consideration in Congress

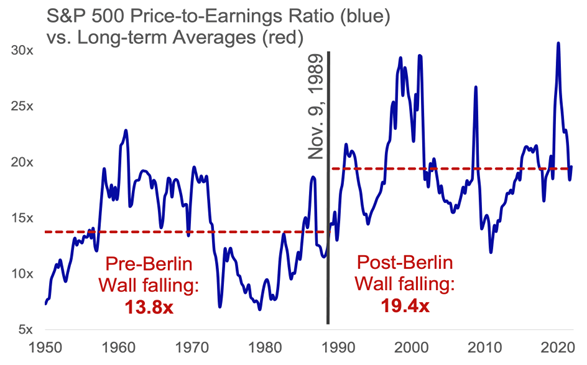

Implications for US investors. The fall of the Berlin Wall accelerated the pace of globalization, which lowered inflation and interest rates. Price-to-earnings ratios on stocks subsequently increased. US policy is now moving in the opposite direction, albeit slowly, which, over time, is likely to result in slightly higher inflation (3% or so), slightly higher interest rates, and lower price-to-earnings ratios on stocks. In this environment, we expect Value to outperform Growth. We also expect US policy to focus on domestic manufacturing and “friend-shoring” to protect the supply chains of the US and its allies. This trajectory has been accelerating over the past two presidential administrations, and, therefore, we find it unlikely that a future president (regardless of party) will reverse it.

Implications for US investors. The fall of the Berlin Wall accelerated the pace of globalization, which lowered inflation and interest rates. Price-to-earnings ratios on stocks subsequently increased. US policy is now moving in the opposite direction, albeit slowly, which, over time, is likely to result in slightly higher inflation (3% or so), slightly higher interest rates, and lower price-to-earnings ratios on stocks. In this environment, we expect Value to outperform Growth. We also expect US policy to focus on domestic manufacturing and “friend-shoring” to protect the supply chains of the US and its allies. This trajectory has been accelerating over the past two presidential administrations, and, therefore, we find it unlikely that a future president (regardless of party) will reverse it.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2022 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.