A Perspective on the Market – October 13, 2022

As we head into the last quarter of an uncertain, volatile year in the markets, Strategas CEO Jason Trennert addresses some of the pressing questions that Baird clients have been asking.

Inflation and rates continue to drive economic and market volatility; how are you thinking about those two factors over the next year?

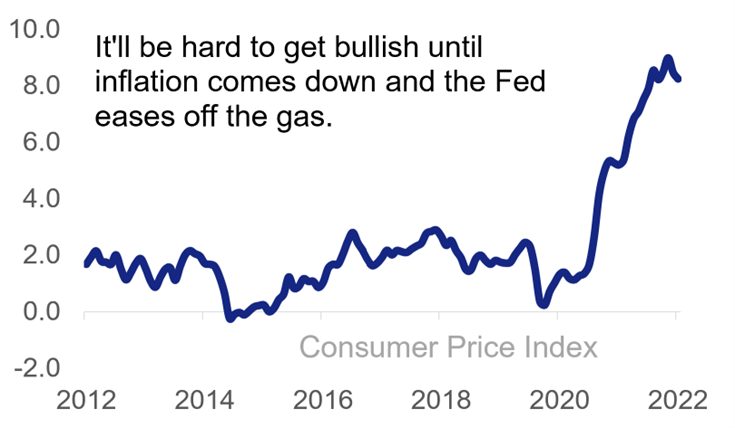

There is a chance inflation has peaked. Mortgage rates have increased, which will likely lead to a decline in housing prices, and items like used car prices have come off the boil. Having said that, there are more structural inputs—such as wages and energy prices—that could keep inflation higher for longer. More importantly, the Federal Reserve seems deadly serious about addressing inflation. We see very little wiggle room in Fed comments about their commitment to controlling inflation. So, to us, it's still going to be challenging for a time until that changes.

What are your odds for recession—and if we get one, how might it stack up with recessions of recent history?

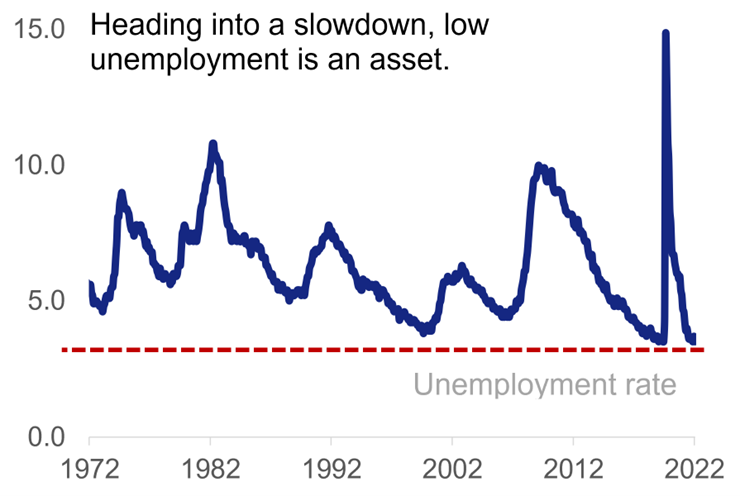

Our Chief Economist Don Rissmiller has the odds of a recession at about 50% in 2023 and 50% in 2024. That puts our odds at about 75% for a recession at some point over the next two years. It's rare to get the so-called “soft landing” scenario that everyone is looking for. When the Fed is tightening and inflation is this high, it's very hard to avoid recession. However, our starting point is better this time around. We are close to full employment at a 3.7% unemployment rate, and so it wouldn’t necessarily have to be as deep a downturn as in recessions past. It’s unfortunate for anyone to lose a job but we have a chance to get through a recession with peak unemployment at only around 6%. That would limit the extent of the pain.

Our Chief Economist Don Rissmiller has the odds of a recession at about 50% in 2023 and 50% in 2024. That puts our odds at about 75% for a recession at some point over the next two years. It's rare to get the so-called “soft landing” scenario that everyone is looking for. When the Fed is tightening and inflation is this high, it's very hard to avoid recession. However, our starting point is better this time around. We are close to full employment at a 3.7% unemployment rate, and so it wouldn’t necessarily have to be as deep a downturn as in recessions past. It’s unfortunate for anyone to lose a job but we have a chance to get through a recession with peak unemployment at only around 6%. That would limit the extent of the pain.

Inflation and rates continue to drive economic and market Strategas recently reduced its S&P 500 earnings estimate for 2023. What prompted that, and how should investors think about a drop in earnings?

I think it’s likely that we’ll have a difficult next couple of years for equity returns. This year is obviously terrible, and while next year is unlikely to be as bad, we may not return to double-digit market gains until we get through this cycle and the Fed can start easing. On earnings, we’ve never had an economic recession without also having a decline in earnings. The average decline is ~30% but it may not be as deep this time because inflation is higher and a recession may be shallower. But either way, with lower earnings and multiples unlikely to expand, it could well be challenging for a time.

Strategas has been clear-eyed all year about market weakness and the conditions behind it. What would get you more bullish on stocks?

One of our hallmarks at Strategas is that we're humble in our forecasting. We've been doing this long enough to remember times when we missed the mark. We just try take in new information and change when the facts change. From here, what would lead us to be more bullish would be a significant decline in inflation and/or a more dovish Fed. Another bullish indicator could be something like an attitude shift among industrialized countries regarding energy policy. A more measured perspective on fossil fuel use as we transition to renewables might make it easier to weather the economic storm and take the temperature down in terms of recession.

One of our hallmarks at Strategas is that we're humble in our forecasting. We've been doing this long enough to remember times when we missed the mark. We just try take in new information and change when the facts change. From here, what would lead us to be more bullish would be a significant decline in inflation and/or a more dovish Fed. Another bullish indicator could be something like an attitude shift among industrialized countries regarding energy policy. A more measured perspective on fossil fuel use as we transition to renewables might make it easier to weather the economic storm and take the temperature down in terms of recession.

Ultimately, the market is a discounting mechanism and will start to bounce before the depths of the recession are over, but we think there's some time left before we see that kind of turn.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2022 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.