Investing in an Election Year

Mike Antonelli and Ross Mayfield discuss the perils in letting the upcoming election influence your portfolio strategy.

While it is difficult to predict who will win an election, it is even more challenging to predict how markets might react. Elections are about more than one person, variable, or campaign. They’re about the intersection of local races and national races, the president and Congress, governors and judges, and more.

The market isn’t as much concerned with the theatre of politics as it is the policies that are eventually enacted. What are the agendas of the potential winners? What are the odds they can actually enact those policies? How will those choices affect one of the world’s largest and most complex economies?

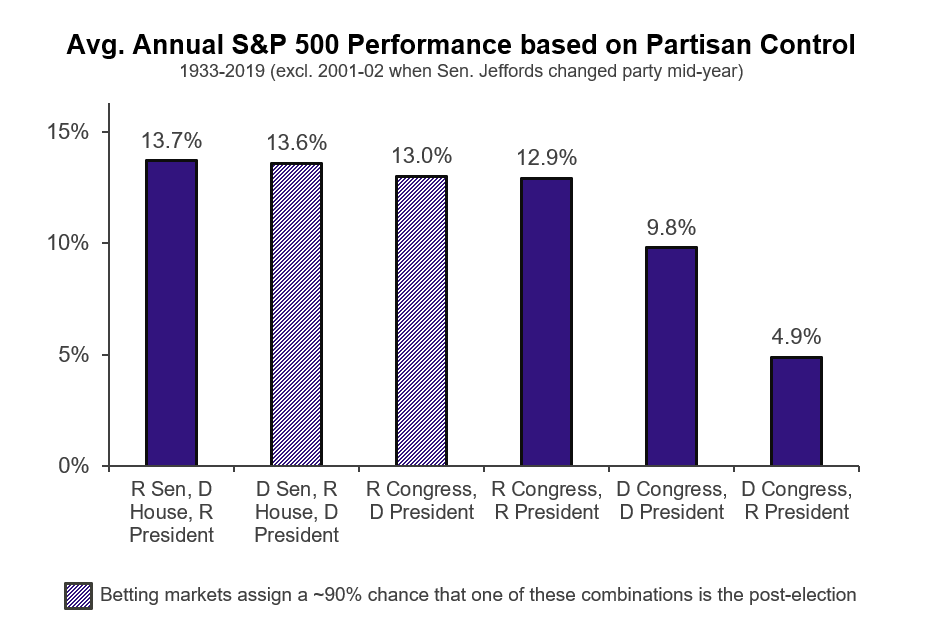

All of this is why making changes to your portfolio based on a potential election outcome is one of the worst decisions an investor can make. And though we know how loud the partisan noise can be, let’s set that aside for a time and look at the pure data. How has the market reacted to various political regimes in U.S. history? Take a look at this chart, courtesy of Strategas:

We see a few main takeaways:

- Stocks have done well under nearly every possible party configuration. Full stop. Through peace and war, high tax and low tax, pro-nationalism and pro-globalization, the stock market has persevered. Government party makeup is no different. Most partisan combinations saw double digit returns, and even the worst averaged ~5% increase per year (mostly due to bad luck, as we’ll get into next).

- The stock market is influenced by many factors, only a handful of which are directly attributable to the President or Congress. Take the lower-returning R President/D Congress period: this grouping included both the 1973–1974 oil shock and the 2008 Great Recession, two of the worst crises in market history. While certain U.S. policy decisions may have impacted these outcomes, a tremendous amount of geopolitical and financial complexity led to the ultimate result. From nonpolitical central banks and foreign national activity to shifting consumer behaviors and technological advancements, the stock market is driven by a wide array of factors. Political actions are a small piece of this pie.

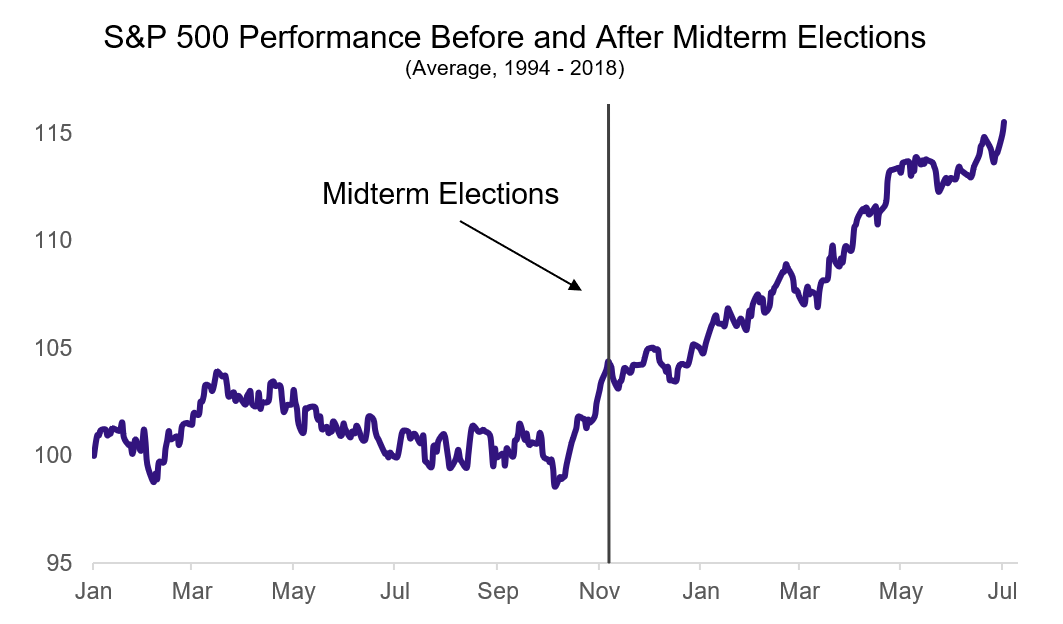

Let’s look at one more chart before we wrap up: How has the stock market performed around midterm elections? Once again, we look to a chart from our partners at Strategas:

In the case of midterms, simply getting to the election has often acted as a catalyst for stock market outperformance. In fact, the S&P 500 has not declined in the 12 months following a midterm election since 1942. Whatever the lead up may look like, the market ultimately moves on regardless of the outcome.

And while your financial plan should never change based on politics, it is worth noting that volatility tends to be higher during midterm election years. Though this year’s market weakness has plenty of contributors – historic inflation, rapidly rising interest rates, geopolitical turmoil – shifting polls and campaign stumping often intensify market moves. Things usually calm down once the election buzz has passed and the day-to-day grind of running the country resumes, but holding firm until that time can be stressful.

Whether it’s true or not, the partisan divide in our country feels wider than ever. The debate is noisier, the rhetoric is harsher, and social media has a way of amplifying the loudest and most controversial voices. Politics is an emotional game and, unfortunately, some of our worst biases and behavioral mistakes show up when we let emotions drive our decision-making. Investing is no different. That is why your Baird Financial Advisor is here to work with you through the political noise and election-year volatility. They aim to help you build a robust portfolio and long-term plan, regardless of the shifting political winds.

Editor’s Note: This article was originally published August 2020 and was updated October 2022 with more current information.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.