Strategas Midterm Election Preview

With midterms fast approaching, Strategas Head of Washington Research Dan Clifton breaks down the coming elections, potential policy outcomes, and other big themes to watch.

How are you seeing the current political environment?

Before we talk about the 2022 midterm elections, it’s important to understand the current political environment that we're operating in. The United States is undergoing its single greatest bout of political volatility since the end of the Civil War. We've had eight federal elections since the 2008 Financial Crisis, and voters have removed the party in power in seven of those eight elections. We've tried every party combination out there, and none have proved sustainable (further, we think it is very likely to become eight of nine elections where the power dynamic shifts in a few weeks). This all comes as inflation has completely dominated the financial markets’ attention this year and is also the single greatest issue heading into the 2022 midterm elections.

What is the framework you’re using to evaluate the 2022 midterms?

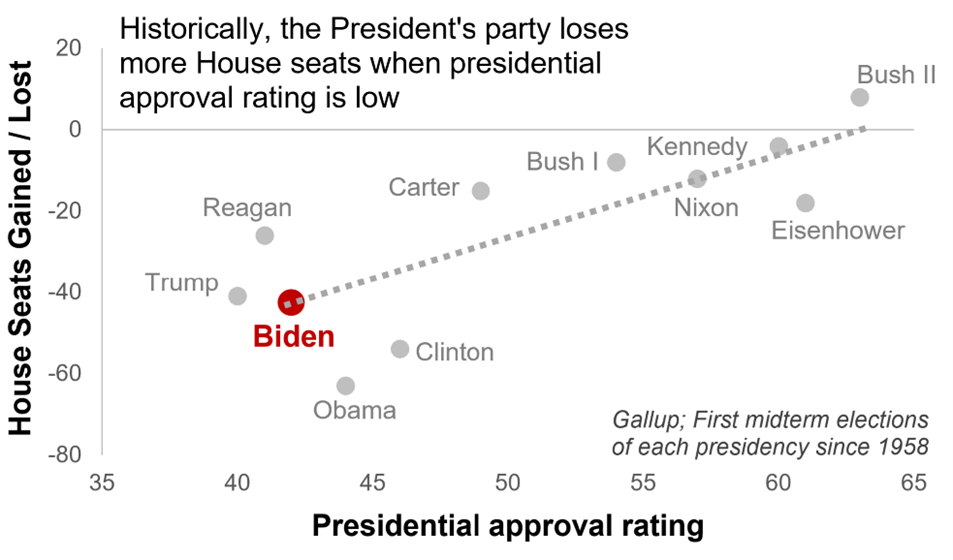

Midterm elections have historically been referendums on an incumbent president’s first two years in office. We know this because a president's approval rating is highly correlated to the number of seats gained or lost in their first midterm election; that is, as a president becomes more unpopular, they tend to lose more House seats. This is common – most presidents lose seats for their own political party in the midterm election, and in fact, there are only two presidents in the last 100 years who have actually gained seats in their first midterm (Franklin D. Roosevelt during the Great Depression in 1934 and George W. Bush in 2002 after 9/11).

Midterm elections have historically been referendums on an incumbent president’s first two years in office. We know this because a president's approval rating is highly correlated to the number of seats gained or lost in their first midterm election; that is, as a president becomes more unpopular, they tend to lose more House seats. This is common – most presidents lose seats for their own political party in the midterm election, and in fact, there are only two presidents in the last 100 years who have actually gained seats in their first midterm (Franklin D. Roosevelt during the Great Depression in 1934 and George W. Bush in 2002 after 9/11).

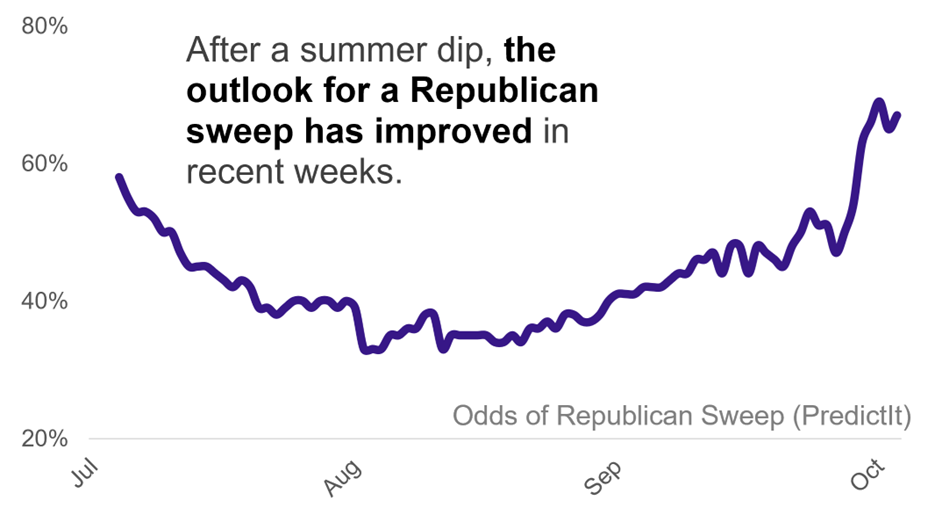

This election was shaping up to be very similar to that historical pattern, but that shifted a bit over the summer as gasoline prices fell, the Supreme Court ruled on Roe v. Wade (prompting an increase in voter registration amongst Democratic women), and a few other key events occurred. We had five special elections in August for retiring members of Congress, and in those elections the Democrats did quite well. In fact, if the midterm elections had been held mid-August, the Democrats could have been closer to keeping the House. But that has again shifted in recent weeks. Since Labor Day, the issues that crystallized as most important for voters (seen in polling) started to square up with what the Republicans were campaigning on: gasoline prices, crime, and immigration. All three have been prominently pushed by the Republicans, and as a result, the Republicans have regained points in the polls. We also see undecided voters starting to break towards the party out of power, as is common in midterms. Our House model right now has the Republicans gaining 25 to 30 seats.

The Senate is less clear, with four or five races still within the margin of error. But as of today, the equity markets and betting odds are giving the Republicans a slight edge. And so, consensus today is about a 65% odds of a full Republican sweep, which is up markedly from 35% just three weeks ago. Of course, we're still two weeks away, so plenty could yet change.

What could bring a potential change to that outlook?

We're focused on a few areas that could change the odds between now and Election Day. First, the president has announced the release of an additional 15 million barrels of oil from the Strategic Petroleum Reserve. Gasoline prices are the single biggest factor in voter behavior this election, and so it makes sense politically to try to keep the price of oil down. We're also closely watching whether Donald Trump rises to the top of news headlines over the next couple of weeks. We've been keeping tabs on the story about whether President Trump has returned all classified documents and how the FBI may act on that information. We are at the six year anniversary of the FBI reopening Hillary Clinton's emails right before the 2016 election, and regardless of how you feel about that, it changed the conversation in the final weeks of that race. Should an event like that happen with Donald Trump, it could affect races.

What are the policy implications of the different midterm election scenarios?

There are really three election scenarios that can result from this election:

- Democrat House, Democrat Senate.

The lowest probability of the three, but also the clearest with regards to policy implications. President Biden would be able to claim a mandate for a continuation of his existing policies, which would likely mean going back for remaining portions of his Build Back Better agenda in three key areas: a child tax credit, Medicaid expansion, and making renewable energy credits refundable (which means that he could deploy clean energy faster). That spending would have to be offset with tax increases; a higher corporate rate, a higher tax on US multinationals, a surtax on the wealthy, etc. The president is also likely to double down on his opposition to fossil fuel infrastructure being expanded in the US. - Republican House, Democrat Senate.

This outcome likely brings us gridlock after January 3, but with a potentially active lame duck session of Congress in November and December. Some of the agenda items on tap would be an increase in defense spending, the extension of expiring tax credits from President Trump's tax reform, the possibility of a slim child tax credit, and a significant change in retirement savings (i.e., increasing the required minimum distribution, maybe expanding of 401ks and IRAs). Finally, it's likely that as an amendment to the National Defense Authorization Act, you'd see 1) Outbound investment restrictions placed on US companies, specifically around critical technologies; and 2) Companies that want to put supply chains in China would be subject to national security review. - Republican House, Republican Senate.

We’d still expect some of the above provisions to pass in the lame duck session, but Republicans would have more leverage in this scenario. Republicans would likely use must-pass legislation (e.g., the budget) to get items in play like increasing energy infrastructure spending, expanding border security at the southern border, and increasing the defense budget. We would anticipate some level of compromise between the two parties on those fronts. The bigger issue is that the debt ceiling will have to be raised at some point in 2023. The more Republican seats gained in the midterm election, the more power they’ll have to rein in government spending in 2023 as the national debt continues to increase and interest costs begin to rise.

We’d still expect some of the above provisions to pass in the lame duck session, but Republicans would have more leverage in this scenario. Republicans would likely use must-pass legislation (e.g., the budget) to get items in play like increasing energy infrastructure spending, expanding border security at the southern border, and increasing the defense budget. We would anticipate some level of compromise between the two parties on those fronts. The bigger issue is that the debt ceiling will have to be raised at some point in 2023. The more Republican seats gained in the midterm election, the more power they’ll have to rein in government spending in 2023 as the national debt continues to increase and interest costs begin to rise.

What are some of the big themes that you are watching outside of the midterms?

Regardless of the elections, we believe that our three frameworks for policy analysis – fiscal, monetary, and geopolitical – have all been upended. Obviously, the fiscal framework has been upset by the rising rate environment; as the interest cost on debt continues to rise, it will limit any future fiscal policy (both in terms of tax cuts and spending increases). In monetary policy, this is the first time in 40 years that the Federal Reserve has to actually get inflation out of the system rather than just prevent it. They must remain vigilant.

And finally, geopolitical. For the first time since the Berlin Wall came down, the US is looking at a more multipolar world. The threat of China and Russia together challenging the Western order has raised geopolitical risks, and US government policy is beginning to change as a result. We're starting to pay the semiconductor manufacturers to come back to the US, to do national security reviews on outbound investment, and more recently, to limit computer chip equipment makers from being able to do business in China. This is going to lead to a more bifurcated world. And with governments increasingly forcing companies and investors to choose sides, it feels very similar to the pre-Berlin Wall era in the 1980s. As a result, we anticipate these policy choices will lead to slightly higher inflation, slightly higher interest rates, and lower price-to-earnings ratios on stocks moving forward. This trajectory has been accelerating over the past two presidential administrations, and, therefore, we find it unlikely that a future president (regardless of party) will reverse it.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent. This communication is provided for informational purposes only and is not an offer, recommendation or solicitation to buy or sell any security. This communication does not constitute, nor should it be regarded as, investment research or a research report or securities recommendation and it does not provide information reasonably sufficient upon which to base an investment decision. This is not a complete analysis of every material fact regarding any company, industry or security. Additional analysis would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any particular client and is not presented as suitable to any other particular client; therefore, this communication should be treated as impersonal investment advice. The intended recipients of this communication are presumed to be capable of conducting their own analysis, risk evaluation, and decision-making regarding their investments.

For investors subject to MiFID II (European Directive 2014/65/EU and related Delegated Directives): We classify the intended recipients of this communication as “professional clients” or “eligible counterparties” with the meaning of MiFID II and the rules of the UK Financial Conduct Authority. The contents of this report are not provided on an independent basis and are not “investment advice” or “personal recommendations” within the meaning of MiFID II and the rules of the UK Financial Conduct Authority.

The information in this communication has been obtained from sources we consider to be reliable, but we cannot guarantee its accuracy. The information is current only as of the date of this communication and we do not undertake to update or revise such information following such date. To the extent that any securities or their issuers are included in this communication, we do not undertake to provide any information about such securities or their issuers in the future. We do not follow, cover or provide any fundamental or technical analyses, investment ratings, price targets, financial models or other guidance on any particular securities or companies. Further, to the extent that any securities or their issuers are included in this communication, each person responsible for the content included in this communication certifies that any views expressed with respect to such securities or their issuers accurately reflect his or her personal views about the same and that no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this communication. This communication is provided on a “where is, as is” basis, and we expressly disclaim any liability for any losses or other consequences of any person’s use of or reliance on the information contained in this communication.

Strategas Securities, LLC is a registered broker-dealer and FINRA member firm, as well as an SEC-registered investment adviser. It is affiliated with Strategas Asset Management, LLC, an SEC-registered investment adviser. Strategas Securities, LLC is also affiliated with and wholly owned by Robert W. Baird & Co. Incorporated (“Baird”), a broker-dealer and FINRA member firm, although the two firms conduct separate and distinct businesses.

A complete listing of all applicable disclosures pertaining to Baird with respect to any individual companies mentioned in this communication can be accessed at http://www.rwbaird.com/research-insights/research/coverage/thirdpartyresearch-disclosures.aspx.

You can also call 1-800-792-2473 or write: Robert W. Baird & Co., PWM Research & Analytics, 777 E. Wisconsin Avenue, Milwaukee, WI 53202.