Financial Planning in Boom-or-Bust Industries

Whether you own a business in a boom-or-bust industry like agriculture, technology or energy or are employed in one, you’ve probably experienced firsthand how difficult financial planning can be. Be it due to shifting market conditions or just a change in the weather, forces outside your control can very easily dictate how profitable you are from month to month or year to year. That kind of unpredictability makes it challenging to make thoughtful, forward-looking financial decisions – but not impossible. Here are six strategies to help you make the most of the highs and ride out the lows.

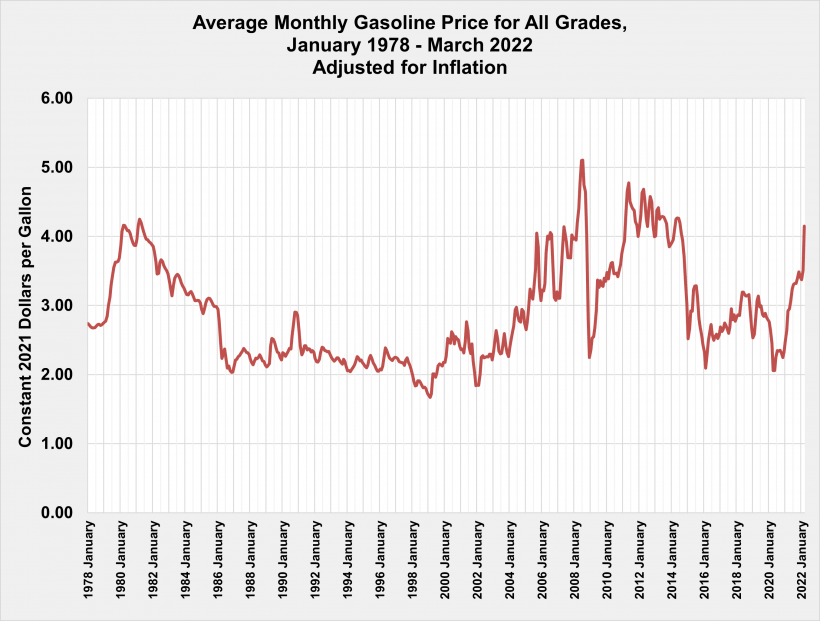

Figure 1. Gas prices affect far more than just the oil industry. From fencing to piping to transportation, life can be a lot different at $2 per gallon (January 2020) than at $4 per gallon (January 2022).

Source: Energy Information Administration, Monthly Energy Review, April 2022

When Times Are Good

While it’s important to celebrate the good times, you can’t forget that leaner times are around the corner – which means you have to make the most of those opportunities when they arise. Here are some strategies to consider when business is booming.

Strategy 1: Maximize Savings for the Future

While you might be tempted to spend more on non-necessities, now is the time to build up your emergency reserves beyond what you’re saving for retirement. These accounts can help sustain you during those bust periods when income might be inconsistent and keep you from tapping into funds earmarked for other priorities.

To determine how much you should save, start with your current budget: Map out your essential monthly spending (things like food, shelter, transportation and business expenses) against how long typical bust periods last. For example, if you spend $8,000/month on the necessities and anticipate a down period lasting a year, the math would look like this:

$8,000/month of essential spending × 12 months = $96,000

Note that this is only a target: You might bring in some income during that down period, but the bust period might last longer than a year as well.

As you’re building up your savings, don’t forget to max out funds for retirement, like a 401(k) / IRA or a health savings account. Just make sure you separate your retirement funding from your cash reserves: It can be difficult – and expensive – to withdraw from investment and retirement accounts if you need immediate cash, especially in a down market.

If you’ve already built up a robust savings plan and maxed out your retirement plans, consider these other strategies for saving for retirement.

Strategy 2: Diversify Your Investments

Diversification, or intentionally spreading your portfolio over many unrelated assets and asset classes, is designed to mitigate portfolio risk by limiting the potential damage from a downturn in any one asset class or investment. While some economic declines can impact the market broadly, others are more limited in scope due to industry-specific reasons, like supply chain issues in a certain part of the world or new legislation addressing a particular product or sector. A diversified portfolio can help limit how much you’re exposed to those more targeted declines.

This is especially important for investors who work in a boom-or-bust industry. When your household income is tied to an industry with a lot of ups and downs, you’re already experiencing the challenges of irregular or unpredictable income. Those challenges can become compounded if your investments are experiencing the same kinds of unpredictability at the same time. (For example, if you both work and heavily invest in the oil industry, an unexpected decrease in oil demand could send your income and your portfolio into a tailspin at precisely the same moment.) This is especially common for employees who receive company stock as part of their total compensation – they end up being overweighted in their industry through no fault of their own. Your income and your career are already dependent on your employer – having your portfolio dependent on it as well introduces a great deal of risk

Strategy 3: Plan Ahead

Unlike someone who is suddenly laid off, if you’re in a boom-or-bust industry, you know that leaner times will be coming at some point. Keeping that long-term perspective needs to be part of your everyday mentality when making financial decisions. What might that look like?

- Establish a budget. Get a handle on which of your monthly expenses are discretionary (like a gym membership) and what are non-negotiable (like a mortgage). Having a sense of where you stand financially – even if it’s not down to the exact dollar – can help you make smart financial decisions in the moment.

- Don’t take on debt you can’t manage. While your income might vary due to outside forces, debt payments don’t: If you splurge on a truck with $800 monthly payments because business is booming, you’ll be on the hook for those same payments if business dries up. (Looking to get debt under control? Here are five strategies that can help.) Living within your means can be challenging with unpredictable income, which is why long-term planning is so important.

- Look for the clues. The more warning you have that a bust period is coming, the better you can prepare your own finances. Get to know how your industry works and what impacts your customers’ purchasing decisions – it might help you more quickly identify the gathering storm clouds on the horizon.

One final thought on planning ahead: Generally speaking, it’s better to own assets than owe on assets when your income is unpredictable. But as you’re putting together a financial plan for leaner times, be wary of counting on the potential sale of an asset, like a piece of property or inventory. A down period, especially one that affects your broader community, can dramatically dry up demand – selling off land or resources only works if there’s a buyer with the means and willingness to meet your price.

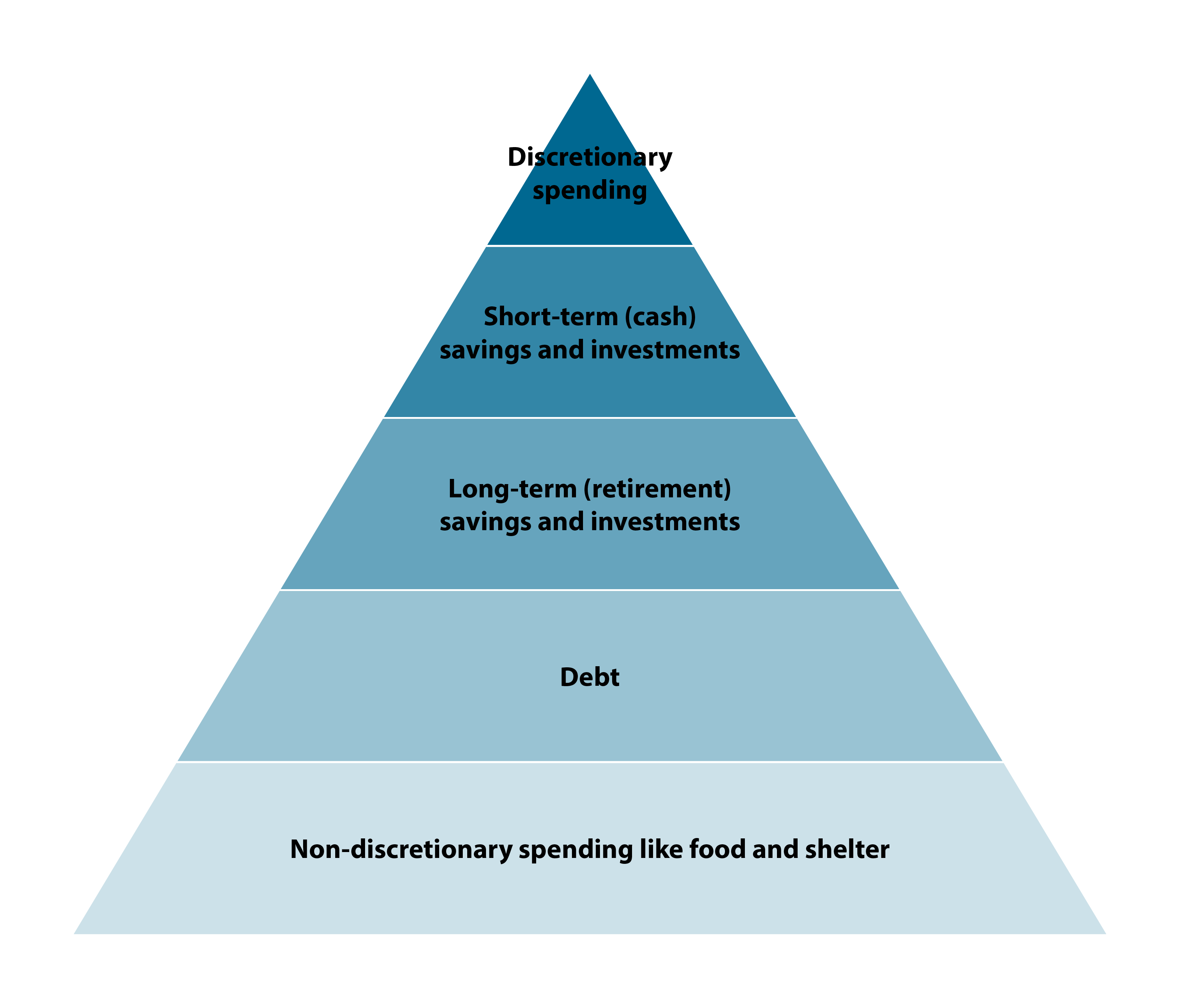

Figure 2. In leaner times, focus more of your energy – and budget – on the lower half of the pyramid.

When Times Are Bad

While the best time to plan for the down times is when you have the most resources and flexibility, there still might be way to make the most of leaner circumstances. Here are some strategies to consider when times get tougher.

Strategy 4: Tighten Up Your Budget

When times are tough, it’s essential that you prioritize your spending and separate the essentials from the nonessentials. If you’ve built an emergency reserve, now is the time to draw on it – with the understanding that you might not know how long it needs to last before you can replenish it. In most cases, withdrawing from retirement funds should be a last resort.

As you explore what expenses can be eliminated or redirected, remember that investments in yourself – be it your knowledge, skills, services or marketability – might be worth maintaining even in down periods.

Strategy 5: Consider a Secondary Source of Income

One strategy to help level out the unpredictability of boom-or-bust industries is to create a secondary revenue stream during the lean times. The key is to have a firm grasp on what assets and services you have at your disposal and how far you’re able to stretch yourself. Here are some strategies to keep in mind:

- Maintain your financial flexibility. Ideally, this source of income wouldn’t require a lot of start-up capital (you don’t want this second job to eat up your savings in what’s already a down period) and is something you could easily flex into and out of as your main business allows. A second business that requires a lot of upfront resources and interferes with your primary occupation might be self-defeating.

- Be counter-cyclical. Just as you would diversify your investments, look for a secondary source of income that operates on an entirely different cycle than your main job. Supplementing your primary income as a real estate broker with a second job in carpentry could see both fail in a bad housing market.

- Get creative. What assets do you have, and how could they be used differently? Could land currently being used for agriculture be converted into solar farming? What industries thrive in conditions that negatively impact yours? In colder climates, it’s not uncommon to see landscapers in the spring and summer use their plows for residential and commercial snow removal in the winter.

To echo an earlier point, the best time to plan a second, down-market career is during your boom periods, when you likely have the resources to invest in it. (If your second career requires specialized equipment, it’ll be easier to budget for that expense when times are good.) Building relationships with networks outside your primary industry can be a useful first step.

Strategy 6: Keep Up on Your Taxes

When you’re in a down cycle, it can be easy to forget that you still might owe significant taxes from an earlier boom. As bad as your circumstances might get, you don’t want to compound your financial issues with tax delinquency.

If you don’t pay your taxes by their due date, you can incur interest and penalties, be subject to liens on your property, have your assets seized or even face jail time. Filing your returns promptly – even if you can’t pay them – can lessen but not avoid those penalties. Separating the essentials from the nonessentials isn’t just about identifying what you can do without – it’s also about making sure you can pay for the things you can’t live without.

At its core, financial planning is about anticipating for the unknown ‒ about making concrete financial decisions now that give you the most flexibility as the future unfolds. As challenging as that can be with a regular, stable income, it’s doubly so when your income is unpredictable or highly variable. Your Baird Financial Advisor can work with you on a forward-looking plan that prepares you for both the highs and the lows.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.