Debt Ceiling Deal Includes Two Years of Spending Caps

Strategas Washington Policy Research

Just days before the United States was set to hit the X date (at which the government could no longer pay all of its bills), policymakers reached a deal to raise the debt ceiling. In this note, we’ll break down what’s in the deal, its impact on economic growth over the coming years, and what to focus on next.

Policymakers reached a deal to raise the debt ceiling just days before the US hit the X date. The deal requires some cuts to federal spending, which will serve as a drag on GDP over the next two fiscal years, but we do not believe this is the end of the fiscal austerity narrative. Additionally, now that the debt ceiling has been lifted, there are concerns that a liquidity drain will impact markets.

What’s in the deal?

The forged debt ceiling deal includes a number of provisions. Most importantly, it raises the debt ceiling through January 1, 2025, and it imposes caps on overall discretionary spending for FY24 and FY25, cutting spending by $975 billion over 10 years. Defense spending, however, will see a 3.3% increase in FY24 and a 1.0% increase in FY25. The bill also calls for non-binding discretionary spending caps for FY26 through FY29, which, if enacted, would lead to a total of $1.5 trillion in savings. The agreement also expands work requirements in the TANF and SNAP social safety net programs, implements modest energy permitting reform, and ends the student loan payment moratorium on August 29.

What are the implications?

The binding discretionary spending cuts will result in a fiscal drag of 0.65% of GDP in FY24 and FY25, combined. Federal government spending will no longer be the support it has been for economic growth. Requiring student loan payments to restart at the end of August will lead to potentially an additional 0.2-0.4% hit to GDP, leading to less consumer spending at the same time as we move into a slower US economy (though President Biden may look to implement an income-driven repayment program in July, which could be an offset).

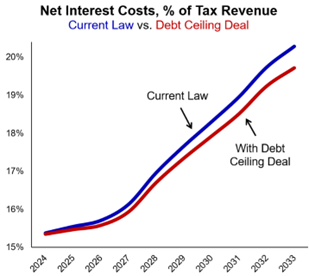

The deal does little to change the long-term fiscal outlook. While it does bring down costs to service federal debt to an extent, we are still expected to have net interest costs reach 14% of tax revenues this year, which is the level at which financial markets have historically begun to impose fiscal discipline on policymakers. We have not seen that level of net interest costs as a percentage of tax revenues since 1998. As a result, Speaker McCarthy announced he will establish a bipartisan commission to look at long-term spending now that the debt ceiling debate is over. We expect the US to enter a multi-year period of fiscal austerity.

A liquidity drain will impact financial markets.

Since the US hit the debt ceiling in January, Treasury has been unable to issue net new debt and has instead spent down $408 billion in the Treasury General Account (TGA) to fund government operations, which has boosted liquidity over the past several months. Now that the debt ceiling has been raised, this liquidity injection will cease as Treasury likely refills that account. If bank reserves are used to buy new Treasuries, it will be a further drain on liquidity from the financial system. We have found that increased liquidity has boosted stocks, the dollar, and bitcoin. This may reverse as the Treasury refills the TGA over the coming months.

Disclosures

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2023 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.