Strategas Mid-Year Market Outlook

Nicholas Bohnsack, President, Strategas

While the first half of 2023 was undoubtedly better than expected in markets, it was not without challenges along the way: from a banking crisis to debt ceiling turmoil, and many things in between. Strategas President Nicholas Bohnsack weighs in with the outlook for the second half of the year.

What is Strategas’ economic outlook for the remainder of the year?

The U.S. economy is under acute pressure from a number of sectors, not least of which has been the dramatic tightening of monetary policy over the last 15 months. Historically, the cost of tightening monetary policy has been a slowdown in economic activity; what’s been interesting in this most recent episode is the resiliency of the U.S. consumer due to the labor market’s strength. At the same time, when we look under the hood at the data (particularly earnings and interest rates) it's difficult to get past the idea that the economy is likely to slow further from here as we look out toward the end of 2023 and the beginning of 2024.

How do you see the path of inflation and interest rates unfolding from here?

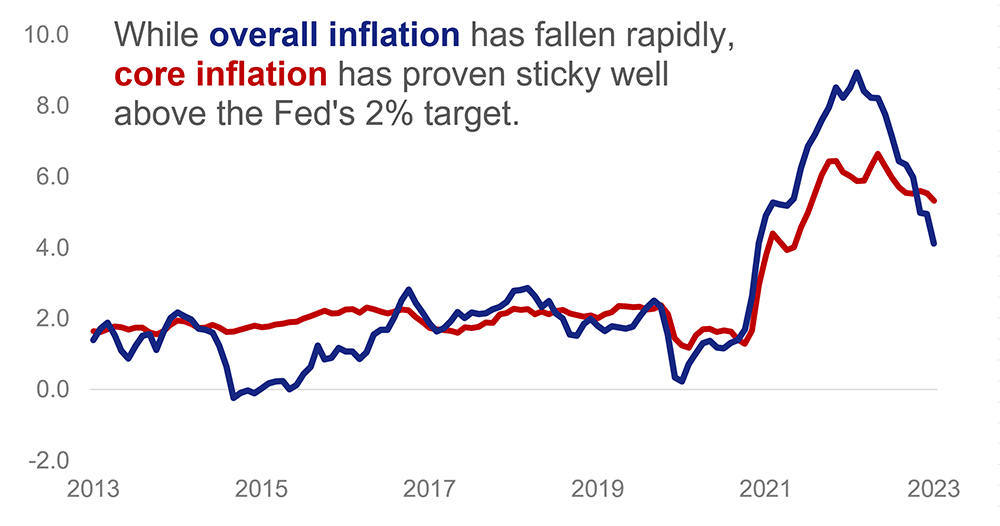

Inflation has been the scrooge that keeps taking from this economy. And it's clear to us that the Federal Reserve and other global central banks have decided that allowing inflation to become unanchored would be a bigger “policy error” than pushing the economy into recession would be. So while we've already had a very aggressive tightening campaign in the U.S. and headline inflation has lowered, some of the stickier elements like wages and rents remain more elevated. Because of that, Fed Chair Powell has indicated that the Fed’s proclivities will likely be to tighten monetary policy further from here. Short-term rates are likely to move higher from here – indicating continued volatility in the fixed income markets. Still, it's our suspicion that we're closer to the end of this tightening campaign than the beginning, so we would also expect to see a steadying and leveling out of interest rates as we move toward year-end. Inflation should continue to come under some pressure with rates elevated, although we expect it will ultimately level out above where it has existed historically.

Inflation has been the scrooge that keeps taking from this economy. And it's clear to us that the Federal Reserve and other global central banks have decided that allowing inflation to become unanchored would be a bigger “policy error” than pushing the economy into recession would be. So while we've already had a very aggressive tightening campaign in the U.S. and headline inflation has lowered, some of the stickier elements like wages and rents remain more elevated. Because of that, Fed Chair Powell has indicated that the Fed’s proclivities will likely be to tighten monetary policy further from here. Short-term rates are likely to move higher from here – indicating continued volatility in the fixed income markets. Still, it's our suspicion that we're closer to the end of this tightening campaign than the beginning, so we would also expect to see a steadying and leveling out of interest rates as we move toward year-end. Inflation should continue to come under some pressure with rates elevated, although we expect it will ultimately level out above where it has existed historically.

What are your expectations for corporate earnings and profit margins?

One of the interesting aspects of the economy has been the resiliency of the labor market. That has led to a slightly stronger consumer and better-than-expected economic growth, but on the other hand, it has also put a little bit of pressure on company profit margins (vis-à-vis higher wages). We have seen a flattening out of aggregate profit margins since last fall, and it's expected that they will continue to come under pressure as we move towards 2024. The general consensus is a bit more optimistic on profits and margins than we are at Strategas; if recession is the base case, we would anticipate a greater drawdown in corporate profits than perhaps the market and its optimism has baked in.

One of the interesting aspects of the economy has been the resiliency of the labor market. That has led to a slightly stronger consumer and better-than-expected economic growth, but on the other hand, it has also put a little bit of pressure on company profit margins (vis-à-vis higher wages). We have seen a flattening out of aggregate profit margins since last fall, and it's expected that they will continue to come under pressure as we move towards 2024. The general consensus is a bit more optimistic on profits and margins than we are at Strategas; if recession is the base case, we would anticipate a greater drawdown in corporate profits than perhaps the market and its optimism has baked in.

How are you positioning portfolios for such an environment?

![]()

It's tempting to want to chase this stock market rally when it seems like it's going up every day. In our view, it's important to remember that the market was basically flat heading into the regional bank failures that we saw earlier this year. Almost all of the market's performance came after it became clear that policymakers were willing to step into the void to prevent another systemic financial crisis. As we look out towards year end, our proclivity is to remain somewhat cautious on the market. We've maintained that stance – and positioned for it – for the better part of the last nine months, even when it has made us look wrong.

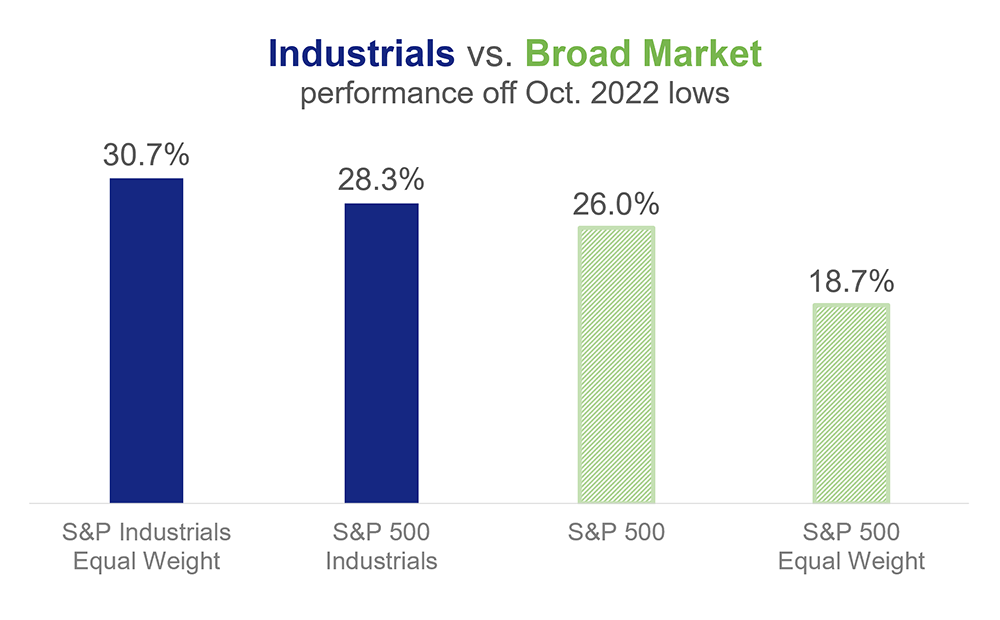

We favor Value stocks over Growth stocks, particularly given the likelihood of slightly higher interest rates going forward. While Growth has done particularly well to start the year, it has been driven by very narrow leadership focused on Technology and AI. One sector that has showcased its resiliency, perhaps above all others, is Industrials. These tried and true operators 1) have existed through multiple business cycles 2) are willing and able to adjust to different operating environments, but 3) are ultimately driven by the underpinnings of the global economy. When other sectors do well for brief periods but then Industrials take up the mantle, it suggests an economy that muddles through but is also looking for opportunities. So, we think highly about taking a second look at Industrials, even against the backdrop of a more cautious outlook.

What could change your mind on your market and economic outlook?

Though we remain cautious overall, certain pockets like the Industrials sector and the labor market have characterized the stronger-than-anticipated economic performance in the first half of 2023. To the extent that we're closer to the end than to the beginning of the Fed’s tightening campaign, and to the extent that inflation will be wrestled back to a level acceptable to both consumers and policymakers, any follow-through on the corporate earnings side will have to be taken as a bullish indication for a new economic cycle. Ultimately, and somewhat in contrast to what we've experienced over the last decade, the next business cycle will likely have to be sustained not by persistently suppressed interest rates but by organic drivers of growth strong enough to bring capital in from corporate operators and to entice investors looking for returns in an otherwise difficult market. Evidence of those drivers would ultimately cause us to reevaluate our outlook.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.