US Consumer Will Be Impacted by the Restarting of Student Loan Payments

Strategas Washington Policy Research

After a three-year hiatus during the COVID-19 pandemic, student loan payments will restart in October. The Biden administration’s efforts to enact broad student loan forgiveness were stymied by the Supreme Court, but the administration is taking other steps in order to lessen the burden of student loan payments for some individuals.

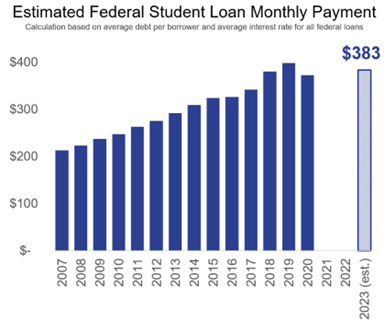

The debt ceiling deal enacted in June included a provision requiring student loan payments to restart in October (with interest beginning to accrue in September), ending the three-year moratorium on payments and interest since the start of the COVID-19 pandemic. Restarting these payments will put some strain on the US consumer, as the average monthly payment is estimated to be $383. However, the Biden administration is taking steps to reduce or eliminate the payments for some borrowers, particularly low-income borrowers, which will mitigate the overall impact.

Large-scale student loan forgiveness was struck down by the Supreme Court.

Last fall, the Biden administration introduced a plan to provide student loan forgiveness of up to $20,000 for those individuals making $125,000 or less (or $250,000 for those filing jointly). However, the Supreme Court ruled at the end of June that the forgiveness plan was unlawful as the administration had exceeded its authority under the statute cited to implement the program.

In response, the president announced several initiatives to reduce the impact on borrowers of student loan payments restarting.

These include:

These include:

- Implementing an on-ramp repayment program in which borrowers who miss payments will not be reported to credit agencies for 12 months, beginning October 1, to prevent them from going into default and having their credit impacted. Although interest will continue to accrue, some borrowers may not make payments given the lack of default risk.

- Implementing a new income-driven repayment plan (the SAVE plan), which will be fully in place by July 2024 and will require undergraduate borrowers to pay only up to 5% of their disposable income rather than 10%, with loans forgiven after borrowers pay for 20 years. (Graduate borrowers will still owe 10% and loans will be forgiven after 25 years of repayment.)

- Increasing the threshold of income protected from payment on existing student loan programs from 150% to 225% of the federal poverty level by October 1. As a result, a single borrower earning less than $32,805 will owe $0.

- Forgiving interest costs that are greater than borrowers’ monthly payments by October 1. This will prevent loan balances from increasing. The administration estimates that 70% of borrowers will benefit from this change.

Taken together, the US is moving back to a system in which student loan borrowers will need to begin to make payments.

This represents a change from the pandemic era and is likely to place an additional burden on the US consumer at a time when excess savings are being drawn down and inflation remains persistent. However, the Biden administration is working to minimize the burden through a series of existing and new programs that will be implemented over the course of the next few months and the next year.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2023 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.