7 Steps to Take When Tying the Knot

You and your intended may be focused on the planning and expenses that come with a wedding, but there are key planning moves to ensure you’re on the right track to a financially stable marriage.

Discuss Shared Costs and Debts

A conversation that may be sensitive, yet is crucial to have, is how income, expenses and debts are going to be split up within a newly married couple. You will need to decide if you want zero, one or more shared accounts, and how much each person is going to contribute to each shared account. You will also need to talk about how you are going to split (or not split) recurring expenses like groceries, a mortgage and paying off debt. In a situation where one spouse has more debt than the other, like student loans, it is also important to discuss if the spouse with less debt will be helping to pay off the debt of the other spouse.

Build Your Emergency Fund

As you merge your household with your spouse, it’s worth revisiting your individual emergency funds to ensure you’re covered in the case of an unexpected event. Whether or not you merge your two emergency funds into one account, confirm that they are insured by the FDIC – and preferably in a place where it can earn some interest for you. It’s important to make all these decisions with your partner, but of course you and your partner also need to decide how you are going to fund the account.

The reality is, you may already be contributing to retirement funds, making a mortgage or car payment, paying for your wedding, etc. And because many young couples are making as little as they will ever make in their career, it can be difficult to fathom putting even more money away for an emergency fund. Though it may be challenging, consider making some sacrifices to start putting money aside that could eventually be your saving grace in an unexpected financial situation. Ideally, your emergency fund should cover three to six months’ worth of expenses. Talk to your spouse about where you could both cut spending to be able to place a specified amount into the emergency fund. A good way to stay on track is to set incremental monthly savings goals.

Consider Tax Implications

Going from single to married means the IRS now views you differently. If one spouse earns much more than the other, the total tax paid as a married couple might go down. However, if two single people with similar levels of income are married, their total tax bill might not change much – unless they’re both high earners, in which case “the marriage penalty” can cause their taxes to increase. There are also different rules on deductions, credits and other items once you’re married, so be sure to check with your Financial Advisor on how your tax situation may change.

Check on Your Retirement Savings

In most cases, getting married does not change how you make a Roth IRA contribution. But, if your combined income is higher than the income limits set by the IRS for Roth IRAs, you may no longer qualify. And unfortunately, you can’t get ahead of this by contributing before your wedding date; your marital status on the last day of the tax year is what matters. If you and your spouse don’t qualify for a Roth contribution, fear not: a Roth conversion could be an option.

Update Your Estate Plans

An important step to take when getting married is to either update or create your estate plan. Estate plans are useful for managing assets after death, naming a power of attorney and designating a guardian for children. Without an estate plan, you’ll have less control over what eventually happens to your assets, and you could be submitting your heirs to avoidable income, state or gift taxes. If you already have an estate plan, updating it is crucial. It’s not uncommon for new spouses to unintentionally be left out of existing plans.

When updating your plan, there are three questions you should ask:

- What do you own?

A good estate plan starts with a good balance sheet. This includes anything you and/or your spouse own: businesses, properties, savings accounts, stock portfolios, etc. In your estate plan, you must acknowledge every asset you plan to pass on after your death. - Who will receive your assets?

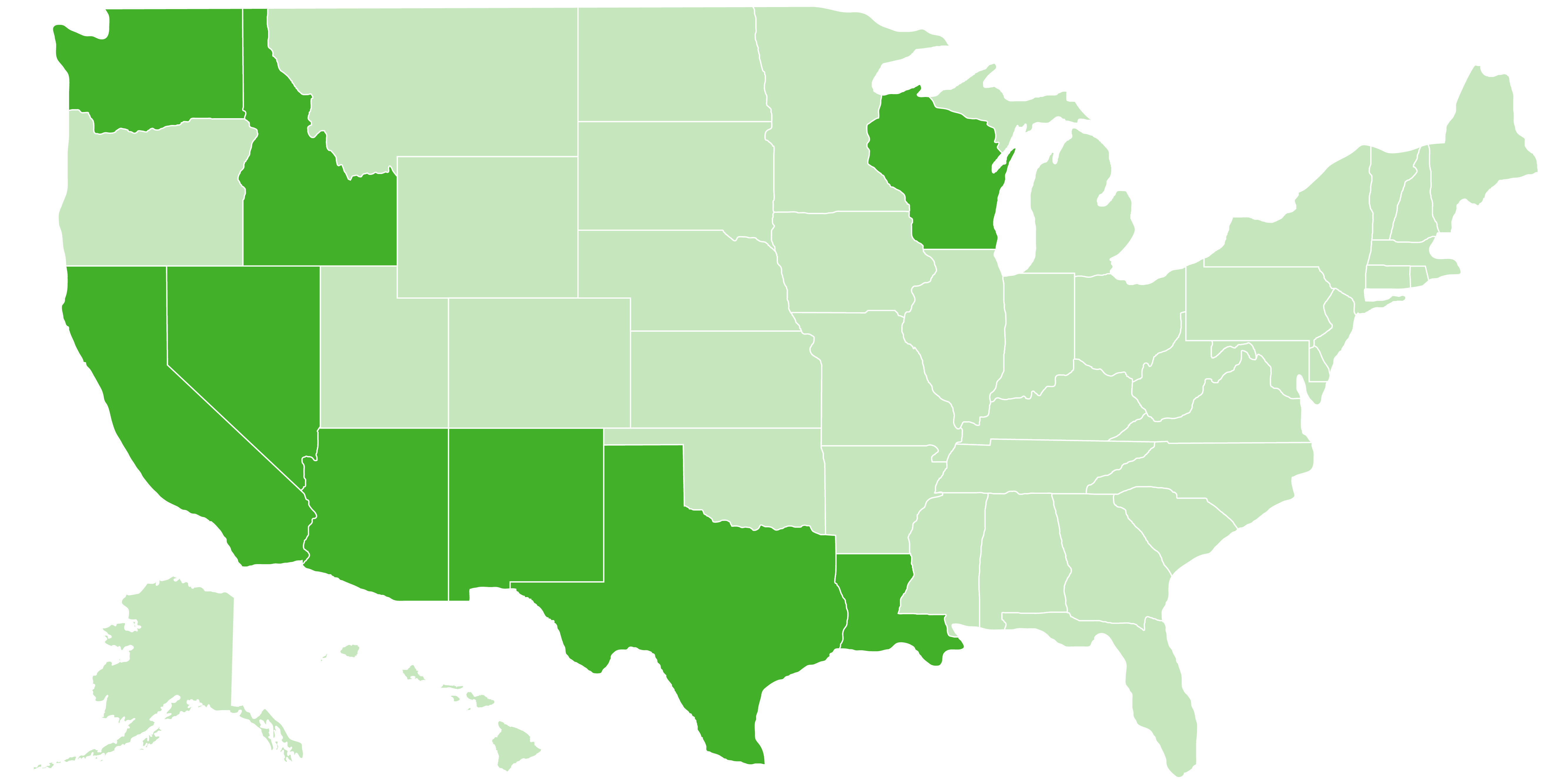

Together, you and your spouse need to designate your beneficiaries. You must also decide when you want them to receive the assets you chose for them, and who would hold them in the meantime. To accompany making this decision, you will also need to check if you live in a community property state. If you do, each spouse owns exactly half of all the assets and income obtained throughout the marriage. Unless overridden by a prenuptial agreement, each spouse can decide what will be ‘their’ half of the estate after their death, and therefore what will happen with that portion of it.

Where you live can dictate how your assets are distributed after death. The states highlighted in dark green represent the community property states.

- Who will you designate as a fiduciary?

When choosing someone to handle your financial affairs in the event you are no longer able to, there are many factors to consider. It’s important that you trust your fiduciary, that they have the time and capabilities, and that they know you and your values well. You may also want to select a backup in case your primary choice is unable to serve when the time comes. Be sure to ask the person if they feel comfortable managing your finances before appointing them.

Explore Employer Health Insurance Coverage and Other Employee Benefits

When your marital status changes, you are taking part in a Qualifying Life Event, which gives you and your spouse a Special Enrollment Period to enroll in or make changes to your employer health plans. Marriage may even qualify you for spousal benefits you didn’t previously have access to.

While health insurance plans often offer a discount for families, you might decide to have each spouse stay on their own health insurance plan. For example, if one spouse has a chronic health condition, it might be cheaper to have one partner on a low-deductible plan and the other on a high-deductible (but lower-cost) plan. If either partner is under age 26 and still on a parent’s plan, you might decide to stay on it until you pass the age limit. As you weigh your choices, be sure to compare the costs of monthly premiums, annual deductibles, out-of-pocket maximums, and copayments with what they would be on a family plan.

Just like having separate insurance plans, a family plan has its pros and cons. If both you and your partner are in good health, you could save money by using a family health insurance plan, which would also reduce the amount of paperwork to be done and ease the record-keeping process of the plan’s coverage. However, if you choose an employer-provided plan and the partner providing the insurance loses their job, both spouses may lose their insurance. Whichever type of health insurance plan you choose, be sure to also check if it includes your own doctor in the network.

Review Your Life Insurance Coverage

Life insurance is an important part of any couple’s financial security, and your coverage is worth revisiting when merging two households together. As a starting point, a good general rule of thumb for calculating life insurance is to maintain an insurance benefit that is 10 to 12 times your annual income. On top of this amount, be sure to consider major debts and sizeable long-term expenses that you are responsible for, like a mortgage or childcare, that could be burdensome to the surviving spouse.

An additional consideration for life insurance could be if you decide to have children. Raising kids can bring their own costs, so consider a term life insurance policy that secures a death benefit and premium amount only for a specified period of time. For example, purchasing a term policy that expires in 20 years could cover your family until your children are mostly independent. Choosing term life insurance can be far less expensive than permanent life insurance, which would last for the duration of your life.

With as exciting of a milestone as marriage is, there are various loose ends that will need to be tied up. Make sure you and your spouse’s futures are protected by working with your Baird Financial Advisor to figure out the best way to plan for your next chapter together.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.