A Young Adult’s Guide to Debt

While ‘debt’ has an underlying negative connotation, its purpose is often positive: to help fund important purchases we wouldn’t otherwise be able to afford, like a house or business equipment. When deciding whether debt is 'good' or 'bad,' it’s best to look at what the loan proceeds were used for. Here are six types of debt and how they can impact your overall financial future.

Mortgages/Home Equity Line of Credit

Purchasing a home is likely the largest expense you will incur throughout your life, but can also be one of your greatest investments. A mortgage is a loan that finances the purchase of a home, land or other type of real estate, and is secured by the property itself. A home equity line of credit (HELOC) is a loan that allows you to borrow against the net value of your house and can be used for any purpose. Mortgages and HELOCs vary in the way they impact you financially – and therefore need to be treated slightly differently.

Is It Good Debt or Bad Debt?

Generally, mortgages are considered a type of good debt. Mortgages offer advantages such as:

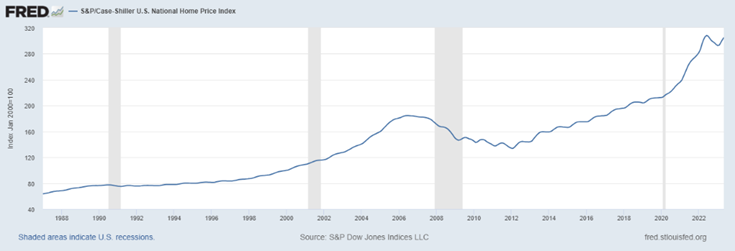

- The potential to build equity: Unlike other big purchases that depreciate over time, the value of your home has the potential to appreciate. When you sell the home, the eventual payout is often much larger than its original expense.

Property values have generally followed an upward trajectory. Source: The Federal Reserve Bank of St. Louis.

- Tax benefits: Tax-filers can deduct the interest on up to $750,000 of mortgage debt (higher for older loans) if they itemize their tax deductions, which reduces the net cost of the debt.

But, a mortgage comes with monthly payments. If you struggle to keep up with those, you can incur late fees, and worse, your credit score can be impacted, which could prevent you from getting the best interest rates the next time you need to apply for a loan.

Like a mortgage, a HELOC can be a good debt – if used to increase the property’s value. Typically, it is used for things like home improvements (a mid-scale remodel can cost anywhere between $20,000 and $70,000) that can be difficult to pay for with cash. And if you do use the HELOC to repair or improve your home, the interest can also be tax-deductible. It’s important to note that the size of a HELOC is based on the difference between a home’s value and the primary mortgage (its net value), and if you just purchased the home, that net value may be zero. If a HELOC is used for expenses that don’t improve the value of your home, such as material items or vacations, it can become a bad debt. It can be tempting to have an open line of credit, but keep in mind that any money you borrow must be paid back eventually.

Most types of debt can be categorized into either a fixed-rate or adjustable-rate debt. Some debts, like mortgages and student loans, allow you to choose between a fixed and adjustable interest rate, while other debts, like HELOCs and personal loans, are almost always chosen for you. A fixed-rate debt is one where the interest rate is constant for the duration of the loan. An adjustable-rate debt might start with a period of a fixed interest rate, but once that period is over, the interest rate can adjust based on a benchmark rate. Adjustable rates are typically lower than fixed rates at the beginning of the loan, but once they adjust, you may be paying much more interest than with a fixed rate loan. An adjustable-rate loan can be best if you’re confident you can pay it off before the rate begins adjusting upward.

Educational Loans

Many post-college students are faced with the responsibility of paying back student loans. While a college degree is often necessary for many career paths, make sure you are managing student loans in a way that benefits your financial situation.

Is It Good Debt or Bad Debt?

Just like mortgages and HELOCs, student loans are a good debt if they are handled the way they are intended to be. When taking out a student loan, it is important to consider:

- The cost of the university: Be sure to research more than just tuition – dorm or rent costs, meal plans and books are all important factors.

- The potential salary of your post-grad career: Make sure the debt you’re taking on is in line with the salary expectations of your career path. Starting your career with large loan payments can make it hard to begin saving for other financial goals, like a home.

- Your repayment plan: Understand how the loan repayment fits into your budget. Fortunately, lenders can offer a variety of payment plans to choose from.

When it comes to federal student loans, one of their largest benefits is that they have the potential to eventually be forgiven and may have multiple repayment plans to select from, depending on the type of federal loan and eligibility. For example, the Public Service Loan Forgiveness Plan can forgive the entire remaining balance of Direct Loans after 120 monthly payments over 10 years for borrowers who work full-time for the government or for a nonprofit organization. The Saving on a Valuable Education (SAVE) Plan (formerly the REPAYE Plan) is the newest income-driven repayment (IDR) plan. Like other IDR plans, the SAVE Plan calculates your monthly payment based on your income and family size. On top of this, federal student loans can also include tax breaks. The Student Loan Interest Deduction is a tax deduction that reduces your taxable income by up to $2,500 per year in student loan interest payments.

When federal loans don’t quite cover the expense of college, private loans can help fill the gap. Although private loans don’t qualify for loan forgiveness programs, they typically have higher borrowing limits, plus the interest on private loans can also qualify for the $2,500 student loan interest tax deduction. Note that private loans may have higher interest rates and less attractive repayment plans compared to federal student loans.

Business Loans

All businesses need capital – and whether it be to start a new business, finance the purchase of inventory or even purchase an existing company, it’s not always in the cards for businesses to pay for those things fully up-front. Because of this, lenders and banks offer businesses loans to provide liquidity, under the expectation that the money will be paid back as scheduled.

Is It Good Debt or Bad Debt?

Similarly to educational loans, business loans are generally a good debt if the business plan surrounding them is sound. An evaluation of the business’s potential use for the loan, along with the terms of the loan, is necessary to determine how helpful the loan will be. Businesses have different needs so luckily, there are different types of loans that may work best for each type of business. To ensure you get the right type of loan, create a strong business plan and research what business loan fits your plan best.

Personal Loans and Credit Cards

Personal loans are common among young adults, and can be used for things like debt consolidation, home improvement projects and emergencies. Credit cards, which act in a similar unsecured manner (meaning they don’t require collateral), are also common and are often used for day-to-day expenses.

Is It Good Debt or Bad Debt?

Personal loans could be good or bad debt. If the loan proceeds are used to finance an important investment, and the repayment fits within your budget, then it’s a good debt. Some benefits of using personal loans include the versatility of what they can be used for, their competitive interest rates and their flexible borrowing limits.

Credit cards also undeniably have their advantages. As we live in an increasingly online world, many retailers are going cashless, and credit cards offer more fraud protection than traditional debit cards. Credit card companies also offer rewards for using their services, and they are helpful in building credit history. So, what’s the catch?

Personal loans and credit cards can go from helpful financial tools to bad debts when they are used indiscriminately. Major risks include:

- Damaging your credit score: You have the potential to start carrying a high credit card balance if you can’t pay your bill in full every month, leading to added interest. And if you fail to make on-time payments on your personal loan, you’re likely to see a decrease in your credit score.

- The temptation to overspend: When cash is tight, using a credit card for purchases can be tempting since the bill won’t be due for maybe several weeks. But if cash is tight now, will it be any better when the bill eventually comes? If you’re not careful, you could end up spending months paying off one night on the town, or one pair of expensive shoes. It’s easy to fall into a trap of making purchases you simply can’t afford.

- Only paying the minimum payment: Although this strategy keeps your account in good standing, an interest charge is still tacked onto the outstanding amount that will be rolled over into your next payment. Paying only the minimum amount on a large balance can mean carrying the debt – and paying interest – for years.

- The lack of benefits compared to other loans: Other types of loans often offer unique financial advantages, like the tax benefits that can accompany a mortgage. Outside of a credit card rewards program (that only encourages more spending), personal loans and credit cards don’t typically offer benefits like these. And another problem – you may not qualify for a personal loan as a young adult who doesn’t have enough credit history.

There’s also a downfall specific to credit cards:

- Credit cards are typically the most expensive form of debt: Since the Federal Reserve started raising interest rates, the average credit card rate is going over 20%, and even higher for those with a bad credit history.

To overcome any of these risks, make sure you are balancing your lifestyle with your means. If you can only pay the minimum payment on your credit cards or loans to achieve your desired lifestyle, you may need to reconsider that lifestyle before it has a devastating impact on your other long-term plans. (Here are some strategies to help get you out from under credit card debt.)

Auto Loans

Depending on your location, purchasing a car may be a necessity. Since cars are such a large expense, taking out loans to finance them is a common debt that many take on.

Is It Good Debt or Bad Debt?

Whether a car loan becomes a good or bad debt is largely based on the borrower’s decision-making. If owning a car is needed to get to work or for another daily commute, a car loan is justifiable – as long as the loan payment still fits within your budget. Choosing to purchase a more expensive car without being sure you can make its monthly payments is not a good way to utilize a car loan. In fact, the larger the down payment, the better, as it reduces the amount you need to borrow, and in turn reduces the amount of interest you will eventually pay.

Medical Debt

Managing medical debt can be especially tricky because so much of it is unplanned for and there is little opportunity to compare pricing.

Is It Good Debt or Bad Debt?

Because medical debt is often a result of an unplanned medical emergency, it’d be difficult to qualify it as “good” or “bad” outright. If the medical debt is due to something like emergency surgery, then the debt may simply be unavoidable. On the other hand, many forms of elective or cosmetic medical treatments can be hard to justify if they cause you to incur a significant debt. To manage medical debt in the best way possible, be sure to review all medical bills and be willing to negotiate with the healthcare provider to set up payment plans. Keep in mind that medical debt is typically a lower priority when it comes to repayment, because it tends to be less harmful to your credit score if you default.

Although each debt may be categorized as ‘good’ or ‘bad,’ these categorizations are not ultimate classifications – if managed poorly, even good debt can be detrimental to your finances. Your Baird Financial Advisor can help you strategize how to use debt in a way that supports your goals and financial plan.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.