November Wealth Strategies

Year-End Tax Planning

Getting ahead of the game when it comes to year-end planning can be pivotal in managing your tax liability. In our November Wealth Strategies Webinar, Senior Tax Strategist Kelsey Clair covers crucial information and tips on everything from charitable contributions to tax loss harvesting.

Kelsey Clair, CPA, CPWA®

Senior Tax Strategist

Applying General Tax Planning Guidelines

When strategizing your year-end tax plan, a general rule of thumb is to accelerate your deductions into the current year and defer your income into next year. By taking deductions in the current year and delaying income until the next one, you can get the advantage of those deductions sooner, while delaying the tax on income to later.

If your filing status or residency is changing, consider the impact that may have on your tax plan. Certain milestone events can change your tax bracket, deductions or eligibility for certain credits, and moving to a different state of residence can influence how you time certain transactions. If moving to a state with a higher income tax rate, you may want to accelerate your income to occur before you move to avoid the higher tax cost in your new residence. The timing of capital gains, Roth conversions and deductions becomes significant in this situation.

Understanding the SECURE 2.0 Act

Unlike the previous SECURE Act that was passed in 2019, the 2.0 Act includes many minor stipulations with a few big-ticket items. One of the main changes that came with the act is the delay of the required minimum distribution age to 73, with an extension to age 75 for those born in 1960 or later. Because of this change, withdrawals from retirement accounts can be deferred, and retirees can potentially stay in a lower tax bracket for longer, while waiting to start their RMDs. Another change with the SECURE 2.0 Act is the opportunity for higher catch-up contributions to a workplace retirement plan. Starting in 2025, people between the ages of 60 and 63 can make catch-up contributions of up to $10,000 annually to their workplace plan, and that amount will also be adjusted for inflation. But, starting in 2026, those who make more than $145,000 must make those catch-up contributions to a Roth account. While this means tax-free growth in the future, it also means there’s no immediate tax benefit for the contribution itself.

Another change to consider is an expansion of the existing qualified charitable distribution rules. In 2023, IRA owners over the age of 70½ can gift up to $50,000 under the QCD rules to either a charitable gift annuity or a charitable remainder trust. Previously, these gifts could only be made directly to a charity.

Looking Ahead at the 2026 Tax Landscape

Since many provisions of the 2017 Tax Cuts and Jobs Act begin to reach their sunset at the end of 2025, it’s a great time to start thinking about what happens next. Notably, potential changes in 2026 include:

- Increased individual income tax rates across most brackets.

- Decreased standard deduction and the itemized deduction phaseout returns.

- The expiration of the $10,000 state and local tax deduction limit.

A key potential change regarding estate planning is the lifetime exemption amount falling by roughly 50% upon expiration of the TCJA. This would lower the threshold for estates to be subject to federal estate taxes. For couples with net worths of below $15 million (or singles at half that amount), this is not likely to cause an issue, but for those over that threshold it may be worth consulting your Financial Advisor to understand what strategies are valuable to consider.

Crafting Tax Strategies

After taking into account the general tax planning guidelines, the SECURE 2.0 Act and the future tax landscape, you can start digging into specific tax strategies that may work for you.

Bunching Itemized Deductions

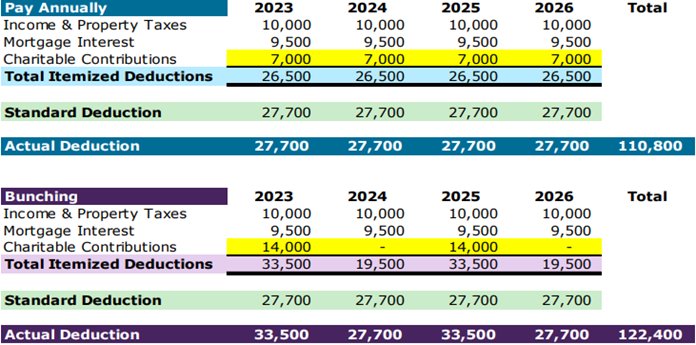

To maximize the tax benefit of deductible expenses, it may be necessary to accelerate or defer your deductions between years. This practice, known as bunching, has a main goal of alternating between taking the standard deduction one tax year and itemizing the next. If your total itemized deductions exceed the standard deduction amount (in 2023, $13,850 for single filers and $27,700 for those married and filing jointly) then it may be best to itemize your deductions. This requires multiyear tax planning to manage your money around the standard deduction – something to consider talking with your Financial Advisor about in order to create multiyear strategies. See the chart below for an example of what bunching could look like:

Making Charitable Contribution Deductions

Giving charitable gifts to a charity of choice can have benefits for both the charity and you. To make the most of your donations, it’s important to familiarize yourself with charitable contribution tax deduction rules. Deductions are only available to taxpayers who itemize and are also limited to a percentage of income before deductions. These adjusted gross income limitations vary based on the type of charity and the type of property that’s donated. If your contribution exceeds the AGI thresholds, the excess will carry forward five years.

When deciding what type of property to donate, keep in mind that long-term appreciated securities have a deduction equal to fair market value and avoid capital gain tax recognition. Short-term appreciated securities, on the other hand, don’t allow you to claim a loss for the difference between the fair market value and cost basis. It’s good to avoid donations of depreciated securities because the unrealized loss will not be deductible. Instead, consider selling the position, deducting the loss and then donating the cash.

In the webinar, Kelsey stated that qualified charitable distributions are one of the most efficient ways to give to a charity. Once you reach age 70½, you become eligible to utilize QCDs by making direct gifts from your IRA to a charity. The withdrawal is not considered taxable, and can count towards your RMD for the year, allowing you meet your required withdrawal but avoid the tax cost. On top of this, QCDs keep your AGI low, helping avoid higher Medicare premiums as well as the 3.8% tax on net investment income, while also making it easier to deduct medical expenses.

Converting to a Roth IRA

Roth IRA conversions are not for everyone, but they are an important choice to consider. Here are a few factors to keep in mind when choosing whether to convert to a Roth IRA:

- A Roth conversion may be harder to justify if you’re using IRA funds to pay the tax cost.

- It’s best to convert to a Roth IRA in a year when your marginal tax rate is lower than your projected tax rate when taking IRA withdrawals.

- The longer you delay accessing the funds inside the Roth after conversion, the more effective the conversion will be.

If you do decide that converting to a Roth IRA is for you, funds can be withdrawn from a Traditional IRA and redeposited into a Roth IRA. This can be done in multiple ways, which Kelsey goes into depth on in the webinar. It’s also important to note that converting to a Roth IRA can trigger other costs, such as higher Medicare premiums or higher investment taxes. Recharacterization, or reclassifying a contribution to a traditional or Roth IRA as having been made to the other type of account, is no longer an option either, so before you decide to convert consult your Financial Advisor to discuss the strategy.

Making Tax Payments

To avoid penalties due to underpayment of estimated taxes, be sure to pay in the required amount throughout 2023. To do so, pay in the lesser of either 90% of your current year liability (this may be difficult to predict), or 100% of your prior year liability (or 110% if your 2022 AGI was greater than $150,000.) It’s important to ensure you have enough liquidity to cover any remaining tax liability in April. States typically follow similar rules, but be sure to verify the treatment in your state. A few basic ways to make payments into your tax account for a given year include:

- Applying your prior year’s tax refund.

- Withholding from your regular paycheck.

- Withholding from your IRA (or other retirement account) distributions.

- Quarterly estimated tax payments.

Knowing Your Deadlines

The effort that goes into tax planning can’t be rewarded without following the tax deadlines. Here’s a list of deadlines to remember as you head into the end of 2023:

- December 31, 2023: Deadline for your 2023 RMD if you turned 73 in 2023 or earlier, deadline for employer retirement plan contributions and deadline for charitable contributions.

- January 16, 2024: Deadline for the 2023 fourth-quarter federal estimated tax payment.

- April 1, 2024: Deadline for 2023 RMD from employer plans if you’re age 73 and retired in 2023.

- April 15, 2024: Deadline to contribute to IRA, Roth IRA and HSA for 2023. Deadline to file 2023 tax return or extension.

To listen more in-depth about these strategies for year-end tax planning, check out November’s Wealth Strategies video. If you have questions or want to have a discussion on your personal situation, don’t hesitate to reach out to your Baird Financial Advisor. Our entire series of Wealth Strategies webinars is available online.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.