2024 Market, Policy & Planning Outlook

As we approach the end of the year, it is time to reflect and prepare for the year to come in Baird’s 2024 Market, Policy, and Planning Outlook video series. Market and policy experts Jason Trennert and Dan Clifton at Strategas, a Baird Company, share their perspectives on the market, economy and policy landscape for 2024. And to put these insights into context for your plan, Heather Osborn and Tim Steffen highlight key strategies to consider for the year to come.

Market Outlook

Jason Trennert

Chairman and CEO of Strategas

What are your odds for recession in 2024?

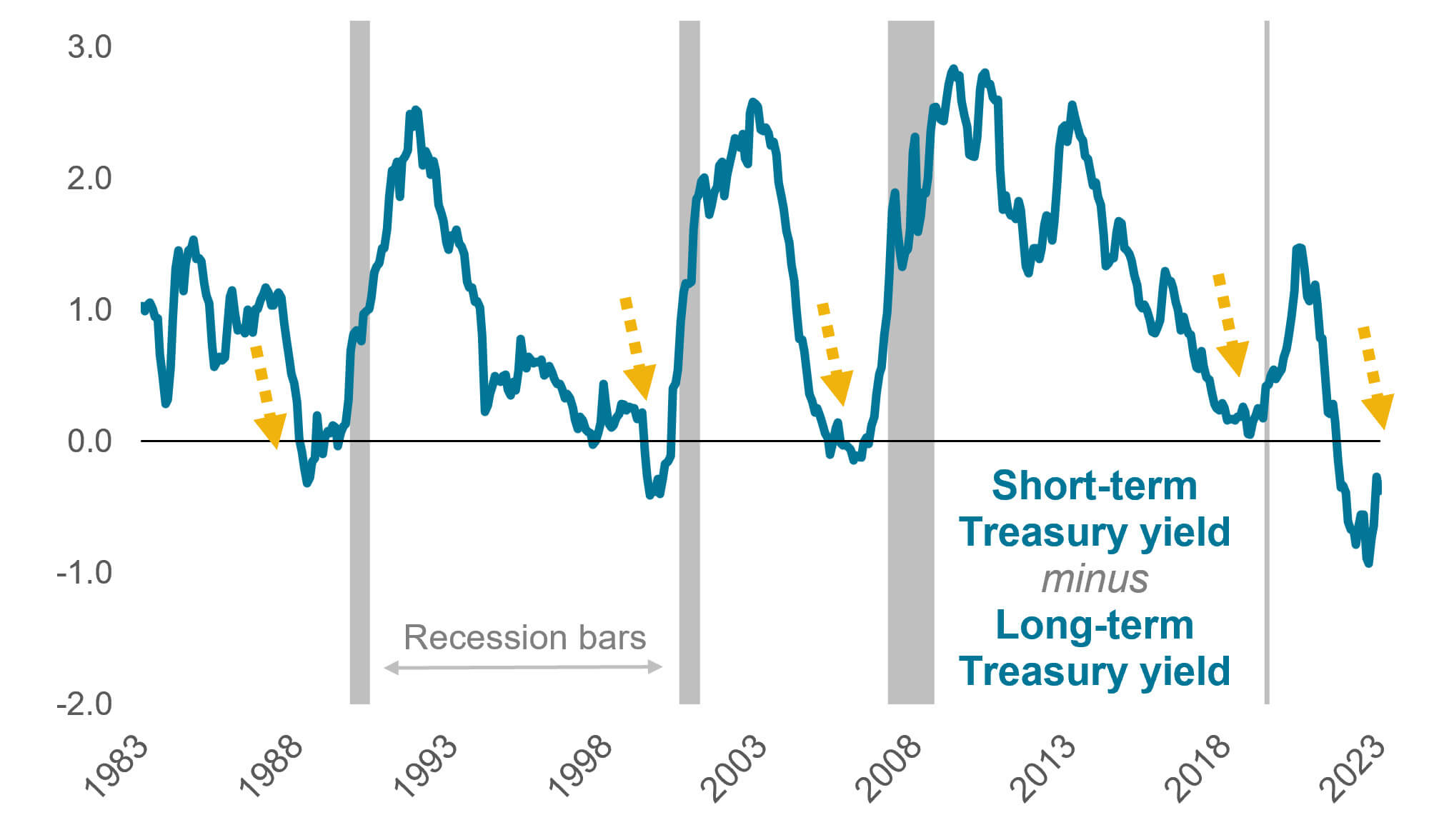

We're using odds of about 50%. And while that might sound like a rather neutral answer, it’s only about 15% odds in a typical year, so we are quite a bit above average. We feel this way in part because the Treasury yield curve (the difference between long-term and short-term interest rates) remains inverted as money growth slows (an inverted curve reflects investors' expectations for interest rates to fall in the near future, something typically associated with economic downturn). However, if we do get a recession, I’m not sure it will be particularly deep. And that's in part because it's an election year and because we are running extensive budget deficits to ease some economic pain. So, we think the chances of recession happening are elevated, but the chances of a deep recession remain pretty low.

Yield curve inversion often precedes recession.

What does that mean for the stock market?

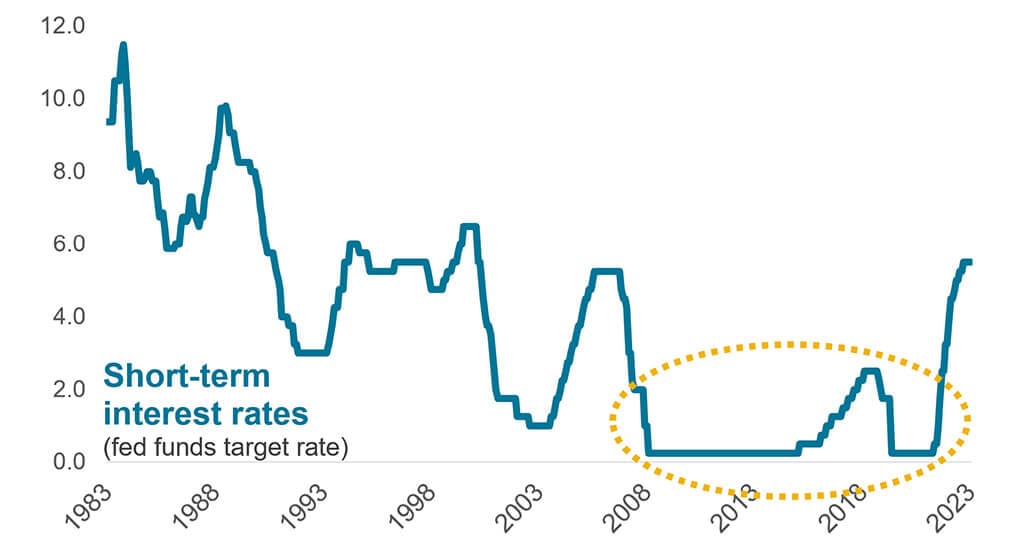

I think it means that investors will want to stick with high quality companies that can generate cash and earnings without relying on the kindness of strangers for their capital needs. From 2009 through 2021 the Federal Reserve kept interest rates artificially low, which allowed a lot of marginal companies to get funded and ultimately led to very stable economy. But inflation has changed that. The Fed has now tightened monetary conditions significantly (via higher interest rates and quantitative tightening), and in the end, that means that higher quality companies are going to have a better access to capital and a cheaper cost of capital. It also means that weaker companies may not make it, or may need to be consolidated into other companies in order to survive. We still are very much of the view that the name of the game is buying high quality companies that generate their own cash flows and profits.

The era of artificially low interest rates is over.

What is something in the markets that’s underdiscussed today?

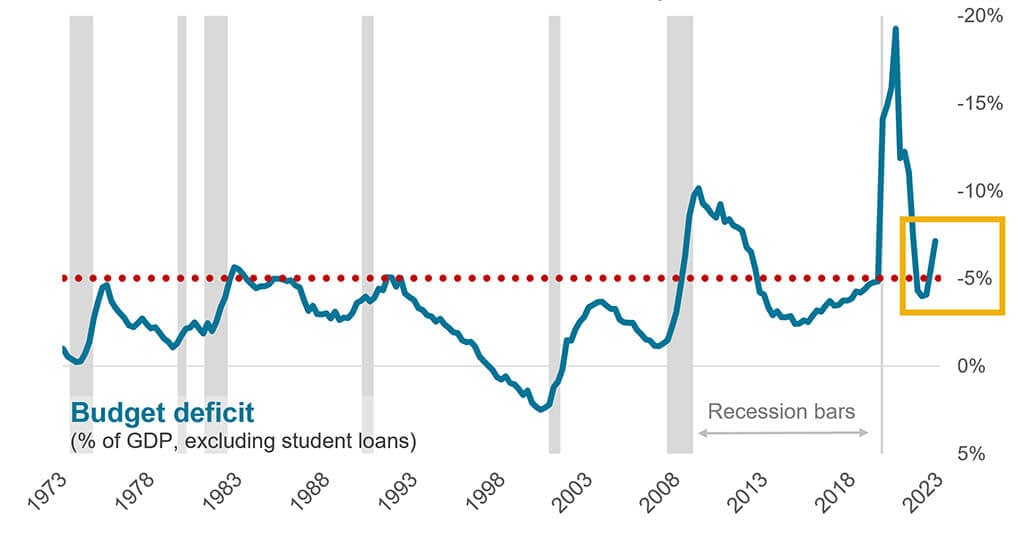

One thing that's not being discussed enough is the fact that we are running budget deficits around 6% of GDP at a time of basically full employment. Something like that has never really happened in peacetime and with an unemployment rate under 7% (it is roughly 4% today). Fiscal spending tends to ramp up when unemployment spikes (e.g., stimulus for a weakening economy), so the deficits could widen further in the event of a recession. There’s also a chance that even if inflation declines next year, interest rates remain elevated simply because the federal government has to issue a lot more debt. Next year is also an election year, and whichever party is in power – Democrat or Republican – tends to grease the skids for their own re-election by spending more money than they have. We would not be surprised to see that again in 2024.

Deficits beyond -5% are typically associated with recession, but that's not the case today.

Policy Outlook

Dan Clifton

Partner and Head of Policy Research at Strategas

What is the global political environment for 2024 and how might that impact fiscal policy?

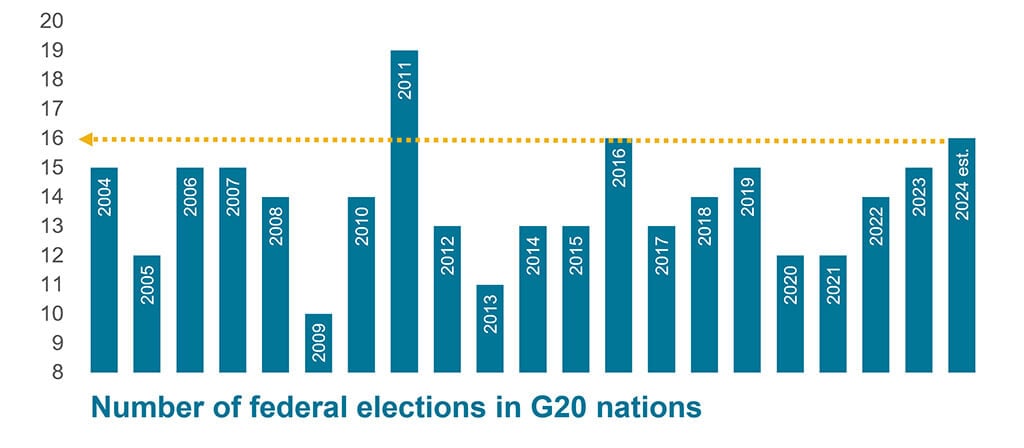

In 2024, about 40% of the world's economy will vote for a president or leader of their country, which is on the high end of the typical range. In the second half of 2023, we’ve noticed that incumbent leaders have lost elections in countries with slower economic growth. And so, as the 2024 elections ramp, there's going to be a lot of pressure to increase fiscal spending and/or to ease monetary policy (e.g., lower interest rates) to help incumbents’ odds.

Globally, 2024 is a big year for elections.

We're already seeing this in the United States, where the Treasury department is increasingly funding the government with short-term Treasuries to minimize liquidity drain. Expectations for easier monetary policy are building, with investors now expecting over 100 basis points, or 1 percentage point, of interest rate cuts by the end of 2024. Additionally, Congress will look at doing a bipartisan tax bill that would expand the Child Tax Credit and reinstate some expired business deductions. The President has other levers available. We'll see the implementation of the Bipartisan Infrastructure bill, the Inflation Reduction Act, and the CHIPS & Science Act, which would cause spending to dramatically ramp up in the 2024-26 window. We could also see a resumption of business tax credits through the Employee Retention Credit, and student loan assistance is scheduled to come into effect on July 1, 2024. Ultimately, policymakers have tools available to them, even if partisan polarization starts to block out any meaningful new legislative ideas in 2024.

How does the U.S. stock market typically act in a presidential election year?

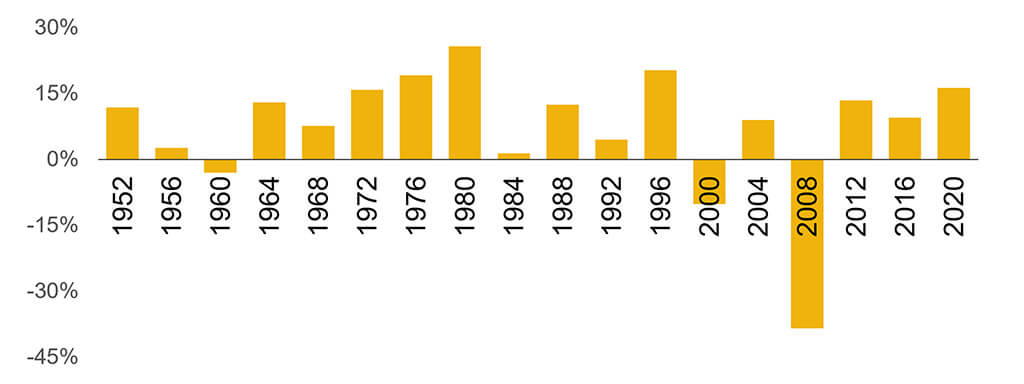

Surprisingly, presidential election years have been very good for stocks. I know there's a tendency amongst investors to get worried about the policy uncertainty that's sure to creep up into the year (and it will creep up), but from a stock market perspective, it hasn't had much of an impact. Going back to 1952, the stock market has only declined three times in a presidential election year: 1960, 2000, and 2008. And what's interesting is that those were all open presidential election years (there was no incumbent running). When you look at reelection years, like 2024, the S&P 500 has not declined since 1948.

S&P 500 performance has been positive in most presidential election years since 1952.

Our belief is that this happens because presidents like to get reelected. They understand that the economy has an outsized impact on their chances so they try to prime the economic pump ahead of the election. Unsurprisingly, stocks have responded favorably to this kind of activity throughout history. In fact, every president that has avoided a recession two years before the election has gone on to win reelection, and every president who had a recession in those two years went on to lose. So, it's very critical for the incumbent to avoid a recession, and they are therefore likely to use all the tools available to them.

Planning Outlook

Heather Osborn

Director of Wealth Planning

Tim Steffen

Director of Advanced Planning

Planning Takeaway #1: What We’re Watching in 2024

While the last year has been fairly stable from a legislative standpoint – and we expect that to continue to be the case for most of 2024 as attention will be on next fall’s Presidential election – it doesn’t mean it will be completely quiet next year. Here’s a few things to focus on in the year ahead:

- New rule for 529s rolling into a Roth IRA. In 2024, taxpayers will have their first chance to take advantage of a new rule that allows 529 college savings accounts to be rolled into a Roth IRA. It’s a limited opportunity, but one that will be frequently discussed.

- Inflation adjustments for tax numbers. Like we saw in 2023, many of our key tax numbers will see substantial increases. This means more income taxed at lower rates, a larger standard deduction, and even the annual gift tax exclusion will increase to $18,000 – the third straight year that number has gone up.

- Awaiting guidance for beneficiaries of inherited retirement accounts. We’re also still waiting for final guidance from the IRS on how and when beneficiaries of inherited retirement accounts will be required to withdraw those assets.

- Closing window for provisions of the Tax Cuts and Jobs Act. A lot of our planning discussions will be focused on the expiration of many provisions of the Tax Cuts and Jobs Act – something that’s been on our radar for years, but is now beginning to become a reality.

Planning Takeaway #2: A Closing Window for Estate Tax Planning

The Tax Cuts and Jobs Act is a large tax bill that was passed back in 2017, and brought significant changes to our income and estate tax systems. Many of the provisions are set to expire after 2025, and so the window to plan around those changes is beginning to close. Among the many things that may change after 2025, we’re particularly focused on changes to the estate tax system:

- The estate tax exemption will go up again in 2024 to over $13.6 million, but it could fall to less than half of that in 2026.

- While that exemption will still be enough for the vast majority of households to avoid estate tax, couples with a net worth over roughly $15 million – or singles at half that – should be looking at ways to take advantage of the current exemption before it goes away.

Planning Takeaway #3: Key Actions for 2024

Many planning opportunities begin with the fundamentals. That means starting with your personal balance sheet, reviewing not only your financial accounts, but also harder-to-value assets like real estate, a small business or even a unique collection you’ve built over the years.

- Understanding the value of these assets, how they’re titled, and how you’d like to see them pass to the next generation is an important part of any planning discussion.

- A good plan also includes a review of your income, which might include exploring ways to manage your tax liability today or ensuring you have your income sources lined up for retirement.

- This extends even further into things like building your emergency savings fund, and reviewing insurance coverage, all to help protect you in the event of a financial or health crisis.

- And don’t forget to consider things like supporting your children or grandchildren as they head off to college, or charitable causes that are most important to you.

Planning Takeaway #4: Don’t Front Run Policy Changes

While you should be aware of outside forces that could influence your plan, you also need to consider when to react to them, and when to ignore them. This will be especially true with the upcoming election. There will be lots of noise from candidates about potential policy changes that could affect your retirement, estate or tax plan. While it can be tempting to react in anticipation of a law change, it may result in a bit of buyer’s remorse if those changes don’t happen exactly as intended. Much like we tell clients when it comes to investing, we have to be careful about overreacting to the news.

Planning Takeaway #5: Partner with Your Baird Financial Advisor

Remember that there are things you control, and things you can’t. Spending your time and energy on the things you can control will make it easier to withstand the headwinds that may come. The best way to do this is by having a team of advisors supporting you in all your financial needs, particularly engaging with your Baird Financial Advisor.

Each of our Baird advisors is backed by specialists in tax planning, investment management, estate planning and more to help you make the most of your plan. And, because we’re employee-owned, we can focus on the long-term, offering multigenerational planning expertise in areas like trust services, legacy and family wealth and business-owner solutions.

As we begin to look forward to 2024, use this time to look forward to the challenges and opportunities that lie ahead of you, making sure you’ve put yourself in the best position to react to whatever may come your way.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.