Planning for a Timely Wealth Transfer Opportunity

You may have heard talk recently about some significant tax changes possibly taking effect in a couple of years. Baird’s Director of Advanced Planning Tim Steffen breaks down the background of these changes, what the changes may include, who is most likely to be impacted, and how to prepare.

The Tax Cuts and Jobs Act (TCJA) Impact on Estate Tax Planning

In 2017, Congress passed a series of law changes that primarily focused on changes to how income for individuals and businesses is taxed. The bill also included provisions that expanded the lifetime gift & estate tax exemption, which significantly reduced the number of people who would be subject to estate tax at their death.

What are the Federal Estate Tax and Lifetime Exemption?

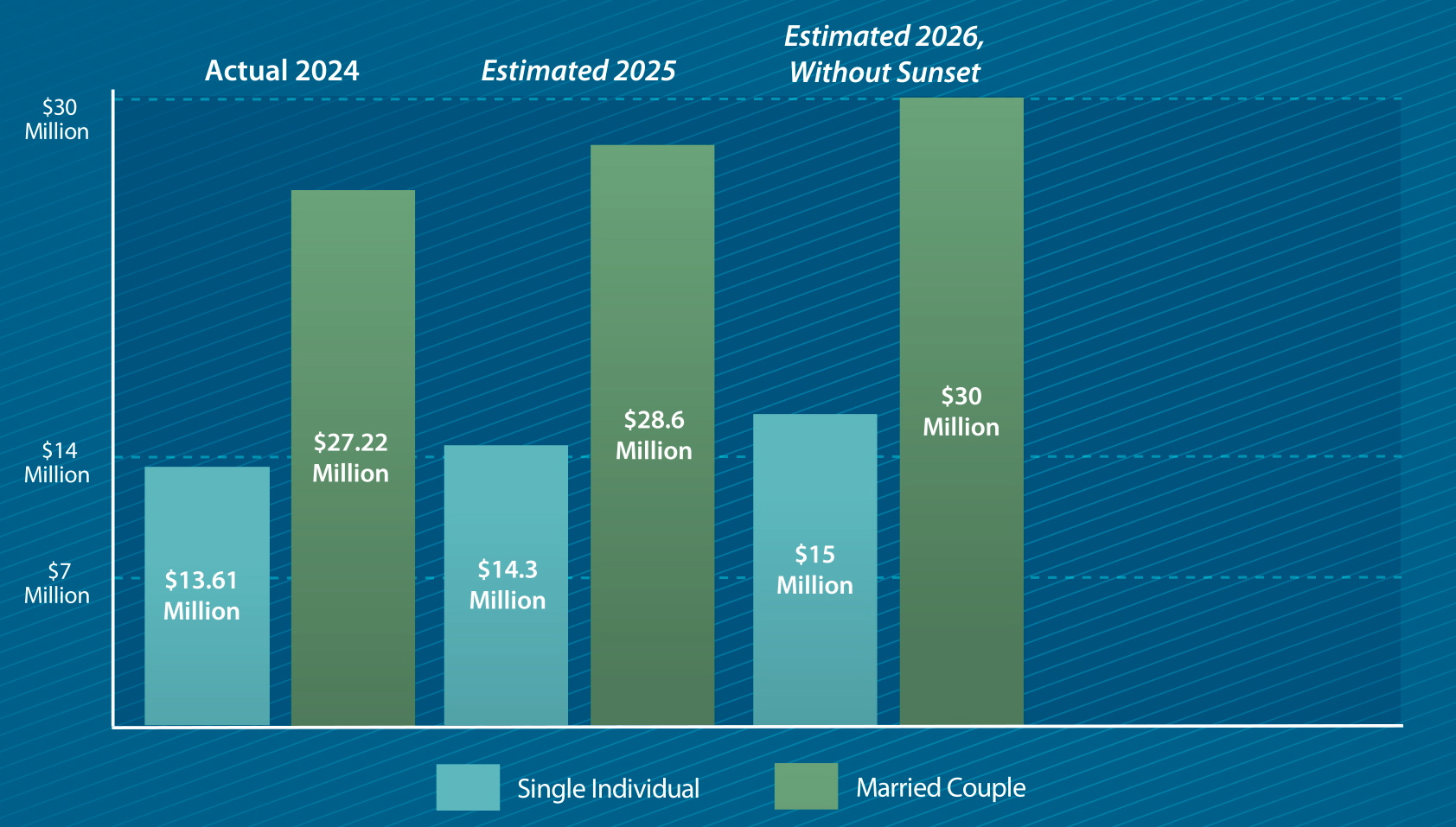

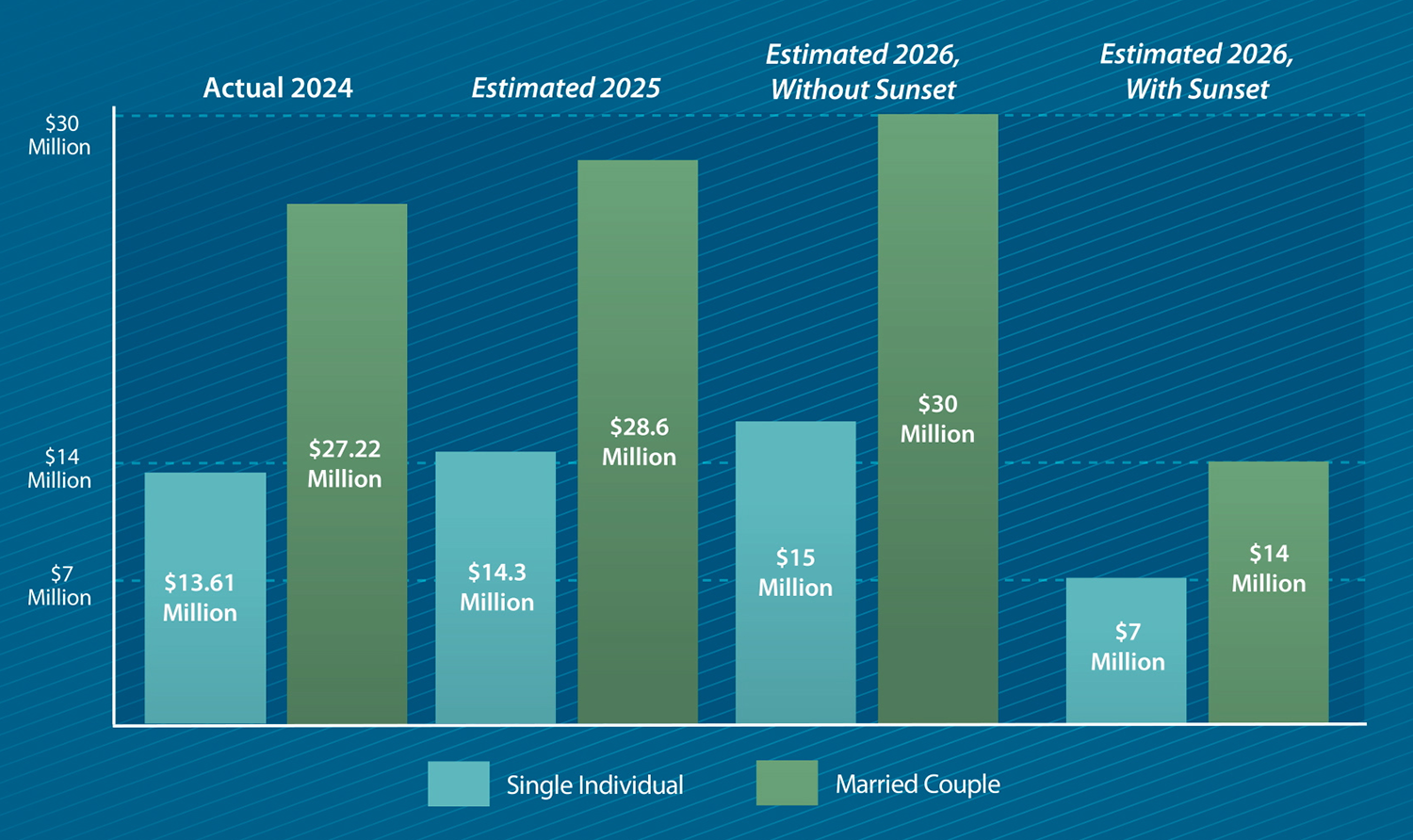

At your death, the federal government imposes a tax on the value of your estate. Today, that tax rate is 40%, but any assets that transfer to your spouse or to charity are exempt from that tax. There is also the lifetime exemption, which is an amount that can be gifted during your life or passed at your death to any other heirs without being taxed. For 2024, that amount is $13.61 million per individual, or over $27 million for a married couple. With inflation adjustments over the next couple of years, that amount is expected to reach roughly $15 million per person by 2026, or $30 million for a couple.

How long will this increased exemption be in place?

This increased estate tax exemption from the TCJA is set to sunset at the end of 2025. In 2026, that exemption amount would fall to less than half, with an exemption limit closer to $7 million per person, or $14 million for a married couple. As a result of this reduction, a single individual could end up paying more than $3 million in additional estate tax, and a married couple could pay more than $6 million extra.

Is there any chance the exemption could change?

If there is one thing to know about taxes, it’s that there is no such thing as a permanent tax law. Any law can change at any time based on who is in control in Washington. So while the current plan is that the estate exemption will sunset after 2025, there’s no guarantee that it will. It is possible that Congress decides to leave the current exemption in place, or they could decide to set it at a level between the current and forecasted amounts. With the upcoming Presidential election and the possibility of entirely new leadership in Washington, it is impossible to predict where this might land. Because of this uncertainty, our planning in this area varies across three scenarios:

What is the potential impact of the sunset of the increased lifetime exemption amount?

| Household | Potential Impact of Sunset | Need for Planning |

| Married couple with a net worth below $14 million* |

|

|

|

Married couple with a net worth between $14 and $30 million* |

|

|

|

Married couple with a net worth over $30 million* |

|

|

* For married couples. Single households would be half this amount.

Why is planning for the TCJA sunset essential now?

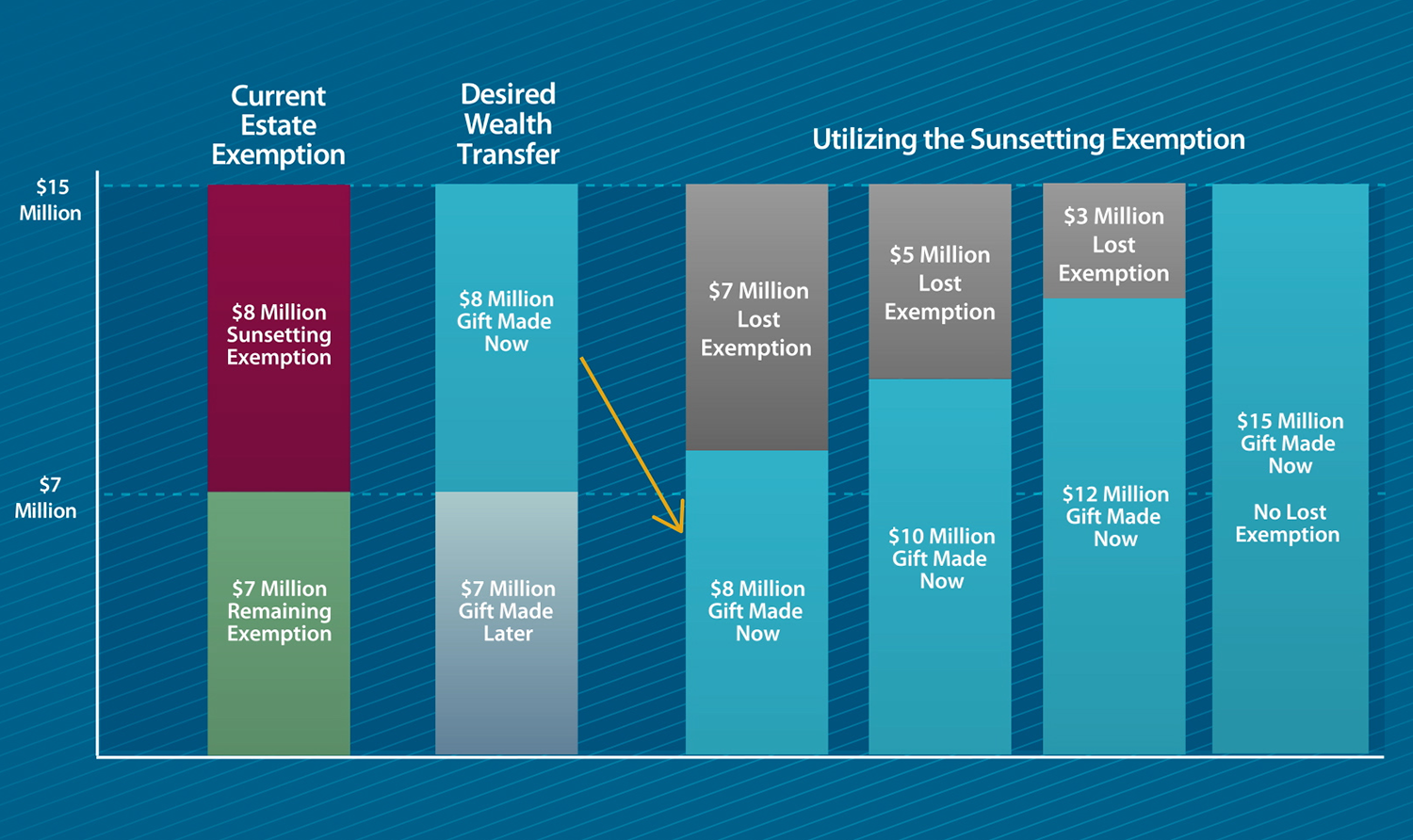

Another reason why planning around this potential sunset is so essential is what it would require to take advantage of this higher exemption amount. While you may assume that you can apply gifts to the increased estate tax exemption amount before it goes away (saving the rest of your exemption for later in life) the gift and estate tax rules do not allow you to do that.

Instead, the transfers you make today are first allocated to whatever exemption is in place at your death. If lifetime gifts do not exceed that amount, the sunset is lost. If your lifetime transfers exceed that amount, then excess gifts can be used against the expired amount, but only if they occur before the sunsetting happens. In other words, to take advantage of the additional $8 million of estate tax exemption that might sunset after 2025, you first must transfer out the $7 million of exemption that would remain after the sunset.

This is a significant transaction to consider that requires a fair amount of planning in partnership with your Baird Financial Advisor. And while 2026 may feels like a long way out, starting the planning now will give you the most time to consider your options. Some planning strategies, like annual gifting or purchasing life insurance, may be easier to implement. Other strategies, like advanced trust planning using a Spousal Lifetime Access Trust (SLAT), or perhaps a transfer of a business that could require an independent valuation, can be more involved and take more time to implement.

Connect with your Baird Financial Advisor

Your planning team at Baird is ready to help. Your Baird Financial Advisor has access to resources and specialists like our advanced estate and wealth strategy teams, trust strategists, and business owner solutions group to discuss and analyze the options available to you. And by working with your other legal and tax advisors, we can help develop a plan that is best suited to your situation.

Whether you are someone who is facing potential estate tax liability now or in the future, or if you just need to review your existing estate plan to ensure it still meets your family’s needs, please know your Baird advisor and our team of planning specialists are ready to help.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.

1https://dqydj.com/net-worth-percentiles/