How To Pay for Long-Term Care

Six ways to make sure you’ll be living the life you want after you retire with the reassurance of long-term care.

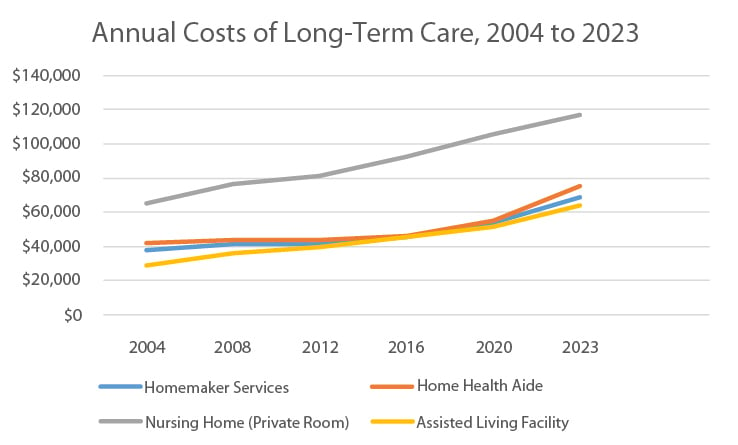

While we all hope to live independently for years into retirement, chances are at some point we will need help with such basic activities like eating, bathing or walking. That kind of care, known as long-term care (LTC), is an expense that needs to be accounted for in your retirement planning: It’s prevalent (two-thirds of Americans will require long-term care at some point in their lives), it’s increasingly expensive, and it’s largely not covered by Medicare.

As more and more baby boomers enter retirement, the demand -- and consequently the costs -- of long-term care will continue to skyrocket. Source: Genworth Cost of Care Survey, 2023

Long-term care will always have a cost, but you have options when it comes to how you cover it – be it cash, equity in your home, or insurance. Here are six strategies to consider when planning for long-term care.

Standalone Long-Term Care Insurance

One option is to purchase a standalone policy from an insurance provider. These policies cover expenses related to nursing home care, assisted living facilities and in-home care.

- Advantages: This is potentially one of your more affordable options and can keep you from having to sell your assets to cover extended care. These policies typically offer inflation protection to help insulate you from the rise in healthcare costs over time, and you can use funds saved in a Health Savings Account to pay some or all of the premiums.

- Disadvantages: Premiums are subject to increases by the insurance provider – and with increasing demand from an aging population, advancements in medical technology and inflation, the costs of long-term care are expected to continue to rise. In addition, standalone long-term care insurance doesn’t have a death benefit and tends to be use-it-or-lose-it: You don’t get your premium refunded if you end up not needing care.

Life Insurance With a Long-Term Care Rider

By adding a long-term care rider to your life insurance policy, you can receive your traditional life insurance benefits plus access the death benefit for long-term care expenses. It provides for both death benefits and long-term care coverage in the same policy.

- Advantages: This option works well if you want flexibility, giving you access to care if you need it while still providing for your loved ones with traditional life insurance in case of your death. Of all the long-term care insurance policies available, this option provides the largest death benefit with a relatively low premium cost.

- Disadvantages: Tapping into your policy’s long-term care benefits reduces your death benefit accordingly, meaning your loved ones would likely receive less upon your death. This option also doesn’t have the inflation protection benefits of a standalone policy and may not have an option of refunding premiums if you don’t require the care.

Asset-Based Hybrid Policies

If you object to paying a premium for care you might not use, you still have an insurance option. A “hybrid” life insurance policy pays for long-term care, but also provides a death benefit in the event care isn’t needed.

- Advantages: Unlike a standalone long-term care policy, a hybrid product offers a fixed premium that isn’t subject to rate hikes, and you have the option of paying in one lump sum or premiums over time. It may also build cash value, and most offer a partial or full return of your premium should you decide to cancel the policy. There is also flexibility in getting a hybrid policy: if you have a life insurance policy that no longer suits your needs, you may be able to exchange it tax-free for an asset-based hybrid long-term policy through what’s known as a 1035 exchange.

- Disadvantages: The hybrid nature of these products limits their upside too. For example, if you own your own business, you won’t be able to deduct the full premium on your taxes – only the portion that goes toward the long-term care coverage. In addition, hybrid policies are generally more expensive than standalone long-term care policies, and if you tap into the policy to pay for care, you reduce the death benefit for your loved ones.

Annuities That Provide Long-Term Care Benefits

Life insurance policies aren’t the only solutions that allow for a long-term care rider – you can do the same with annuities. Although limited, there are some carriers that offer an annuity that has a long-term care rider.

- Advantages: This option offers a great deal of flexibility when you receive long-term care payments (monthly or all at once) and how those healthcare expenses are paid (as you go or as reimbursements for payments already made). If you already have a health issue, you might find it easier to qualify for an annuity with a long-term care rider than for a separate insurance policy.

- Disadvantages: Annuity contracts can be complicated and are not suitable for every investor. They can also require a significant financial investment upfront, especially if the insurance company determines you are likely to require this kind of care. This option also lacks many of the benefits mentioned previously, like inflation protection or tax benefits for business owners.

Home Equity

If you want to avoid insurance products altogether, or if you are considered uninsurable, you might choose to use the equity built up in your home to pay for long-term care through either a reverse mortgage or a home equity line of credit (HELOC).

- Advantages: Both a HELOC and some types of reverse mortgages offer homeowners access to cash, and at little to no expense until you actually need the funds. This can provide peace of mind, but without having to worry about incurring interest on a loan – all while still maintaining ownership of your home.

- Disadvantages: Both options could fundamentally impact your financial security in retirement. Using a HELOC to pay for long-term care introduces a regular (and potentially unplanned) payment with interest into your budget, and should you default on this loan, your lender might choose to foreclose on your home. A reverse mortgage doesn’t have a monthly payment for as long as you live in your home, but there can be substantial costs involved, such as loan origination and interest payments (if you were to move), and your debt increases over time due to the interest on the loan. Also, a reverse mortgage requires you to live in your home: If you require nursing home care for more than a year, for example, you may be found in violation of the loan and be required to sell the house or pay back the reverse mortgage.

Cash

The option that gives you the greatest control is using your own personal savings, investments, and assets to cover potential long-term care expenses.

- Advantages: This option provides the greatest flexibility – you have no upfront costs, no limitations on benefits, and no policy conditions to be concerned with. If you have fully funded your future, you can decide exactly what your LTC benefits look like.

- Disadvantages: Funding your own long-term care requires a great deal of planning and resources and is not a realistic option for most. If you require more care than you have budgeted for – or if care costs have risen more than you’ve anticipated – your care and options might be limited. It also might require you to sell investments quickly and without much warning, which could have a negative impact on your taxes.

There are always many possibilities to consider when it comes to saving for your future, and you should be as prepared as you can be for any unknowns. Your first step should be sitting down with your Baird Financial Advisor, who can help you determine the right strategies for funding your potential long-term care.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.