The Ultimate Investing Hack

There are lots of reasons why millennials and Gen Z might feel pessimistic about the future – but don’t let that pessimism interfere with the opportunity to build long-term wealth.

There is a popular meme making the rounds on social media with the caption, “Millennials chilling, watching their 173rd historical event and wondering if they should make their car payment.” It’s a joke, of course, but millennials know there is a kernel of truth in it. A lot has happened in the last 40 years that might make someone who grew up in a time of political, financial and global uncertainty reluctant to take risks with their income. And it’s not just millennials – Gen Z is following suit.

The Human Flourishing Lab recently asked a sample of Americans about their hopefulness for the future. One notable takeaway was that among all age cohorts, those age 18 to 29 were the least hopeful about their own futures and the futures of their families. And that shows in their investment choices: A 2023 financial industry study found that millennial investors (the youngest group included) had the highest percentage of their portfolios in fixed income and the lowest percentage in equities compared to older generations. This makes some sense: Younger generations are disproportionately overburdened with student loans and an increasingly expensive housing market. However, letting that apathy inhibit your willingness to save and invest for the long-term could get in the way of building the nest egg you’ll eventually need.

Regardless of how you might feel about the state of the economy, the path to building long-term wealth still exists. And while there is an entire industry of soothsayers promoting get-rich-quick hacks and investments with high upside and no risk, the ultimate investing hack is actually a much simpler proposition: Invest as early and often as you can and let compound interest do the rest.

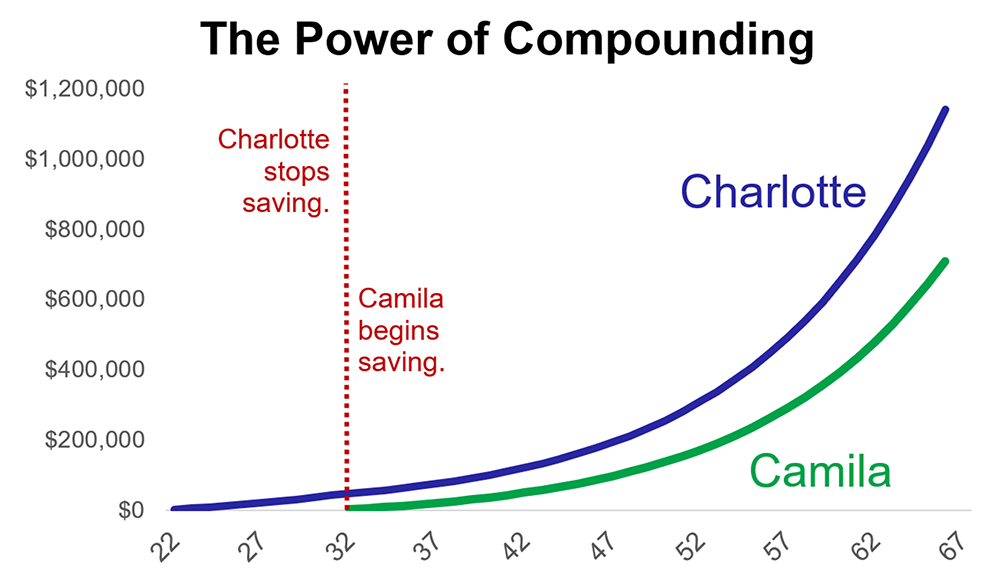

But getting started as early as possible is critical. Consider two investors, Charlotte and Camila:

- Starting at age 22, Charlotte invests $2,500 per year into a broad stock market portfolio that earns the S&P 500’s long-term average return (roughly 10%). She stops investing at age 32, contributing a total of $25,000, and lets the savings compound in the same portfolio until retirement.

- Camila gets a later start, but at age 32 decides to do the same thing – investing $2,500 annually into the exact same portfolio. Only Camila decides that she will invest the $2,500 annually until retirement – ultimately contributing $87,500 over 35 years.

So, who ends up in a better position by retirement? Despite Camila saving 3.5× the amount Charlotte did, Charlotte retires with $1.14 million compared to Camila’s $710,000. While Camila was a more diligent saver, Charlotte’s head start allowed her savings to compound for a longer period of time.

Setting aside $2,500 a year might feel out of reach for some people, but the concept works at any scale. Investing also doesn't have to compromise your weekly budget or trade off indulgences, like the oft-mentioned coffee run or avocado toast. Instead, consider when you get a bonus at work, clock overtime or even get a generous tax return: Take that cash and invest a portion of it. It may not seem like a lot at first, but the beauty of compounding is that small savings today can grow exponentially by retirement.

When it comes to investing, there is never a “right” time. The U.S. economy and stock market have endured wars, pandemics, inflation and more over the last century, and yet the long-term trend of the stock market remains up and to the right, despite the increasingly negative news cycle. We’ve observed that a rational, long-term optimism has been rewarded greatly over time, and yet it has never been harder to take the long view.

The other thing to remember is that stocks aren’t just nameless, faceless certificates. Think of investing in stocks as buying a stake in the collective human capital of the world’s best companies – history shows us that stock prices rise over time because companies continue to compete, innovate and grow. And, by investing in these enterprises, you naturally counteract the negative impacts of inflation on your wealth. In other words, purchasing power goes down as inflation goes up, and investing in stocks is one of the best ways to offset this – ultimately helping you preserve and grow your true, inflation-adjusted wealth.

Millennials have seen and been through a lot, leaving them understandably cautious, but it would be a mistake to let those feelings inhibit your willingness to save and invest in stocks for the long term. Income and “safety” feel great in the moment, especially in uncertain times, but that safety comes at the expense of a far more existential risk – that your portfolio won’t keep up with inflation and grant you the nest egg you need for the life you want to live.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.