In the Markets Now: Labor Day Labor Market Update

As we do every Fall, we are taking the Labor Day holiday as an opportunity to look at some key indicators in the U.S. job market, the health of which will be critical for how the coming year develops.

A Quick Run-Through of the U.S. Job Market

The most important story in the U.S. economy is the transition from a tight labor market to a looser one. A tight labor market – too few workers, too much demand – puts upward pressure on wages, and, usually, consumer prices. And while the labor market was far from the only source of our recent inflation scare, the Federal Reserve still identified wage pressure as a key catalyst and responded by raising interest rates. That largely worked. Job creation has moderated, wage growth is falling, and, critically, inflation seems under control. But now, the shoe is on the other foot. If the labor market loosens too much under the weight of high rates, unemployment (and recession odds) rise. We examine this precarious balance below.

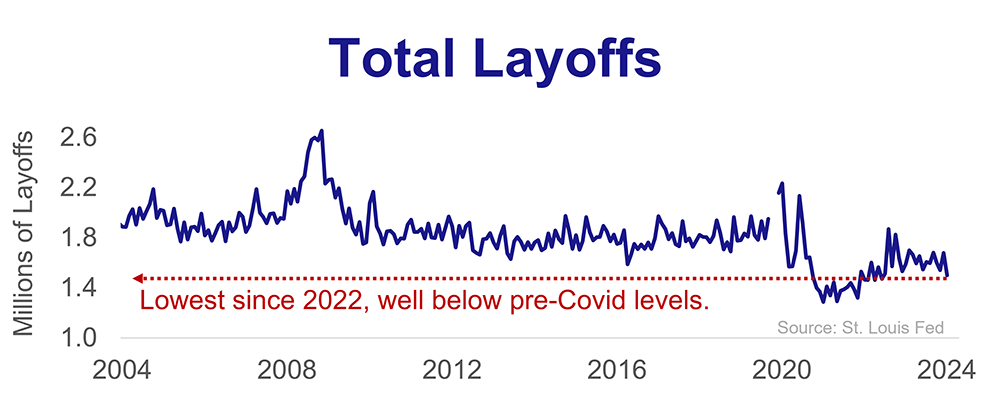

The unemployment rate has risen, setting off some recession alarms. But the unemployment rate can rise for multiple reasons. If it is rising because the labor force is growing (you must be looking for work to be “unemployed”), that’s not necessarily a bad sign. If it is rising because layoffs are up, that is. Layoffs remain low for now, but should be watched closely.

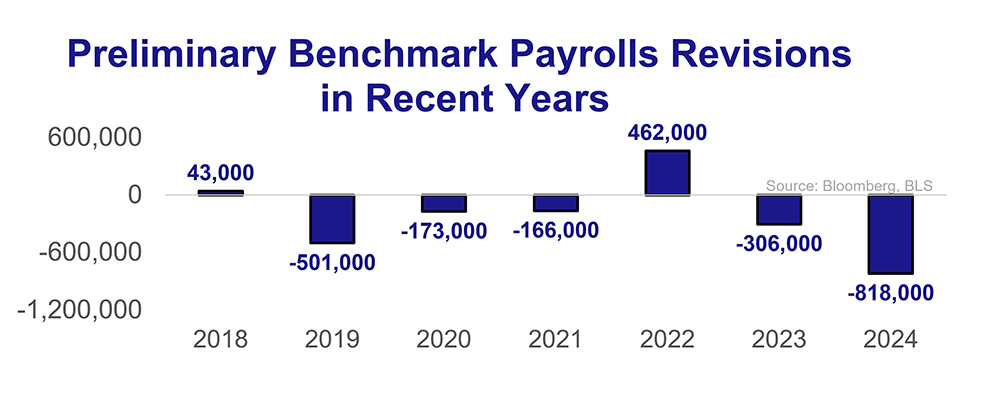

The BLS lowered their estimate of the number of jobs added in the year ending Mar. 2024. The new estimate shows solid job creation, but the huge revision calls into question the labor market strength that underpinned the Fed’s decision to as of yet not cut interest rates. The market expects 3-4 rate cuts by year-end, but it seems clear that the Fed is behind the curve.

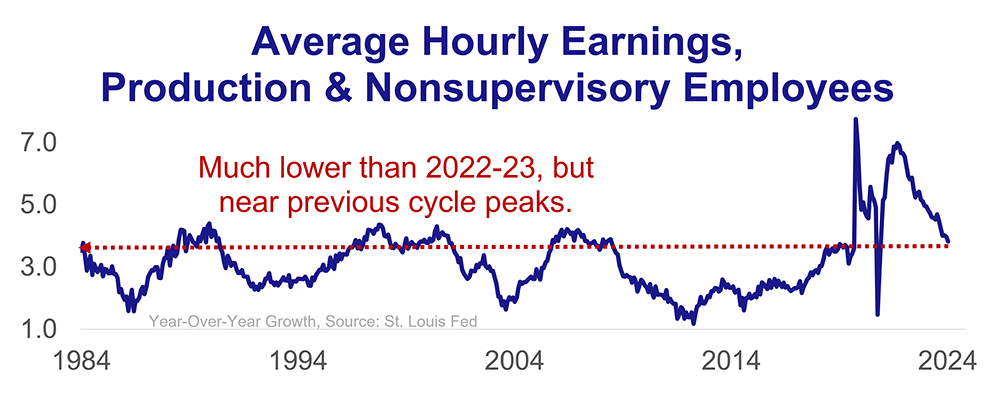

Wage growth for non-management employees has fallen from record levels, but remains historically high. This drives consumer spending, but can also result in inflation if employers offset higher labor costs with higher prices. Improving worker productivity (output per hour) could allow wages to remain elevated without stoking inflation. A.I. might help on that front.

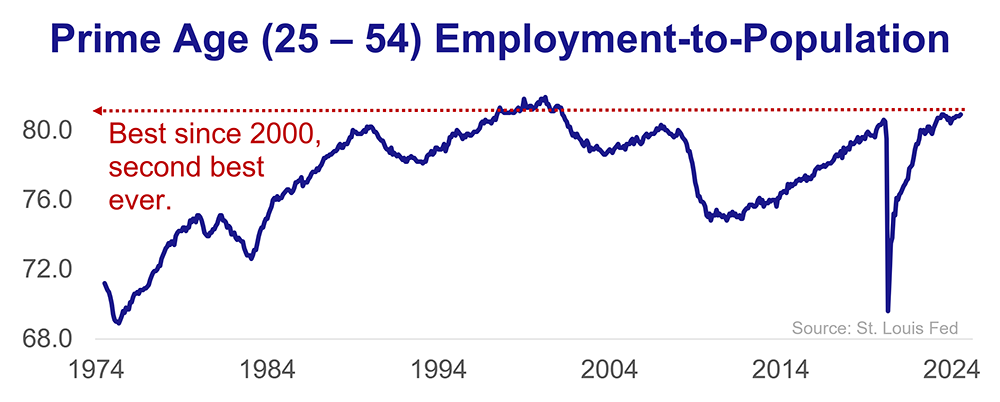

Perhaps the most critical question facing an economy is, “how efficiently are you employing working-age people?” In the U.S., the answer is (still): historically well. Wage growth and job market confidence drive consumer spending and, thus, economic growth. The U.S. economy is far from perfect, but a near-record level of job market participation is a great sign.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Market and economic statistics, unless otherwise cited, are from data provider FactSet.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2024 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.