In the Markets Now: What the Rate Cuts Mean

The Fed lowered interest rates in September, kicking off one of the few rate-cutting cycles of the last 75 years. In this piece, we look at what rate cuts mean and what might be different this time around.

What The Fed’s Rate Cut Means for You

Consumers, companies, and governments all borrow money, and the Federal Reserve’s benchmark interest rate (the fed funds rate) is a critical driver of important borrowing rates across the U.S., from mortgages to credit cards to auto loans. For this reason, interest rates—often called “the cost of money”—are the lifeblood of modern economies and financial markets. In September, the Federal Reserve (the Fed) lowered interest rates by 50 basis points for the first time since 2020, kicking off one of the few rate-cutting cycles of the last 75 years.

Interest rates are the Federal Reserve’s main mechanism to achieve its two goals of maintaining price stability (keeping inflation under control) and maximizing employment. When inflation runs too hot, the Fed raises rates to restrict economic activity. If inflation cools or the economy weakens, the Fed can lower rates to stimulate activity. Now that the post-Covid inflation spike has been wrangled under control (headline inflation is at 2.6%, its lowest since February 2021 and below its 40-year average) and the unemployment rate has started to rise, the Fed feels it can make borrowing cheaper by lowering interest rates.

Investors have been anxious for the Fed to begin cutting rates, as lower rates boost corporate profitability (less money goes out the door to pay interest) and help justify higher-than-average valuations for stocks. Per Charles Schwab, there have been 13 rate cut cycles since WWII. The average S&P 500 return one year after the first rate cut in those cycles is 14%. Rate-sensitive sectors, in particular, are rejoicing. High dividend payers (e.g., Utilities) like lower rates because their payouts look more attractive vs. bonds when rates are low. Cyclicals (e.g., homebuilders) like what lower rates do for their specific economic outlooks. Sure enough, rate-cut expectations have helped Utilities and homebuilders to outperform the S&P 500 by over 10% since June 30. There is also the question of whether some portion of the nearly $7 trillion in money market funds (i.e., cash) might find its way into the stock market once money market fund yields begin to dip. An influx of a trillion or two could be a nice-sized tailwind for stocks, though it’s also possible that money market cash proves sticky and/or moves to fixed income-type products instead. Where that money goes will likely come down to the speed and magnitude of the cuts.

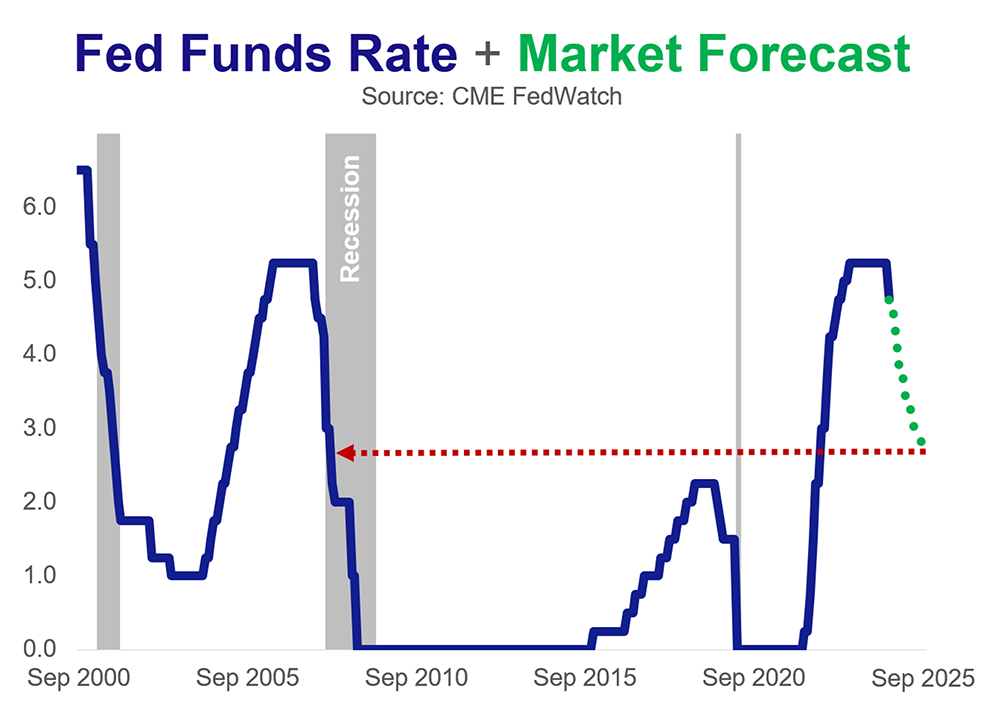

So where to from here? The market expects that by this time next year, the Fed will have cut interest rates 10 times and taken its benchmark rate from 5.25% to about 2.75%. That is a significant easing of monetary policy any way you cut it. But unlike other recent cutting cycles that took interest rates down an elevator shaft to zero, a “soft landing” does not require hyper-aggressive rate cuts to “save” the economy (like 2008 or 2020). Based on the Fed’s own projections, rates would settle to around 3% when all is said and done. That would be much lower than today’s rate but higher than at any time from 2009 to 2021.

It does not seem like a stretch to say that the era of rock-bottom interest rates seen in the 2010s is unlikely to return (outside of a crisis). I’d argue that a more normal rate environment is actually a good thing overall, but it still represents quite a change from recent history. Investors and consumers might need to utilize a different playbook for the years ahead.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2024 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.