In the Markets Now: Soft Landings and Bull Markets

The current bull market is set to enter its third year amidst a cacophony of macro noise – geopolitics, elections, rates and inflation. But with the U.S. in a soft landing scenario, what are the real risks facing investors?

Soft Landings and Market Rallies

Amid all of the macroeconomic noise in the world, it seems one idea is becoming consensus: an economic “soft landing” has been achieved. While no textbook definition of “soft landing” exists, the concept relies on the Federal Reserve bringing inflation back down to an acceptable level via higher interest rates without inducing a recession. This has been rare throughout history, but as we sit today, inflation is down markedly (now below its 10-, 20-, and 30-year averages), unemployment remains historically low, third quarter GDP growth is expected to be robust, and corporate earnings are forecast to grow double digits in both 2024 and 2025. No economic backdrop is ever perfect, but it seems fair to argue that we’ve arrived at the doorstep of 2025 with a “soft landing” in tow. Which presents the one million dollar question: what comes next?

We’ll start by looking to the last “soft landing,” when, in 1994-95, the Fed raised interest rates without getting a recession or uptick in unemployment. What followed was a period of hearty economic growth and market ascendance (S&P 500 +251% from 1995 to 1999) amid a strong labor market, internet revolution, and post-Cold War time of (relative) peace. While the last item may prove challenging in today’s world, the post-Covid labor market has shown signs of strength not seen since the 1990s and the comparisons between the internet and A.I. revolutions are too many to count. Should the 2020s market come even close to replicating the 1990s, the “Roaring ‘20s” moniker that many had hoped would describe this decade is still well in play.

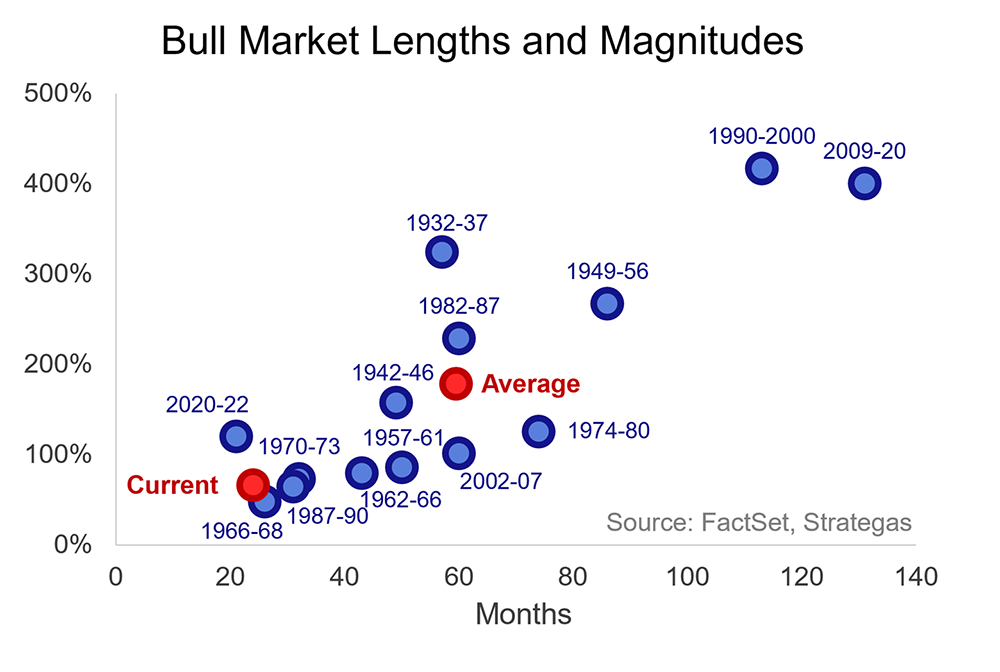

Besides the comparisons above, there’s also the simple fact that the bull market we are in today – which began in October 2022 – would be historically short and weak if it were to end any time soon. While it is no doubt impressive that the S&P 500 is up nearly 70% despite a litany of potential roadblocks over the last two years, the reality is that the average bull market since 1928 is over five years long and sports a total return of nearly 200%. In fact, of the 15 major bull markets in the set, only the most recent – 2020 to 2022 – is shorter than the current run (and the S&P 500’s +120% return then surely made up for its brevity).

Zooming out even further, despite featuring one of the great bull markets of the last century, the last 20 years have actually been mediocre (or worse) from a return perspective. To put numbers to it, the 665% total return of large cap U.S. stocks for the 20 years ending Sept. 30, 2024, is below the average 20-year return over roughly the last century (813%), and well below the highs seen at the end of major bull market runs (reaching returns of +2,000% or greater in both the mid-1960s and early 2000s). Summing it up, despite the U.S. stock market sitting at all-time highs, U.S. stocks have had a below-average 20-year run and are in a (thus far) tepid cyclical bull market. With that backdrop, would it be surprising if there were room to run?

Still, despite the case above, I see more predictions for a “lost decade” in equities than I do for continued equity market strength. It’s not impossible (the S&P 500 was roughly flat from 2000 to 2009), and we don’t take the risk lightly, but the history of the U.S. stock market is one of upside surprise and perseverance in the face of headwinds (real or perceived). Across the last century, the biggest risk to long-term wealth creation has not been the occasional crash or even protracted bear markets, but rather, being out of the market during a significant up-move (which is all the more likely given how often these rallies occur during “uncertain” times). In October 2022, no one was talking about an A.I. boom that might drive a massive capital investment cycle and worker productivity boom – they were talking about the risk of a rate-driven recession – but then ChatGPT arrived and markets took off and didn’t look back. Great investors are mindful of risks, just be sure you’re focused on the right ones.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2024 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.