All That Matters: Closing Out 2024

Before diving into what 2025 and a new presidential administration and Congress may bring, Mike and Ross take a moment to reflect on the past year.

What Surprised Us This Year?

Mike: At the beginning of 2024, I think we were both prepared to handle a lot of client questions on market volatility and the upcoming election. And while we did quite a bit of the latter, we didn’t experience much with regards to volatility.

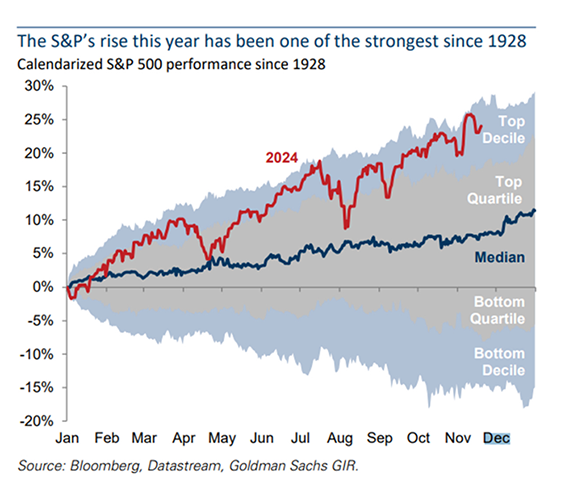

When you look at this chart from Goldman Sachs, you can see just how good of a year 2024 was for the market – one of the best years in history, despite coming off the heels of a 26% return for the S&P index in 2023. I think everyone was prepared for the market to be way lower, and instead we observed two incredible back-to-back years. It’s a great reminder that people’s expectations almost never match up with reality. Despite what the news might imply, the economy has done well, and the earnings of companies are doing fine.

Ross: I was most surprised by how interest rates have behaved this year. We spent the whole year talking about rate cuts: anticipating when the Fed would cut interest rates and by how much. And yet when the Fed finally started cutting rates in September, the 10-year Treasury rate goes up. It’s important to note that the 10-year rate is the basis for most of long-term loans, like 30-year mortgages and auto loans. So, while the Fed is cutting their rates, we’re seeing interest rate on those long-term loans increasing. Case in point: at the start of the year, a 30-year mortgage had a 6.5% interest rate, and now it’s closer to 6.75%. This phenomenon serves as a reminder that the 2010s were abnormal, and what we’re seeing today is a much more normal interest rate environment. It’s a reflection of a good economy, but it’s a surprise for people who are looking to borrow or refinance.

The Biggest Lesson

Mike: The lesson I have for 2024 is going to be the lesson every year for the rest of our lives. It’s an image that I use all the time in my blogs and in client events:

You and I spent the entire year talking about the national debt, the decline of the dollar, and a myriad of other topics that were being fed to people through the news and their friends and that generally stoked anxiety. And yet the stock market had one of its best years. Fear and uncertainty are always part of this journey, but if you tune into a lot of news and a lot of media, it can end up being a very difficult thing for you to keep your focus on your long-term plans. I’m not saying you must stop watching the news, but you have to moderate your consumption before it knocks you out.

Ross: The first lesson I have is something we’ve covered ad nauseum: don’t mix politics and investing. It didn’t work this year, and yet there will be countless temptations to do it again in the future. Don’t do it.

The second lesson has something to do with the year ahead. I’m hearing a lot of people assume that a good year for the market means the following year will be bad. We’ve seen that’s not the case this year: we were at all-time highs in 2023, and most 2024 outlook content predicted that we couldn’t have another 26% year. But 2024 did what it did anyway and it’s up 26-27% as we speak. This kind of momentum is extremely powerful in markets – you can’t miss these big upswings when it comes to building long-term wealth – yet the temptation is there to have the same bearish mindset as we head into 2025. The fact that this year was so good is not a reason to pull your chips off the table for the coming year.

2025 Predictions: What’s Next

Mike: I was an equity trader during President Trump’s last term, and I had a front row seat to his commentary and policies, and I’ve found a helpful way to translate for our private wealth clients. We’re going to see something that I am calling the Trump Cycle, comprised of four stages. President Trump will make a policy statement on social media (Stage One) that causes the market to react (Stage Two). We know President Trump likes to measure his success by the stock market, so if the market reacts negatively, he’ll respond (Stage Three) in a way that allows the market to recover (Stage Four). We say this a lot and it’s worth repeating: just because somebody says something, doesn’t meant it will actually happen. In the last year alone, Ross and I have spent so much time answering client questions about unrealized capital gains taxes that never happened. People – politicians in particular – say things but what happens in the real world is another matter entirely.

Ross: It’s critical to remember that while it might be noisy over the next several years, the market was up over 70% in President Trump’s first term, and up 22% in his first year alone. It’s a good thing to keep in mind if that cycle plays out on repeat in 2025.

My first prediction is that – despite the consensus that inflation will be sticky and potentially reaccelerate based on the president’s policies – inflation will come down in 2025. Part of that stems from changes in energy policy that will bring gas prices down, but it’s also a result of a cooling economy and slowing housing market. While the official inflation metric, the Consumer Price Index, shows rents up 5% year over year, it’s a backward-looking data point. The Apartment List shows that active rent listings are down 1% year over year and it’s a trend I think will continue. And while there’s plenty of talk about tariffs being inflationary, we saw during our last bout of tariffs (2017-2019) that inflation was at 2% on average. While tariffs have the potential to be inflationary, we just haven’t seen that play out in recent years.

Holiday Potpourri

Mike: My favorite podcast network is putting out a Yacht Rock documentary, and I could not be more excited. It’s a Gen X take probably, but Yacht Rock is the greatest music ever and I can’t wait to see this doc come out. I also saw the Wicked movie, which is just a phenomenal musical with some great stars. My family has seen it on Broadway a few times, and I believe the film version is going to be one of those moments in pop culture where everybody latches on to the movie.

I also have holiday movies on my mind, and I recently rewatched the Home Alone 2: Lost in New York. It’s the classic movie about a family who takes their five kids to Paris and accidently leaves one behind. And I’ve been thinking about the family – do they all go back home, or does dad and the other four kids stay back to go check out the Louvre?

Ross: I have a lot of sympathy for the dad who is solo with four kids, but they’re 100% staying. Then again, there’s questionable decision-making by the parents throughout those movies to be honest with you. You mentioned pop culture moments like Wicked – I’d also throw out Gladiator 2. If last year’s movie moment was “Barbenheimer,” I suppose that makes this year’s moment “Glicked.” We also can’t forget about Moana 2 – with a three-year-old, I’m sure that’ll be the first movie we’ll see.

As far as holiday movies, I’m willing to say that the lesser-seen DreamWorks Grinch is the best Grinch movie of all. The first two movies are just kind of mean and nasty, and with a three-year-old, it’s just a little too wicked for me.

Mike: Remember, we’ll be back in January to address topics on your mind – whether it’s tariffs or immigration or whatever the news may want you to focus on. We’ll be joining a Baird webinar in January where we’ll cover these topics and more and any questions you may have in the chat.

In the meantime, the stock market is up and hopefully that stays true through the end of the year. We don’t know what the next month’s going to hold, but hopefully it stays nice and quiet. It’s been a good year, and we’re grateful to be able to support our clients through it all.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.